Context

RBI has put a placed operational restrictions on Paytm Payments Bank Ltd. (PPBL)

Event Timeline:

RBI Restricts Paytm Payments Bank Operations

On January 31st, the Reserve Bank of India (RBI) placed operational restrictions on Paytm Payments Bank Ltd. (PPBL) due to ongoing non-compliance issues and significant supervisory concerns.

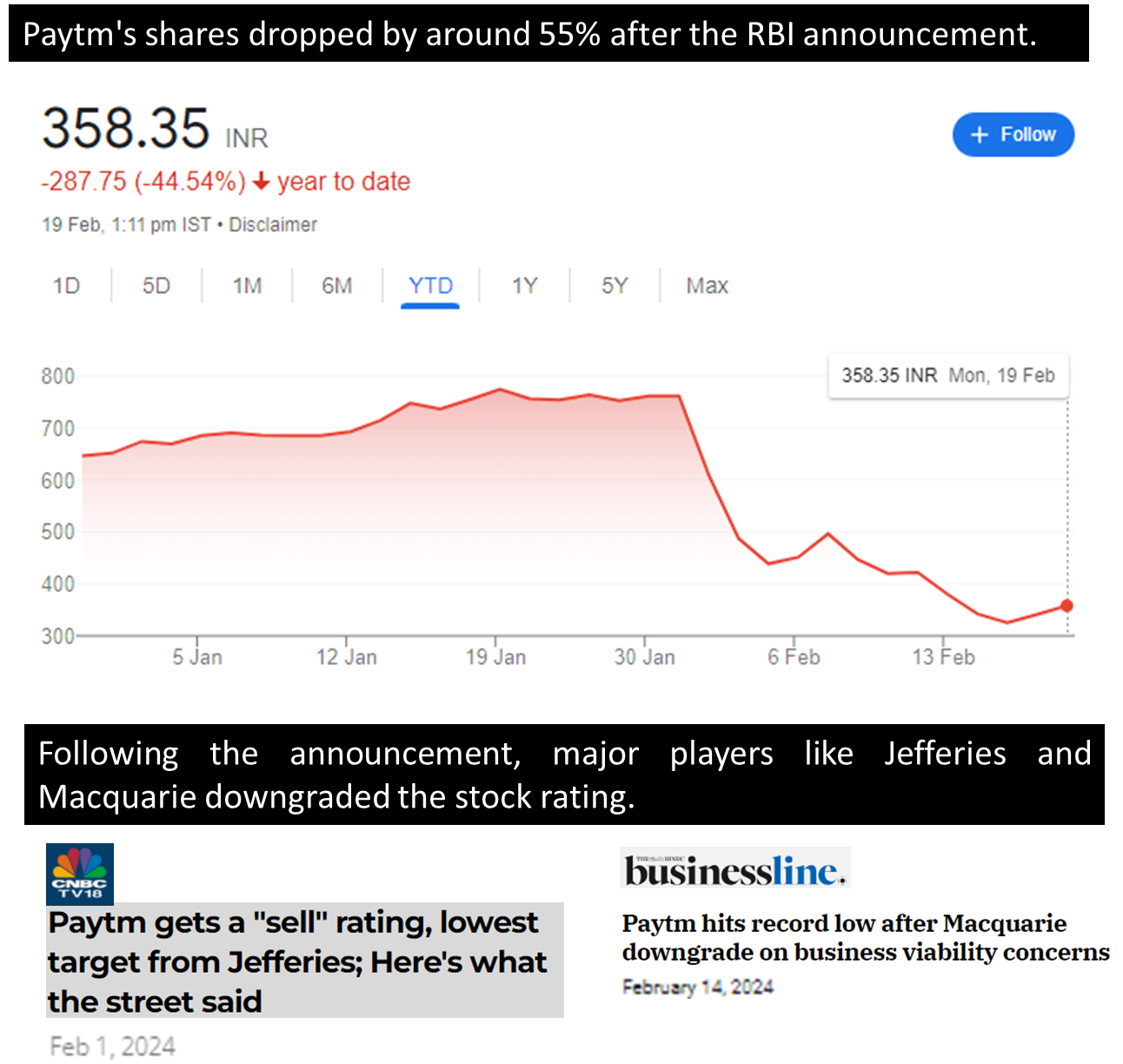

Stock Prices Corrected by ~55% Since 31st Jan till date

After RBI action, one97 Communications Ltd. shares plunge ~55% on NSE and BSE.

What Would Be The Impact On The Business?

The impact may be seen in its lending business, which contributes around 18-20% to its total revenue, which may potentially affect its financial health and stock value

Are you interested in understanding how mutual funds have been positioned in the aftermath of these developments? Read Further…

Executive Summary (1/2)

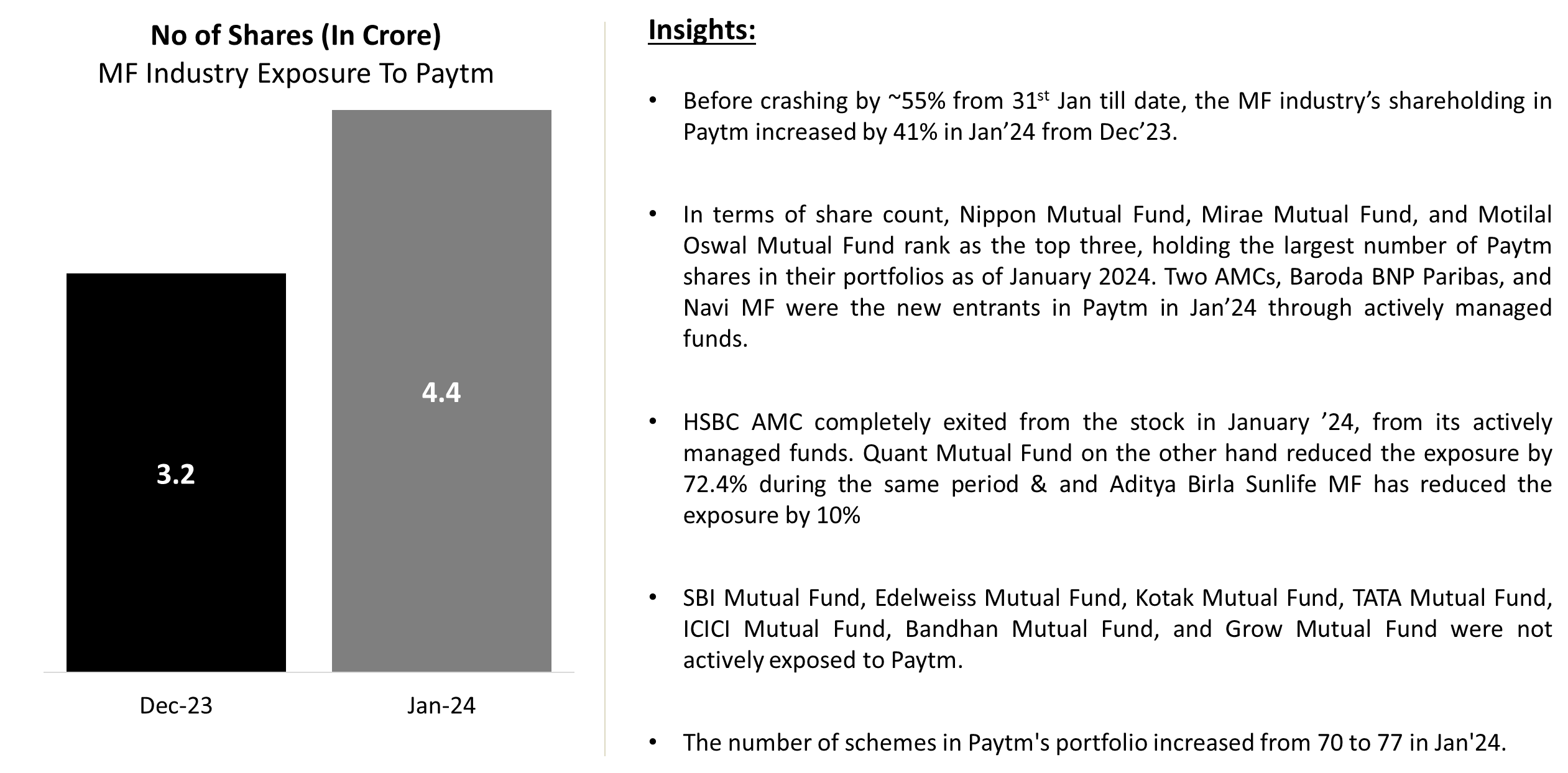

The mutual fund industry continued to purchase Paytm in January, although there were a few exceptions.

Source: ACE MF, Fisdom Research

Executive Summary (2/2)

The Mutual Fund Industry’s Rs. 3,384 Crore Exposure to Paytm

| Company Name | One97 Communications Ltd. |

| No of Shares | 4,44,57,212 |

| Market Value (Cr.) | 3,384 |

| Holding Scheme Count | 77 |

| Maximum % Holding | 5.39 |

| Minimum % Holding | 0.07 |

| No of % Holding < 1 | 45 |

| No of % Holding between 1 & 5 | 31 |

| No of % Holding between 5 & 10 | 1 |

| No of % Holding > 10 | — |