Technical Overview – Nifty 50

Extremely unexciting markets, with barely any movement on either side. The index indicates a slow movement. The index gap-up opened at 23,481 levels, indicating the same open and high for the day. On the daily timeframe, the index developed a Bearish Belt Hold candlestick pattern at all-time highs. Following last week’s severe volatility, the index is struggling to build upward momentum.

The index is trading above the main DEMA, which might lead to a mean reversion dip to the 10 and 20 DEMAs. Support levels for the upcoming sessions are 23,200 and 22,900, with resistance around 23,500 and 23,600.

Technical Overview – Bank Nifty

After last week’s turbulence, the Banking Index lacked upward impetus. The index gap opened at 50,186 levels but was unable to maintain it, falling below 50,000 and closed flat. The index is struggling to go over 50,250, which serves as a significant resistance level. On the daily period, the index is trading above the major EMA, while the 75-minute timeframe has support near the 20-EMA.

The index remains above the wedge formation’s upper band; on a 75-minute period, the index might fall below 49,500 twice.

The support levels for the upcoming sessions are 49,500 and 48,900, with resistance around 50,250 and 50,500.

Indian markets:

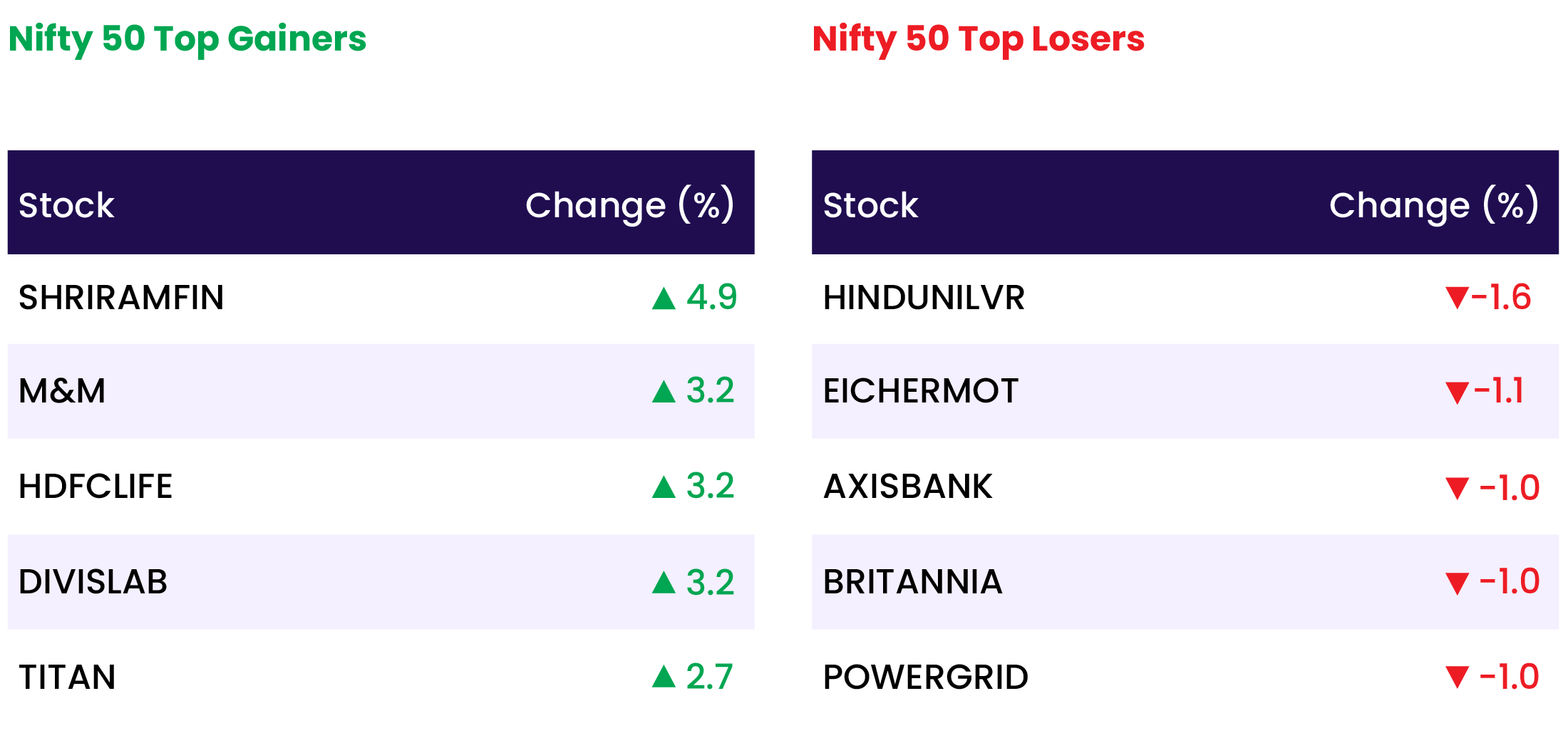

- On Thursday, June 13, the Indian stock market’s main indices, the Sensex and the Nifty 50, surged to new record highs. This rally was driven by strong macroeconomic data, boosting confidence in India’s medium to long-term economic growth prospects.

- The broader market outpaced the benchmarks, with both the BSE Midcap and Smallcap indices rising nearly 1 percent each.

- Among the sectoral indices, Nifty Realty and Nifty IT were the top performers, gaining 2 percent and 1 percent, respectively. Conversely, Nifty Media and Nifty FMCG were the worst performers, falling by 1 percent and 0.6 percent, respectively.

Global Markets:

- Asia-Pacific markets largely rose on Thursday after the U.S. Federal Reserve maintained the federal funds rate at 5.25% to 5.5% and adjusted its “dot plot” to project only one rate cut this year. Hong Kong’s Hang Seng index increased by 0.87%.

- In the region, South Korea’s Kospi led the gains, rising 0.98%, marking its third consecutive day of gains, while the small-cap Kosdaq edged up slightly.

- The mainland Chinese CSI 300 reversed earlier gains, declining by 0.51% to reach its lowest level in about two months.

- Japan’s Nikkei 225 also reversed earlier gains, falling by 0.4%, while the broad-based Topix decreased by 0.89%.

- Australia’s S&P/ASX 200 rose by 0.44%, rebounding from two days of losses.

Stocks in Spotlight

- Paytm’s stock surged by 7.5 percent after Samsung partnered with the payments and financial services distribution company to integrate travel and entertainment services into Samsung Wallet in India. This marked the stock’s third consecutive session of gains.

- Whirlpool India stock reached a new 52-week high of Rs 1,827 per share on June 13, following the announcement of a new market alliance with Hindustan Unilever for Surf Excel.

- Shares of the South-based realty firm Sobha surged by 5 percent after the company board approved the offer and issuance of equity shares worth Rs 2,000 crore through a rights issue. The rights issue price has been set at Rs 1,651 per equity share, reflecting a 25 percent discount.

News from the IPO world🌐

- Ixigo parent’s IPO subscribed 98.1x.

- Leela seeks $2.5 bn valuation IPO likely in 9 months

- DEE Development IPO Opens June 19

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 2.2 |

| NIFTY CONSUMER DURABLES | 1.7 |

| NIFTY IT | 1.0 |

| NIFTY MIDSMALL HEALTHCARE | 0.9 |

| NIFTY AUTO | 0.7 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2345 |

| Decline | 1539 |

| Unchanged | 100 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,712 | (0.1) % | 2.6 % |

| 10 Year Gsec India | 7.0 | (0.3) % | (0.3) % |

| WTI Crude (USD/bbl) | 79 | 0.8 % | 11.5 % |

| Gold (INR/10g) | 71,280 | (0.7) % | 4.0 % |

| USD/INR | 83.56 | 0.1 % | 0.6 % |