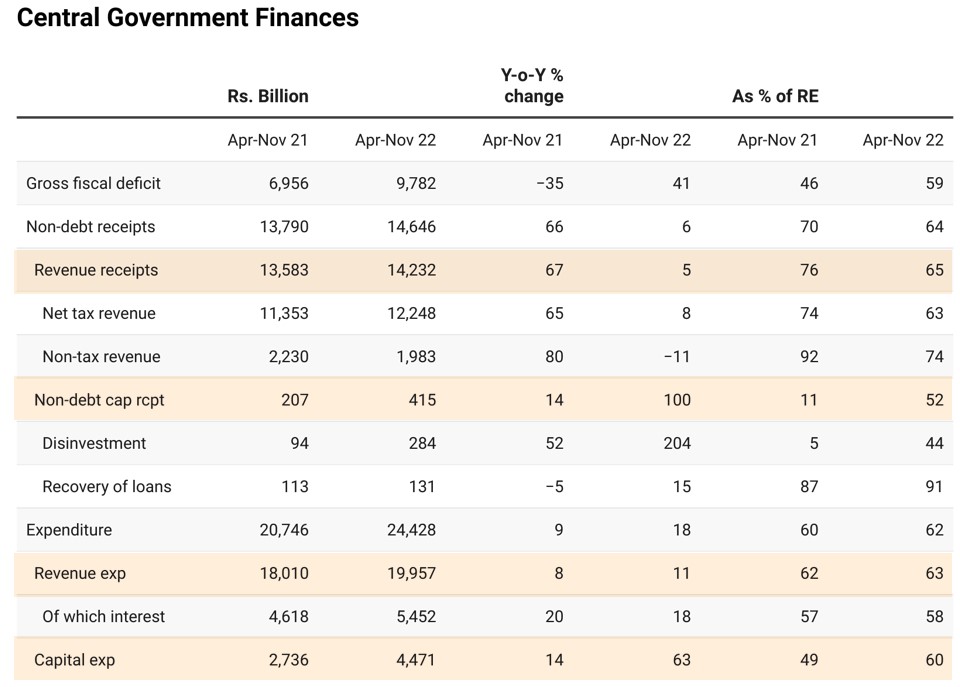

The government reported its largest monthly gross fiscal deficit

The fiscal deficit grew amid more inadequate tax collections

Table: Fisdom Research • Source: CMIE •Created with Datawrapper

- The Central Government reported its highest monthly gross fiscal deficit so far in the current year in November 2022.

- Moderation in YOY growth of net tax revenues, a steep decline in non-tax revenues & solid growth in expenditure, capital and revenue resulted in the widening fiscal deficit in November 2022.

- A 22.3% decrease in corporate tax collections & 32.4% contraction in excise duty collection were primary reasons for the moderation in net tax revenues

- The government increased its expenditure by 20.7% to nearly Rs.3 trillion in November 2022 compared to the year-ago month. Capital expenditure was up by 87.1% YoY in Nov’22.

- Overall, finances are well on track in FY23, with limited dents on account of fuel cuts and higher subsidy cuts. But maintaining the same balance in FY23 will take much work.

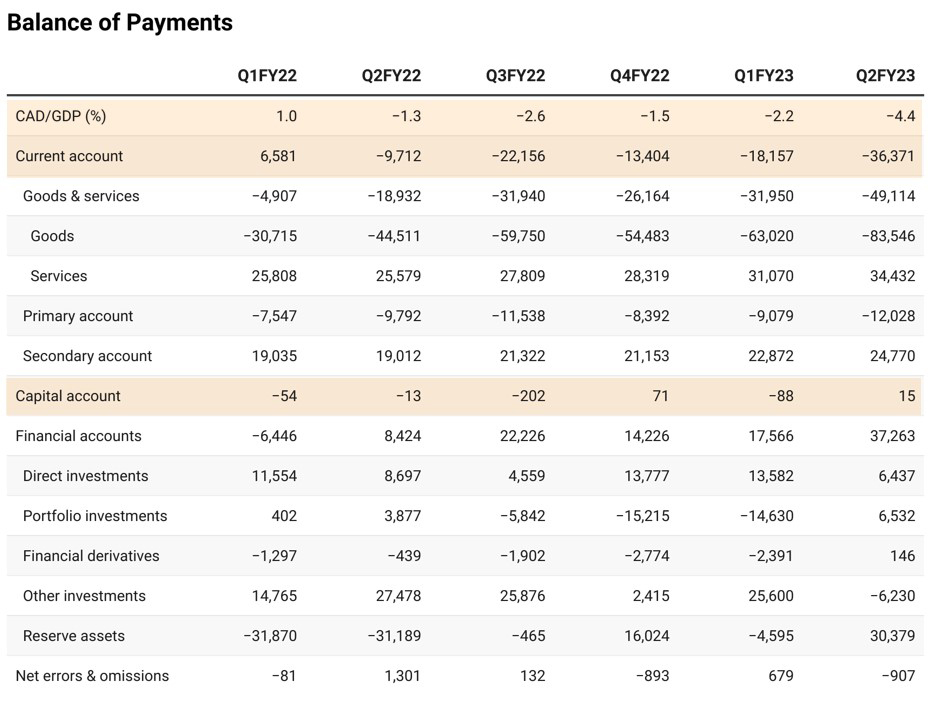

Current account deficit widened in Q2FY23; touched an all-time high

The worst seems to be over for India’s external account amid the fall in crude oil prices & decline in the dollar index

Table: Fisdom Research • Source: CMIE •Created with Datawrapper

- India’s current account deficit contracted sharply and currently stood at 36,371 million, i.e. 4.4% of the GDP.

- Merchandise imports rose to an all-time high of USD 192.5 billion, while merchandise exports reduced to USD 110.8 billion after peaking in the QE June 2022.

- Financial inflows were insufficient to fund the record-high CAD despite the return of foreign portfolio investments (FPIs) after a gap of three quarters. Net FDI flows moderated by 50% on a QoQ basis.

- We expect the current account deficit situation to improve, considering a steep correction in crude oil prices & decline in the dollar index.

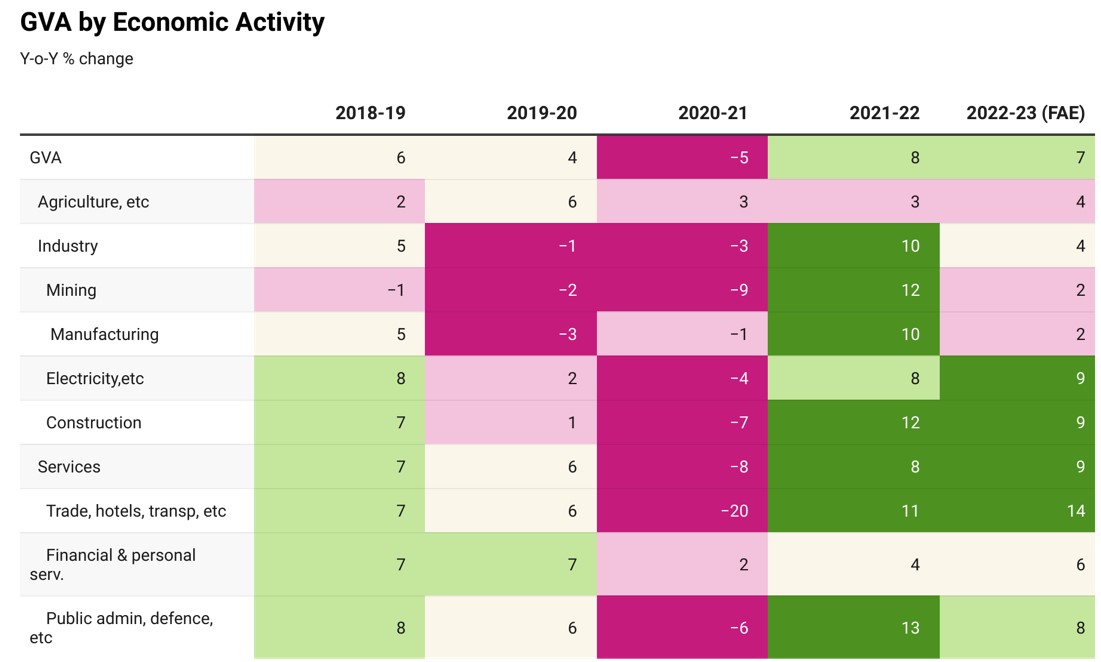

GDP growth for FY23 has been estimated at 7%

Consumption and large public Capex outlay have been critical factors.

Table: Fisdom Research • Source: CMIE •Created with Datawrapper

Table: Fisdom Research • Source: CMIE •Created with Datawrapper

- The National Statistical Office (NSO) has projected India’s real gross domestic product (GDP) to grow by 7% IN FY23 in its first advance estimates released in Jan’23. It expects the real final consumption expenditure (PFCE) to grow by 7%, real gross fixed capital formation(GFCF) to grow by 11.5% & real government final consumption expenditure (GFCE) to grow by 1.3%.

- The NSO has pegged the growth in real GVA for 2022-23 at 6.7 per cent compared with an increase of 8.1% in FY23. The main driver of the projected growth is the services sector, particularly trade, hotels, transport & communication, which has been forecast to grow by 13.7 per cent.

- The NSO’s annual GDP and GVA growth estimates for 2022-23 are slightly more optimistic than the expectations of the Reserve Bank of India, World Bank, International Monetary Fund and many other private forecasters. We also expect the Indian economy to be better than its global counterpart because of solid fundamentals downside risk to these estimates arises from global cues.