Letter To Investors

The Indian stock market has maintained its upward trajectory, with the Nifty 50 and S&P BSE Sensex indices rising by 2.90% and 2.80%, respectively. This positive trend is supported by trading volume surging to a near-two-year high of Rs. 15.26 trillion in the Nifty 50 index.

Over the past year, while the broader markets have shown a sideways trajectory, the small-cap segment has surged in the last four months (April to July 2023). The BSE Smallcap 250 and BSE Midcap 150 indices have outperformed the Nifty and Sensex benchmarks by approximately 200 basis points.

Our confidence in the Indian equity market’s growth is unwavering, driven by ongoing credit expansion, stable macroeconomic indicators, and positive capital expenditure trends. Government initiatives, including the Production-Linked Incentive (PLI) scheme, strategic capital investments & strong fundamentals have significantly bolstered sectors like Industrials, Realty, Capital Goods, Auto, Healthcare, and Consumer Discretionary.

While the Indian economy demonstrates resilience, it’s important to remain cautious of potential risks, such as uneven monsoons, domestic inflation pressures, and global economic uncertainties.

We advise adopting a prudent investment approach that considers the evolving market landscape. Our team is committed to closely monitoring these trends and providing timely insights to inform investment decisions.

Additionally, in the fixed-income realm, G-sec yields have increased across various maturities, with risk premiums rising for 3-year residual maturity securities. Meanwhile, short-term debt securities’ yields, such as treasury bills (t-bills), have increased in the secondary market as residual maturity periods extend.

There is so much that has happened and much more than we anticipate. This is effectively captured in Fisdom Research’s latest edition of its monthly outlook on the Indian economy and capital markets – CapView. This month, the report is titled – “Runway Clear”. You may have already caught onto the reason, but there is much more.

Please feel free to reach out for any queries or clarifications.

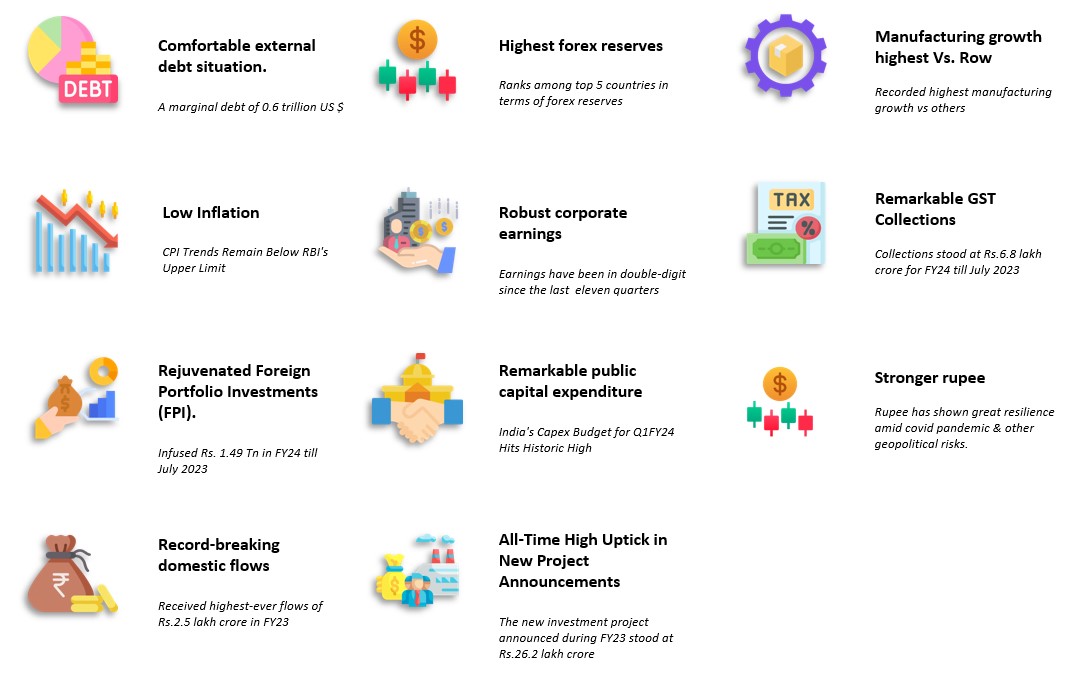

Tailwinds

Headwinds

- El Nino resulting in poor rainfall

El Niño can result in poor rainfall, impacting regions with droughts, crop failures, and water shortages. - Elections and Government Stability in 2024

Multiple state and general elections in 2024 may bring political shifts and instability. - Geopolitical uncertainties and sluggish growth in Europe and USA

Europe and the USA are experiencing slow growth due to geopolitical uncertainties. - Increasing global interest rates

Global interest rates are rising, affecting borrowing costs and economic activities.

Asset Class Views

Equity Large-Cap Focus: Portfolio Orientation |

Fixed Income

Attractive Duration: 4-6 Years |

Gold Volatility Persists: Gold’s Edge |

Widening Fiscal Deficit: A Closer Look

Highlights: Marginal tax growth, early transfer of extra central taxes to states, and significant capex drive widened fiscal deficit

| Rs. Billion | Y-o-Y % change | As % of RE | ||||

| Apr-June 2022 | Apr-June 23 | Apr-June 2022 | Apr-June 23 | Apr-June 2022 | Apr-June 23 | |

| Gross Fiscal Deficit | 3,518.70 | 4,513.70 | 28.3 | 28.3 | 21.2 | 25.3 |

| Non-debt receipts | 5,960.40 | 5,992.90 | 8.9 | 0.6 | 26.1 | 22.1 |

| Revenue receipts | 5,680.60 | 5,885.90 | 5.2 | 3.6 | 25.8 | 22.4 |

| Net tax revenue | 5,059.00 | 4,336.20 | 22.6 | -14.3 | 26.2 | 18.6 |

| Non-tax revenue | 621.6 | 1,549.70 | -51.2 | 149.3 | 23.1 | 51.4 |

| Non-debt cap receipts | 279.8 | 107 | 278 | -61.8 | 35.3 | 12.7 |

| Disinvestment | 245.6 | 42.4 | 514.6 | -82.8 | 37.8 | 6.9 |

| Recovery of loans | 34.2 | 64.7 | 0.5 | 89 | 24 | 28.1 |

| Expenditure | 9,479.10 | 10,506.60 | 15.4 | 10.8 | 24 | 23.3 |

| Revenue exp | 7,728.50 | 7,721.80 | 8.8 | -0.1 | 24.2 | 22.1 |

| Of which interest | 2,286.00 | 2,437.10 | 24 | 6.6 | 24.3 | 22.6 |

| Capital exp | 1,750.60 | 2748.8 | 57 | 59.1 | 23.3 | 27.8 |

- In the second quarter of 2023, the Central Government saw its gross fiscal deficit widen to Rs.4.5 trillion from the prior year’s Rs.3.5 trillion. Several factors drove this shift, including a subdued growth in gross tax collections, an early additional transfer of central taxes to states, and a robust drive towards capital expenditure. The fiscal deficit for this quarter accounted for 25.3% of the annual budgeted deficit, up from 21.2% in the corresponding period last year.

- Non-debt receipts remained steady at Rs.6 trillion during Q2 2023, while net tax receipts, a significant revenue source, contracted by 14.3% to Rs.4.3 trillion. Although gross taxes saw a modest increase of 3.3% to reach Rs.6.7 trillion, specific components such as corporate tax and excise duties experienced declines of 13.9% and 15.4%, respectively. Among these tax categories, income tax and GST collections grew by approximately 11%.

- The government strategically started executing a significant capital expenditure plan of Rs.10 trillion for the fiscal year 2023-24, with nearly Rs.2.8 trillion deployed in Q2 2023 alone. This marked an impressive 59.1% expansion compared to the same period in the previous year, with substantial allocations directed towards road and railway infrastructure development.

- We foresee the potential for a fiscal deficit reduction in the upcoming quarter. While the early sharing of revenues, like the Rs.2.5 trillion central tax devolution to states in June 2023, might not recur in nature, it could alleviate the burden in the next quarter. Additionally, the recent upswing in income tax collections is poised to strengthen the government’s revenue stream. Notably, the recent increase in deficit figures is unlikely to hinder the government’s commitment to expanding capital expenditure.

GDP Growth

Highlights: We are expecting another quarter of robust GDP growth in Q1FY24

| 2018-19 | 2019-20 | 2020-21 | 2021-22 | 2022-23 | |

| GDP | 6.5 | 3.9 | -5.8 | 9.1 | 7.2 |

| PFCE | 7.1 | 5.2 | -5.2 | 11.2 | 7.5 |

| GFCE | 6.7 | 4.0 | -0.9 | 6.6 | 0.1 |

| GCF | 11 | -2.6 | -7.9 | 17.9 | 9.6 |

| GFCF | 11.2 | 1.2 | -7.3 | 14.6 | 11.4 |

| Chane in stock | 27.3 | -58.7 | -85.5 | 687.8 | 2.7 |

| Valuables | -9.7 | -14.2 | 26.4 | 34 | -18.9 |

| Exports | 11.9 | -3.4 | -9.1 | 29.3 | 13.6 |

| Imports | 8.8 | -0.8 | -13.7 | 21.8 | 17.1 |

| GVA | 5.8 | 3.9 | -4.2 | 8.8 | 7.0 |

| Agriculture, etc. | 2.1 | 6.2 | 4.1 | 3.5 | 4.0 |

| Industry | 5.3 | -1.4 | -0.9 | 11.6 | 4.4 |

| Mining | -0.9 | -3 | -8.6 | 7.1 | 4.6 |

| Manufacturing | 5.4 | -3 | 2.9 | 11.1 | 1.3 |

| Electricity | 7.9 | 2.3 | -4.3 | 9.9 | 9 |

| Construction | 6.5 | 1.6 | -5.7 | 14.8 | 10 |

| Services | 7.2 | 6.4 | -8.2 | 8.8 | 9.5 |

| Trade, hotels, transport, etc | 7.2 | 6 | -19.7 | 13.8 | 14 |

| Financial & personal serv. | 7 | 6.8 | 2.1 | 4.7 | 7.2 |

| Public admin, defence, etc | 7.5 | 6.6 | -7.6 | 9.7 | 7.2 |

- India’s real GDP exhibited a robust expansion of 6.1% during the final quarter of FY23, surpassing initial estimates. This upswing in growth was underpinned by extrinsic transactions, while domestic demand remained resilient.

- Anticipations are high for further economic fortification in the initial quarter of 2023-24. As per the median growth projection derived from an RBI-conducted survey of adept forecasters, the figure is 5.9%.

- These projections signify an upward adjustment from the preceding Sample Professional Forecaster (SPF) data, reflecting heightened confidence in solid performance, particularly within the industrial and service sectors.

- Nonetheless, the potential hindrance of an intensifying El Nino looms, capable of disrupting rainfall patterns in August and September. Such an occurrence could impede agricultural progress and erode rural consumption propensities, subsequently influencing overall growth trajectories. Should this transpire, forecasters might adopt a more prudent stance in the upcoming SPF for September 2023.