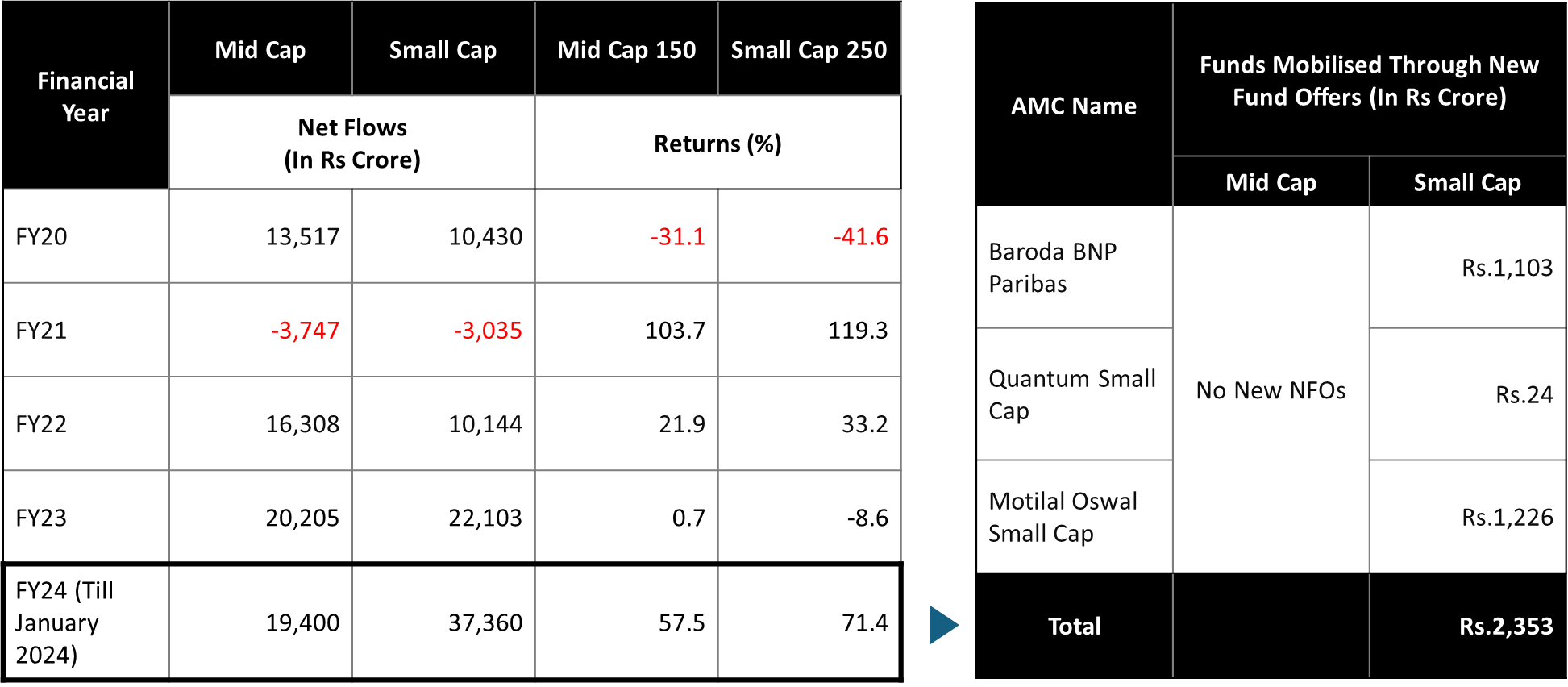

Consistent, High Inflows Observed in Smallcap & Midcap Categories Since FY20

Source: Fisdom Research. Portfolio data as of January 2024. Nifty midcap 150 & Nifty Smallcap 250 have been considered. Data Source: CMIE, Funds sorted by AUM

Some Of Them Have Started Implementing Corrective Measures

We expect more to follow suit

| Fund House | Changes to Investment Options | Effective Date | Restrictions | Exceptions |

| Nippon India MF | Stopped accepting lump sums and switch-ins for Small Cap Fund | 7-Jul-23 | No new lump sum or switch-in investments allowed | Existing SIPs, STPs before July 7, and new SIPs, STPs up to Rs. 5 lakh per day per PAN; Dividend reinvestment allowed |

| Tata MF | Temporarily suspended lump sum or switch-in for Small Cap Fund | 1-Jul-23 | No new lump sum or switch-in investments allowed | Existing SIPs, STPs unaffected; New SIP, STP registrations, redemptions, SWP, and switch-outs allowed |

| Kotak Mutual Fund | Restrictions on investing in small cap scheme | 4-Mar-24 | Lump sum investments capped at ₹2 lakh per month; SIP investments capped at ₹25,000 per month | Not specified |

| SBI Small Cap | Stopped lumpsum investments | Sept-20 | Stopped Accepting Lumpsum Investments | Allowed investments through STP/SIP from May 2018 with a cap of Rs.25,000 per installment per PAN |

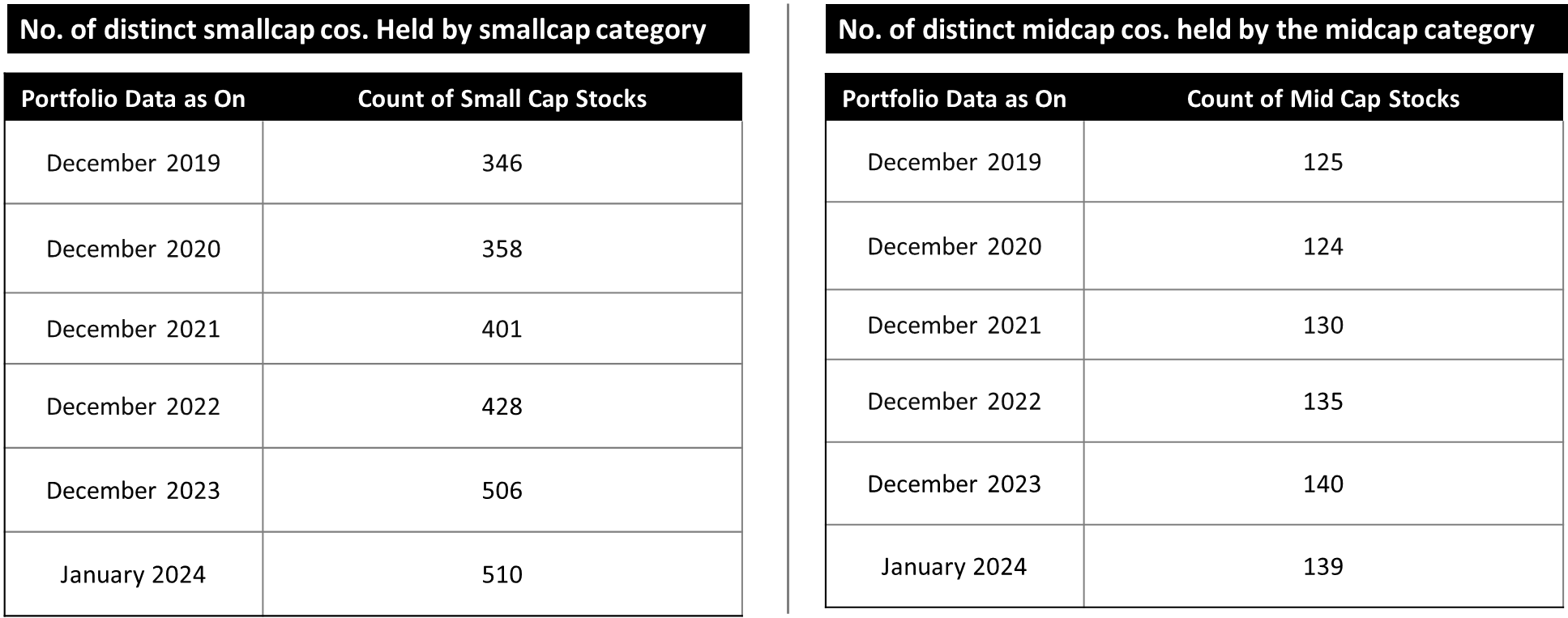

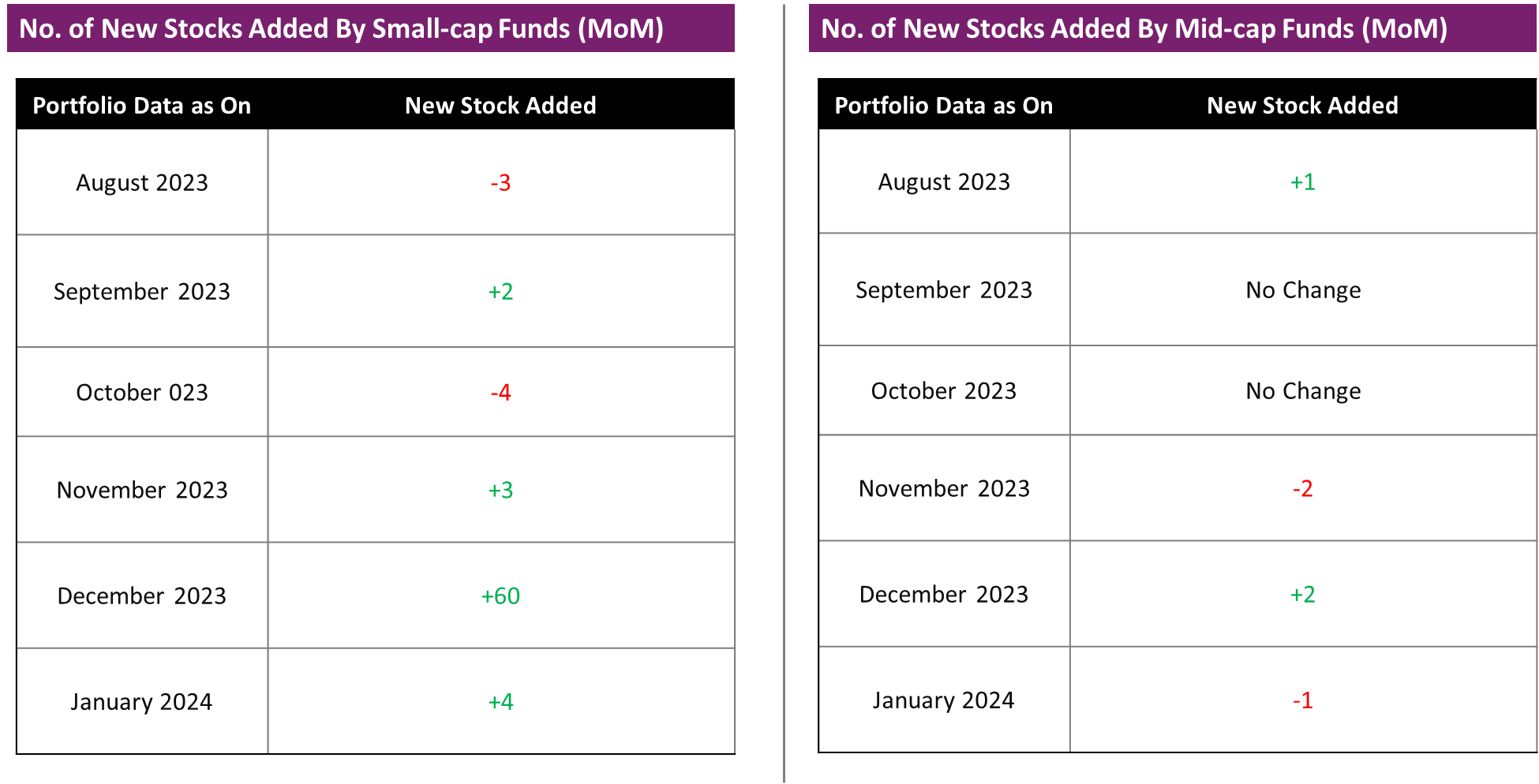

While The Invested Universe For The Midcap Category Has Grown Reasonably, The Same Has Grown At A Much Faster Pace For The Smallcap Category

Source: Fisdom Research. Portfolio data as of January 2024, Data Source: Accord Fintech, AMC Website