Gold has been a traditional investment in India, and many people buy gold on Akshaya Tritiya as a way to bring good luck and prosperity into their lives. It is believed that buying gold on this day brings wealth and success, and it is also considered to be a good time to start new investments or have a relook at your existing ones.

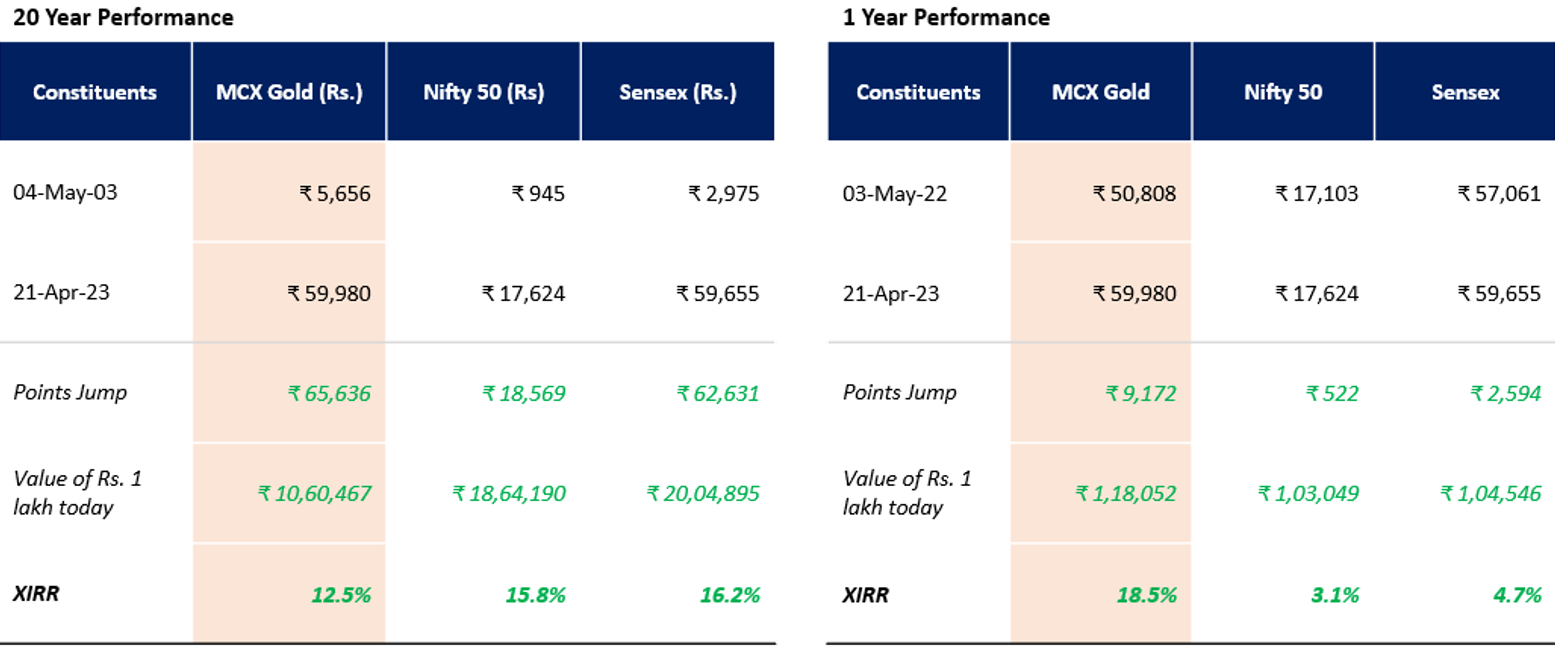

Here’s how gold has performed on Akshay Tritiya in the past 20 years and in the past 1 year:

Source: ACEMF, Fisdom Research

A clear indication from the data above is that gold is not only a reliable asset class that has the potential for double-digit returns over the long term but it has also outperformed both the Nifty 50 and Sensex indices by a significant margin over a short period of just one year.

Amid concerns surrounding geopolitical tensions, interest rate increases, stretched valuations, and recent banking crises in the US and Europe, investors have been reducing their equity holdings. As a result, gold has emerged as a preferred destination for many of these investors and have delivered a staggering 18.5 XIRR in FY23.

Adding gold to a portfolio can be an important diversification strategy and exposure through gold mutual funds or ETFs is cost efficient and easy way to invest in gold instead of taking the risk and expense of holding gold in physical form.

Gold is often considered a safe-haven asset that can help to reduce the overall risk of a portfolio. To understand more about importance of investing in gold below is a typical 70:30 Equity:Debt/Gold asset allocation portfolio:

Portfolio with Gold Allocation:

| Financial Year | S&P BSE Sensex TRI | CRISIL Short Term Bond Index | MCX Gold (Rs.) | S&P 500 TRI (Rs) | *Portfolio Return |

| FY 2011 | 12.5% | 5.1% | 27.4% | 14.7% | 12.7% |

| FY 2012 | -9.2% | 8.3% | 32.9% | 24.0% | 1.8% |

| FY 2013 | 10.1% | 9.1% | 7.1% | 21.9% | 10.8% |

| FY 2014 | 20.7% | 8.9% | -3.2% | 33.9% | 17.3% |

| FY 2015 | 26.8% | 10.3% | -8.3% | 17.3% | 19.0% |

| FY 2016 | -7.9% | 8.5% | 10.9% | 8.1% | -1.1% |

| FY 2017 | 18.5% | 9.1% | -1.9% | 14.9% | 14.2% |

| FY 2018 | 12.7% | 6.1% | 7.4% | 12.9% | 10.9% |

| FY 2019 | 18.8% | 7.6% | 3.2% | 18.1% | 14.9% |

| FY 2020 | -22.9% | 9.9% | 29.7% | 1.1% | -8.7% |

| FY 2021 | 69.8% | 7.8% | 7.3% | 51.8% | 49.4% |

| FY 2022 | 19.5% | 5.2% | 16.6% | 20.0% | 16.4% |

| FY 2023 | 2.0% | 4.2% | 16.0% | -1.5% | 3.5% |

| FY11 to FY2023 year CAGR | 11.30% | 7.70% | 10.50% | 17.50% | 11.1% |

Source: Whiteoak AMC, Fisdom Research. *Portfolio: Sensex TRI Equity: 60%, Crisil Short Term Bond Index: 20%, Gold: 10%, S&P 500 TRI (International): 10%

Upon observing the table above, one can discern that in a multi-asset portfolio, gold has demonstrated some capacity for mitigating downside risk in numerous instances when domestic equity has yielded negative returns, and conversely, when gold has underperformed, domestic equity has often generated positive returns.

In the current market environment, coupled with the auspicious occasion of Akshay Tritiya, investors may want to consider seizing the opportunity to remain invested in gold, rather than holding out for a larger correction in prices. Experts predict that gold prices will likely remain elevated in the coming months, making it a potentially profitable investment for those looking to diversify their portfolio and hedge against market volatility. With this in mind, investors may want to conduct thorough research and seek the advice of a financial professional before making any investment decisions.

Till Then Happy Investing!

Markets this week

| 17th April 2023 (Open) | 21st April 2023 (Close) | %Change | |

| Nifty 50 | 17,634 | 17,624 | -0.1% |

| Sensex | 59,473 | 59,655 | 0.3% |

Source: BSE and NSE

- Markets witnessed ended on a flat note.

- Indian equity market ended the week ended April 21 in red, losing over 1% in a volatile week.

- The market snapped a three-week gaining streak, mostly due to mixed earnings from Indian companies and possible rate hikes by the US Fed.

- Foreign institutional investors (FIIs) turned net sellers during the week, adding to the selling pressure.

- The market’s overall performance was also affected by uncertainty regarding the resurgence of COVID-19 cases in India.

- The upcoming policy meeting of the US Fed may also impact the market in the near term, with the possibility of a rate hike affecting investor sentiment.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Nestle India | ▲ +5.30% | Infosys | ▼ -11.65% |

| Bharat Petroleum | ▲ +4.20% | Tech Mahindra | ▼ -8.11% |

| ITC Ltd | ▲ +3.20% | UltraTech Cement | ▼ -3.88% |

| Asian Paints Ltd | ▲ +2.57% | Adani Enterprises | ▼ -3.62% |

| Coal India | ▲ +2.02% | HDFC Life Insurance | ▼ -3.49% |

Source: BSE

Stocks that made the news this week:

?HCL Technologies has reported lower-than-expected earnings for Q4FY23 with profit falling 2.8% QoQ to Rs 3,983 crore and revenue declining 0.4% to Rs 26,606 crore. On the operating front, EBIT fell 7.5% sequentially to Rs 4,836 crore with margin down by 140 bps to 18.2% for the quarter.

?ITC continued its upward trend for the third consecutive day, surpassing HDFC Ltd in terms of market capitalization and briefly crossing the Rs 5.04 trillion mark. This follows ITC’s achievement on April 20, when it became the 11th listed Indian company to cross the Rs 5-trillion market capitalisation milestone, after its shares hit an all-time high, propelled by a 21 percent surge in value so far this year.

?Reliance Jio Infocomm, the telecom subsidiary of Reliance Industries, announced a net profit of Rs 4,716 crore for the quarter ended March 31, 2023, reflecting a 13 percent increase from the corresponding period last year. The company’s net profit in the December 2022 quarter was Rs 4,638 crore.

?JK Tyre and Industries is set to expand its current capacity by 2 million units per annum by the end of the financial year 2023-24, as it seeks to meet the growing demand from automakers. The company plans to invest Rs 800 crore in the scaling-up exercise, with the bulk of the capex, Rs 530 crore, going towards increasing the output of passenger car radials (PCR). The remaining amount of Rs 270 crore will be spent on capacity expansion of truck and bus radials (TBRs). Singhania, a fourth-generation member of the promoter family, confirmed the plans.