Challenging fiscal performance

Central Government had a tough fiscal performance in H1FY23

Table: Fisdom Research • Source: CMIE • Created with Datawrapper

- Central Government had a rugged fiscal performance in H1FY23. It used only 37.3 percent of the gross fiscal deficit budgeted for the entire year. Typically, the government does 65 percent of the annual budgeted budgetary deficit in the year’s first half. It was mainly because of the shortfall in revenue collections in the year’s initial months. The capital expenditure kept pace in the first half of FY23. The government disbursed 45.7 per cent of its annual budgeted capital expenditure in the first half of the year, which is higher than the average of 42.9 percent in the last two-and-a-half decades.

- Troubles regarding deficit levels emerged as the government announced the extension of the PM-GKAY scheme till Dec’22 at the cost of Rs.448 billion, a 4 percent increase in central government employees’ DA allowance, which would cost about Rs.86 billion and a one-time grant of Rs.220 billion for oil marketing companies (OMCs) to compensate for the losses incurred on the subsidised sale of LPG.

- We expect the fiscal situation to be demanding unless the geo-political situation improves drastically.

The controlled external debt situation

India placed relatively in a much better position compared to other countries

Table: Fisdom Research • Source: CMIE • Created with Datawrapper

- Drawing upon insights from RBI’s report covering India’s external debt situation, the Indian economy’s sustainability basis debt fared better than the LMIC (Low and Middle Income Countries) group while also outranking most on a variety of vulnerability indicators.

- Basis external debt, India ranks at a modest 23, globally. However, U.S’ state of ballooning external debt in a highly globalized trade economy is a looming risk to the world economy even as it flags the possibility of a dreadful contagion.

Comfortable external debt

India’s external debt situation appears comfortable and diversified across multiple currencies

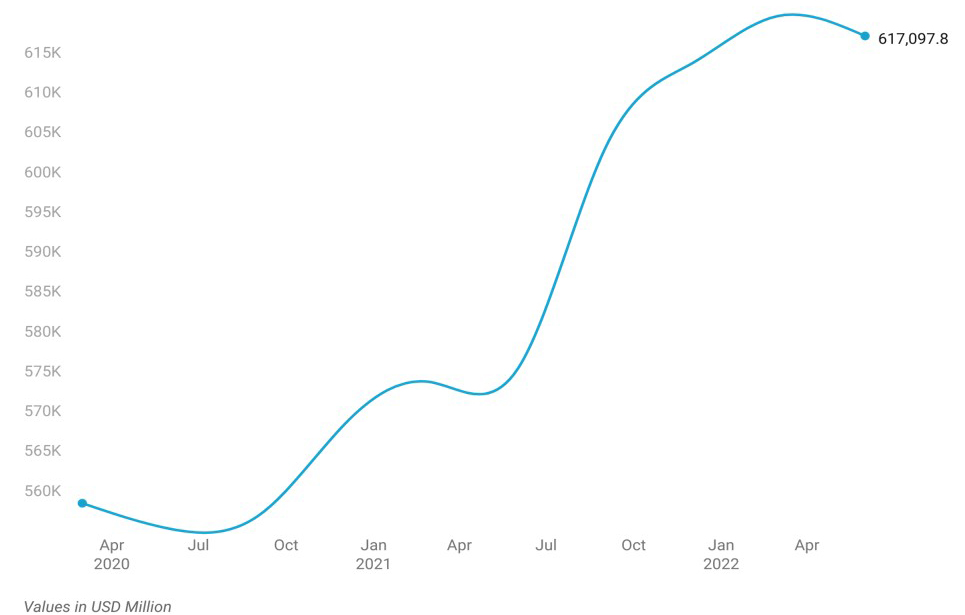

Outstanding External Debt

Table: Fisdom Research • Source: CMIE • Created with Datawrapper

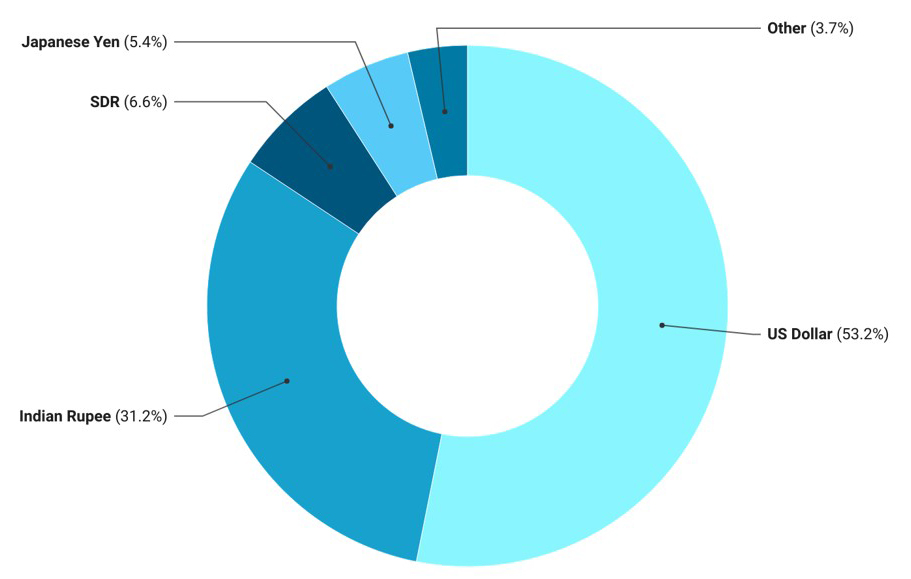

Currency Composition of Outstanding External Debt

Table: Fisdom Research • Source: CMIE • Created with Datawrapper

- Though India’s external debt is rising, it continues to be tolerable and prudently managed. Unlike other countries, India’s external debt is well diversified across multiple currencies and hence relatively insulated from the uptick in the dollar index.

- Even as highlighted earlier, India’s external debt is modest compared to other countries, occupying the 23rd position globally. Even the forex reserves to external debt ratio stood at 86 percent compared to 97 percent in Mar’22. The drop in percentage is attributable to the RBI’s active intervention in the currency market to limit the rupee depreciation. It is not quite related to the sudden spike in external debt.

- There are short-term debts(43 percent of total external debt) up for maturity in FY23. Still, if we compare the ratio of short-term external debt (residual maturity) to reserves, the same was significantly lower at 44.1 as of Mar’22 vs 59 per cent as of Mar’13, reflecting an extended reserves buffer.