Letter To Investors

After five consecutive months of gains, August brought about a significant shift in market sentiment, as the Nifty concluded the month on a downward trend. However, amidst this volatility, the midcap and smallcap indices continued their positive trajectory for the fifth consecutive month. This impressive rally can be attributed to multiple factors, including favourable foreign Portfolio Investor (FPI) inflows, robust domestic flows, superior macroeconomic fundamentals relative to emerging and developed markets, a promising earnings outlook, increased stability in the banking sector, and positive signs regarding private capital expenditure.

In terms of sector performance, we observed some notable trends. The Energy, Banks, FMCG, and Infrastructure indices underperformed, while the Information Technology and Pharmaceutical sectors outperformed. We also noted mixed results in the earnings arena, with upgrades in the Financials and Auto sectors but downgrades in the Materials and Information Technology sectors.

In the fixed-income market, Indian government bond yields remained relatively stable, settling at 7.17%. Rising US Treasury yields and an expanded issuance calendar in the United States influenced these yields. The bond market’s trajectory was further shaped by mixed data releases from the US, which hinted at the potential for sustained elevated interest rates in the near term. Looking ahead, we anticipate interest rates to remain stable with a downward bias in the near term. However, it’s essential to remain vigilant as inflation significantly threatens our outlook.

Turning to the broader economic landscape, we’ve witnessed several noteworthy developments. Despite an expanding fiscal deficit, there was unexpected Gross Value Added (GVA) growth in Q1FY24. Credit growth has continued its positive trend, private capital expenditure is staging a comeback, and Domestic Institutional Investors (DIIs) have played a pivotal role in driving market momentum. The manufacturing and services sectors have displayed encouraging growth trends, and quarterly earnings have surpassed expectations.

Overall, the current market conditions are marked by both challenges and opportunities. We remain committed to navigating these dynamic waters diligently and adjusting our investment strategies as needed to maximise returns while managing risks.

Please do not hesitate to reach out if you have any questions or require further information.

Thank you for your continued support.

Market Outlook

Way Ahead

| Focused Themes: |

| 1. Capex 2. Global Digital Transformation 3. Supply Chain Rearchitecting towards India 4. Energy Transition & De-Carbonization |

| Focused Sectors: |

| Strategic Portfolio: Domestic 1. Financial Services 2. Capital Goods 3. Industrials 4. Auto |

| Focused Sectors: |

| Tactical Portfolio 1. Information Technology 2. Pharmaceuticals |

| Key Risk To Our Outlook: |

| 1. El Nino resulting in poor rainfall 2. Election led uncertainty in 2024 3. Geopolitical uncertainties & and sluggish growth in Europe & USA |

Asset Class Views

| Equity Theme: India’s Growth Story |

| Large-Cap Focus: Portfolio Orientation Selective Midcap Exposure: Strategic Approach Smallcap Inclusion: Target Portfolio Driven Sectoral Winners: Auto & Ancillaries, Banks, Capital Goods, Industrials, IT, Pharmaceuticals Ideal Deployment approach amid current markets: STP or SIP |

| Fixed Income Theme: Quality Focus |

| Attractive Duration: 4-6 Years Conservative Allocation: Longer End with Sov/AAA-rated Papers Minimal AA-rated Allocation: Cautious Approach Accrual + Duration Strategy: Active + Passive Approach Ideal Deployment approach amid current markets: Lumpsum or STPs for 2-3 months |

| Gold Theme: Buy on dip |

| Volatility Persists: Gold’s Edge Inverse Correlation: Gold and Bond Yields Preferred Asset Class: Gold in Current Macroeconomic Environment Global Uncertainties Proven Hedge: Gold’s Attraction for Investors Ideal Deployment approach amid current markets: STPs or SIPs |

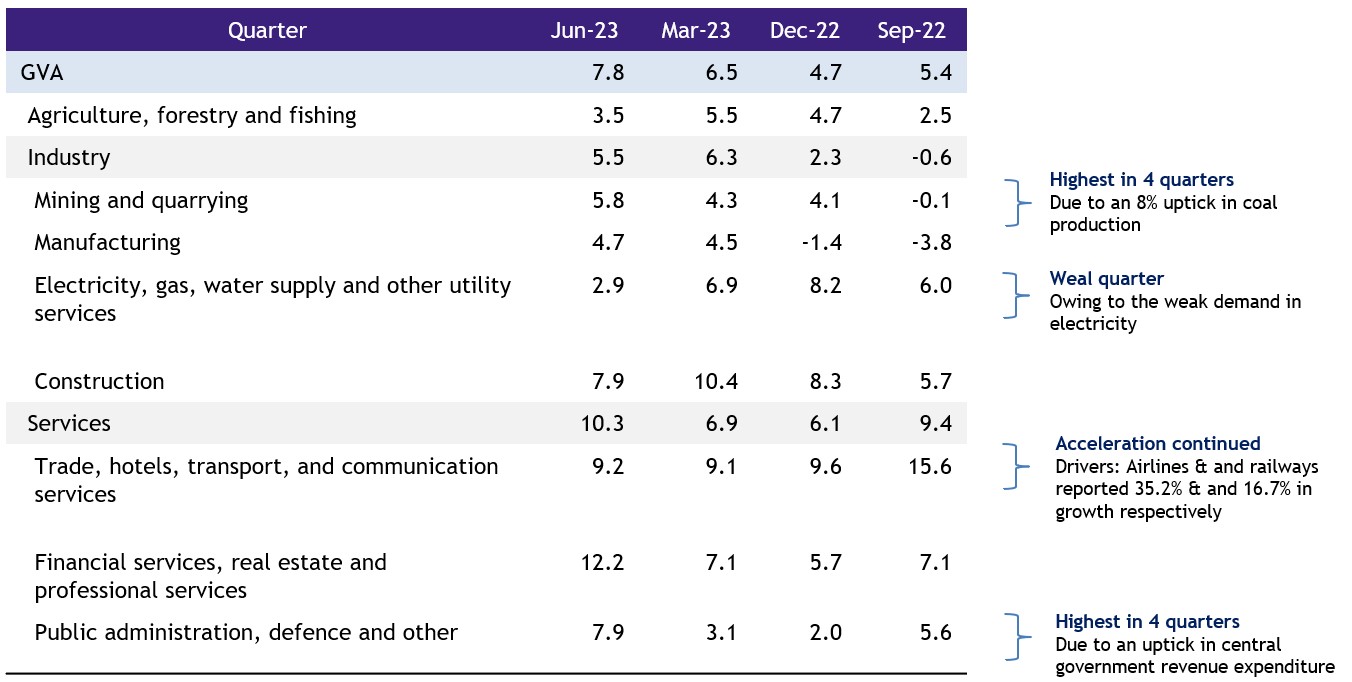

Unexpected GVA Growth in Q1FY24

Quarterly growth exceeds RBI’s predicted median forecast of 6.1%

Trend:

In the June 2023 quarter, India’s GVA growth was primarily driven by robust s, especially in financial and real estate sectors, and positive contributions from trade, public administration, and industry, while agriculture and utilities saw mixed results.

Expectations:

The noteworthy expansion of GVA in the June 2023 quarter instills a sense of optimism for the upcoming fiscal year, potentially setting the stage for across-the-board upward revisions in growth forecasts by analysts. This robust performance is poised to reshape expectations across various sectors.

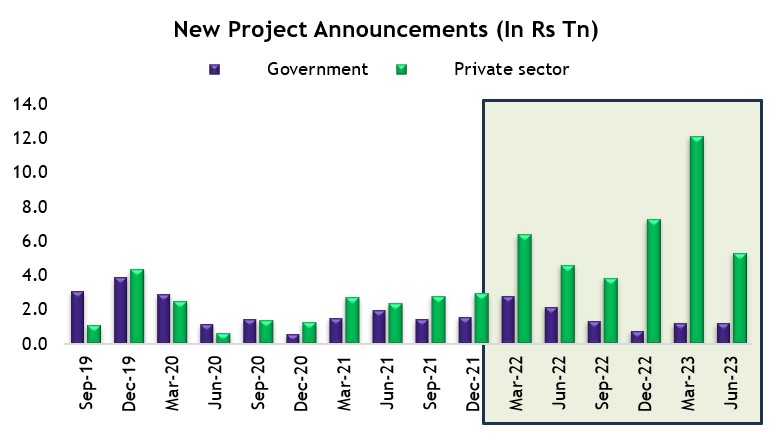

Private Capital Expenditure Staging a Comeback

Declining government share in new announcements over the years