Letter to investors

Dear Investor,

March was a month of turbulence in the global markets, with the collapse of Silicon Valley Bank and Signature Bank in the US, leading to depositors seeking refuge in US government bonds and large US banks. However, despite the challenging environment, Indian equity markets showed resilience and bucked the trend by snapping a 3-month losing streak. This indicates nascent signs of risk-on sentiment globally and highlights the potential opportunities in the Indian market.

In terms of sectoral performance, utilities have shown a rise in performance due to Adani’s stock performance. Additionally, large caps have demonstrated resilience in a volatile landscape, showcasing the stability and strength of established companies in uncertain times.

Foreign portfolio investors (FPIs) have also made a comeback with inflows in services and power sectors, while IT, oil & gas, and healthcare sectors witnessed outflows. In other asset classes, the Indian rupee has shown strength against major global currencies, and the price of gold has reached unprecedented levels. Government securities (g-secs) yields and corporate bonds yields, however, have shown mixed results.

On the macro front, India’s current account deficit (CAD) has shown a significant reduction, which is a positive trend reflecting improved economic fundamentals. Policy makers, including the finance ministry, remain optimistic about India’s economic growth prospects for the upcoming fiscal year of 2023-24. Core inflation has dipped, leading the RBI to pause interest rate hikes and aim for a gradual convergence of inflation towards the target while promoting economic growth.

As we move forward, the focus will shift towards earnings from the March quarter and, more importantly, the commentary from corporate managements on the outlook for the next year. We will continue to closely monitor the evolving market conditions and strive to make informed investment decisions to protect and grow your portfolio.

We would like to express our gratitude for your continued trust and confidence in us. If you have any questions or concerns, please do not hesitate to reach out to us at research@fisdom.com.

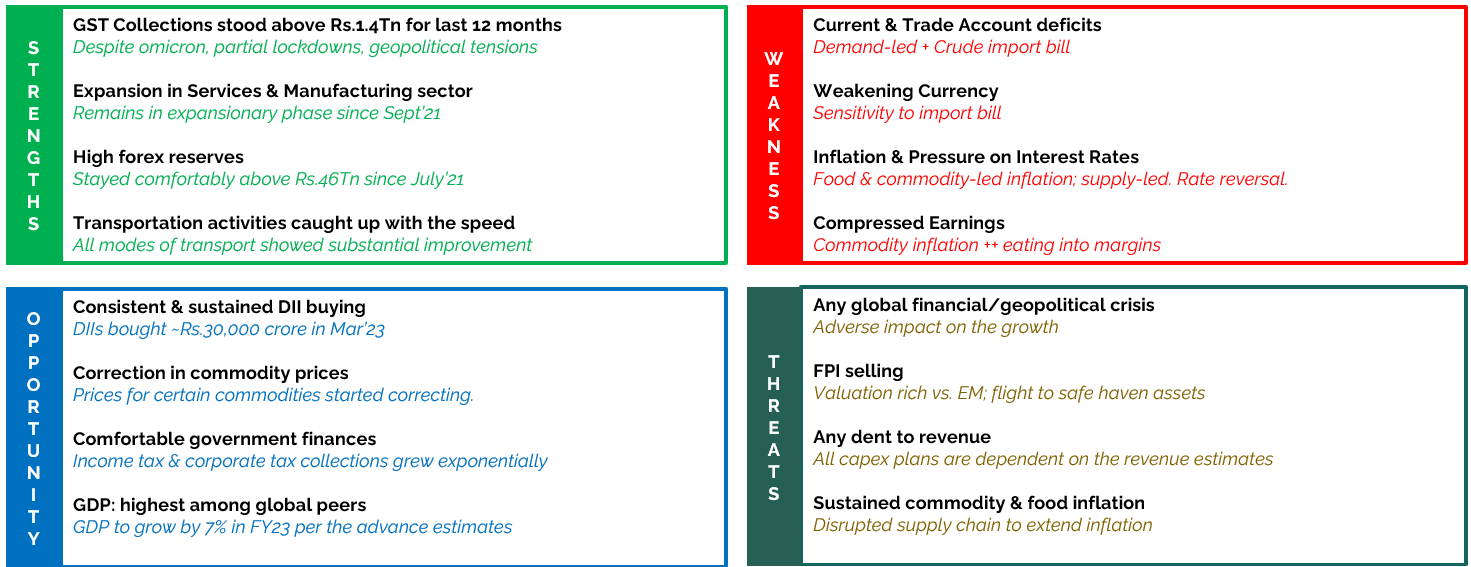

Indian Economy SWOT Analysis

Key Themes for FY24:

- Capital Expenditure(Capex)

- Energy Transition/De-carbonization

- 5G Roll Out

- Re-rating for banks

- Mix of value & growth

- Quality fixed income over credit

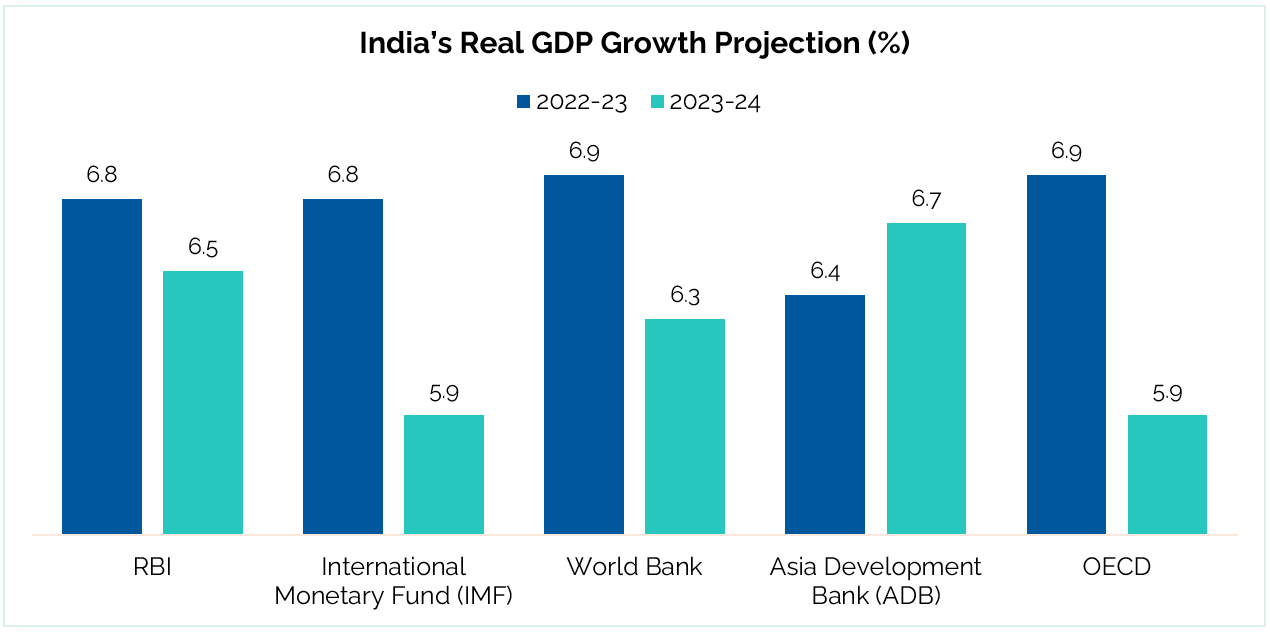

GDP Outlook for FY24

Policy makers optimistic on growth despite downgrades from IMF and world bank

| Quarterly Estimates (%) | 2nd Adv Est of NSO for FY23 (%) |

||||

| Jun-22 | Sep-23 | Dec-23 | Mar-23 | ||

| GDP | 13.2 | 6.3 | 4.4 | 5.1 | 7.0 |

| PFCE | 20.0 | 8.8 | 2.1 | 1.5 | 7.3 |

| GFCE | 1.8 | -4.1 | -0.8 | 6.1 | 1.2 |

| GCF | 21.0 | 6.6 | 5.5 | 7.4 | 9.6 |

| GFCF | 20.6 | 9.8 | 8.3 | 7.8 | 11.2 |

| Chane in stock | 7.8 | -2.3 | 0.2 | 2.3 | 1.9 |

| Valuables | 58.9 | -19.4 | -37.9 | -0.5 | -14.8 |

| Exports | 19.7 | 12.3 | 11.4 | 3.9 | 11.5 |

| Imports | 33.7 | 25.9 | 10.9 | 8.4 | 18.8 |

- Policy makers, including the esteemed finance ministry, are displaying a notable level of optimism when it comes to India’s economic growth prospects for the upcoming fiscal year of 2023-24. This positive outlook stands in contrast to the projections presented by multilateral agencies and private professional forecasters, who hold a more conservative stance. Key agencies/institutions like world bank & IMD revised its India’s real GDP growth forecast downwards to 6.3% & 5.9% from 6.6% & 6.1% respectively.

- There are multiple reasons for its optimistic outlook on India’s growth prospects, including the expected rebound in private consumption, higher capital expenditure (capex), increased spending on contact-based services, reduction in housing market inventory, strengthening of corporate balance sheets, sound health of public sector banks, and a willingness to increase credit supply to Micro, Small, and Medium Enterprises (MSMEs). These factors collectively contribute to the positive sentiment and confidence in the potential for economic growth in the coming fiscal year.]

- Risks to growth in coming fiscal will be:

- Slowdown in global demand

- Geopolitical tensions

- Global financial market volatility

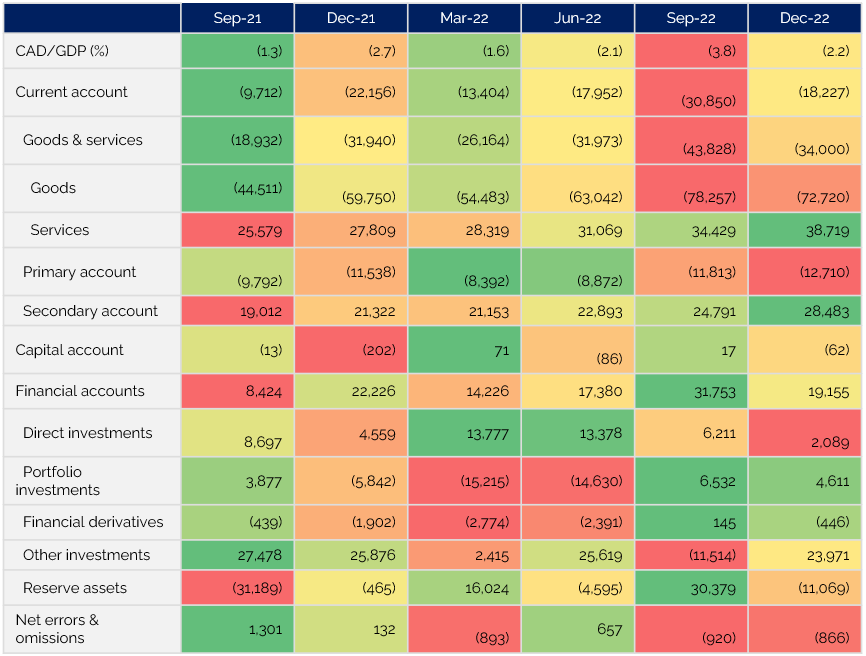

India’s CAD Shrinks Significantly

Expected moderate decrease in India’s CAD, manageable outlook ahead

- India’s current account deficit (CAD) exhibited a significant reduction, declining from a record high of USD 30.9 billion in the previous quarter to USD 18.2 billion in the quarter ending December 2023. Moreover, this figure was also lower than the CAD of USD 22.2 billion recorded in the same quarter of the previous year.

- In terms of proportion to GDP, the CAD for December 2022 quarter stood at 2.2 percent, which was notably smaller compared to the imposing 3.8 percent in September 2022 quarter. This positive trend indicates a notable moderation in India’s CAD, reflecting a favorable outlook for the country’s current account balance.

- Reason for the improvement in CAD were as follows:

- Shrinkage in merchandise trade deficit.

- Sharp improvement in net earnings from services exports.

- Higher secondary income from increased remittances from abroad and local withdrawals/redemptions of NRI deposits.

- We anticipate a moderation in the CAD for the March 2023 quarter, with a manageable outlook for the future.

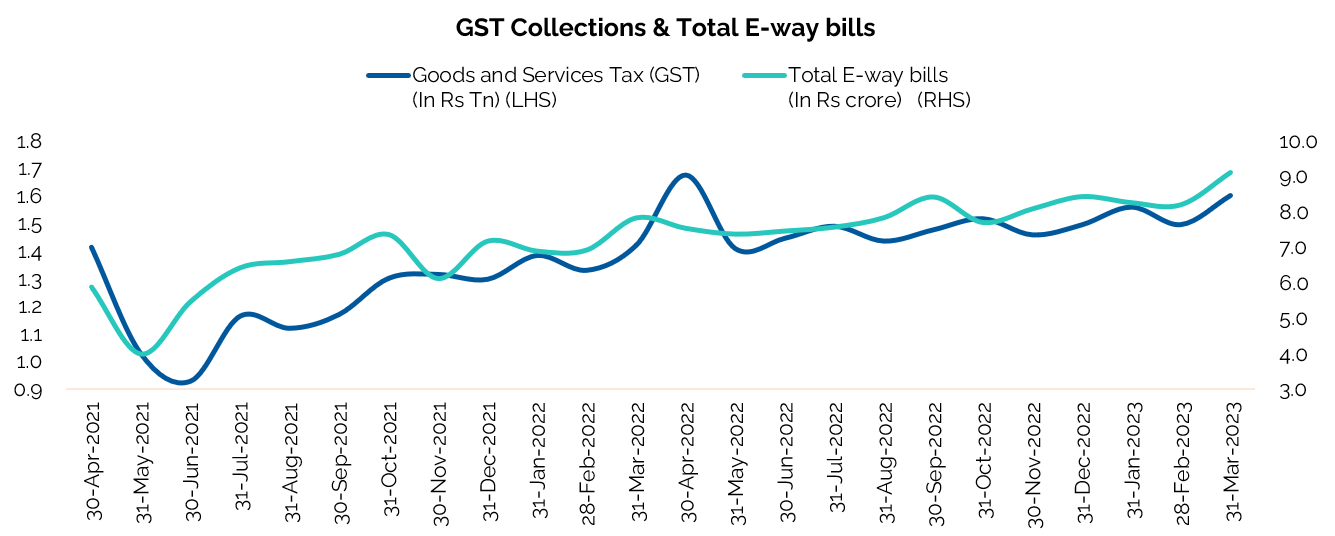

GST Collection: Nearly Topping Last Year

Goss Collections Soar by 22% in 2022-23; Surpassed Rs.1.4 Tn for 12 months in a row