GDP Growth Estimates Surpass Expectations

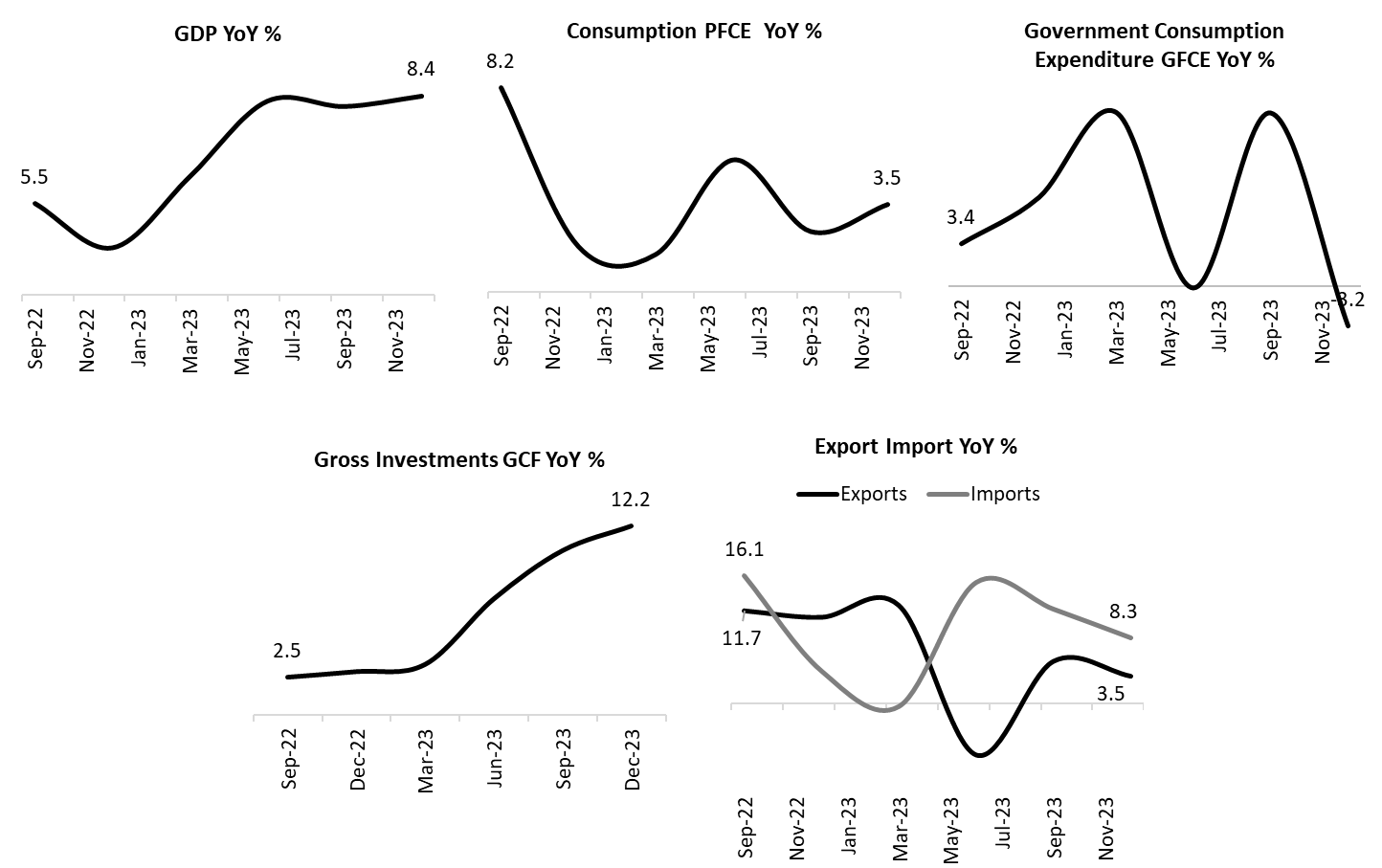

GDP growth for Q3FY24 is the highest growth witnessed in the last six quarters

GDP Estimates for Q3FY24:

| Agency/Institution | GDP Estimates For Q3FY2024 |

| RBI Monetary Policy Committee (MPC) | 6.5 |

| RBI Forecasters Survey (Median) | 6.5 |

| Barclays | 6.7 |

| ICRA | 6.0 |

| India Ratings | 6.5 |

| CARE Ratings | 6.9 |

| Morgan Stanley | 6.5 |

| Deutsche Bank | 7.0 |

GDP Numbers By NSO for Q3FY24:

| Indicators | Q3FY2024: YoY Growth % | % Share in Total |

| Gross Domestic Product | 8.4 | 100.0 |

| Consumption PFCE (C) | 3.5 | 58.6 |

| Gross Investments GCF (I) | 12.2 | 35.2 |

| Government Expenditure GFCE (G) | -3.2 | 7.8 |

| Export (X) | 3.5 | 22.2 |

| Import (I) | 8.3 | 23.9 |

India’s Q4 2023 GDP Surge

Strong Q4 2023 GDP growth showcases India’s economic resilience and future optimism.

- India’s real GDP surged by a remarkable 8.4% year-on-year in the October-December 2023 quarter, exceeding expectations and marking the highest growth rate in six quarters. This growth was underpinned by robust investments, particularly driven by government capital expenditure, coupled with a substantial improvement in the trade deficit and a pickup in consumption demand. Despite sluggish private sector investments, the economy benefited from strong government spending and expanding exports.

- Looking ahead, sustaining this momentum will depend on continued government support, especially in the form of infrastructure spending and investment-friendly policies. Additionally, efforts to stimulate private sector investments and enhance consumption demand will be crucial for maintaining growth momentum.

- Overall, while challenges remain, the strong performance in the December 2023 quarter indicates resilience in the Indian economy, suggesting a cautiously optimistic outlook for the coming quarters.

Industry Growth Makes A Strong Impression

Manufacturing and Construction Lead the Charge

Source: CMIE, Fisdom Research

- In the third quarter of the year, India’s industrial sector exhibited robust growth, particularly in manufacturing and construction. The Gross Value Added (GVA) in the industry surged by an impressive 10.4%, led by a significant expansion in manufacturing activities. Despite a slight slowdown in manufacturing, revisions in previous GVA figures contributed to the sector’s healthy performance. Construction, the second fastest-growing segment, posted a solid 9.5% growth, buoyed by strong indicators such as domestic steel consumption and cement production. Additionally, the mining, quarrying, and utilities sectors also contributed to the overall growth, with GVA increasing by 7.6% and 9%, respectively.

- The notable growth in the industrial sector can be attributed to various factors. The manufacturing sector benefited from revised GVA figures, while construction saw sustained activity supported by indicators like steel consumption and cement production. Additionally, strong performance in utilities, mining, and quarrying further bolstered industrial growth.

- Looking ahead, continued government support for infrastructure projects and favorable economic conditions are expected to sustain growth momentum in the industrial sector, contributing positively to India’s overall economic outlook.

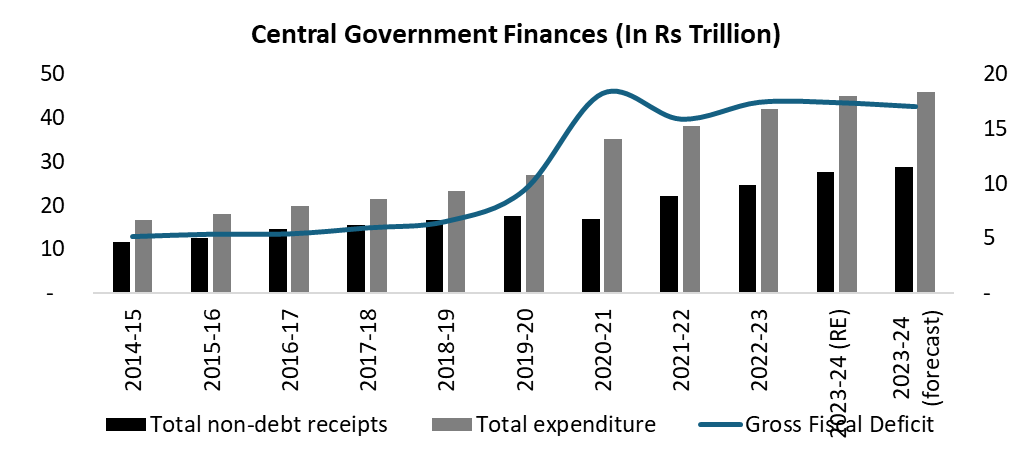

Comfortable Fiscal Figures

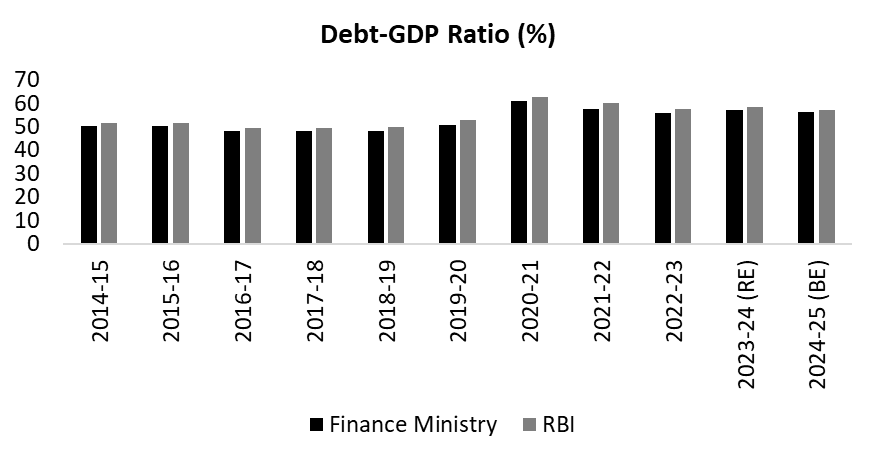

A reduced fiscal deficit is expected to bring down the debt-GDP ratio

- The anticipated gross fiscal deficit (GFD) for the fiscal year 2023-24 is expected to closely match the Revised Estimates (RE), projected at 5.8% of GDP, or approximately Rs.17 trillion, slightly below the government’s initial estimate. This alignment reflects nuanced fiscal dynamics, including a reduction in nominal GDP as per the second advance estimate by the National Statistics Office.

- The alignment is primarily driven by revenue receipts outperforming RE levels, propelled by robust tax and non-tax revenue performance. Increased income taxpayers, corporate profits, and strong dividend collections from public sector enterprises (PSEs) are anticipated to bolster revenue momentum. However, non-debt capital receipts might fall short due to subpar disinvestment proceeds, while government expenditure is expected to marginally surpass RE levels, mainly due to higher revenue expenditure.

- Looking ahead, the Interim Union Budget 2024 indicates a lower GFD for fiscal year 2024-25, alongside reduced government borrowings, likely moderating the debt-GDP ratio and exerting downward pressure on bond yields, which could positively impact India’s debt markets. Additionally, India’s inclusion in JP Morgan’s Government Bond Index-Emerging Markets and Bloomberg’s proposed inclusion of Indian bonds under the fully accessible route is poised to stimulate foreign inflows, potentially further influencing bond prices and yields.