Technical Overview – Nifty 50

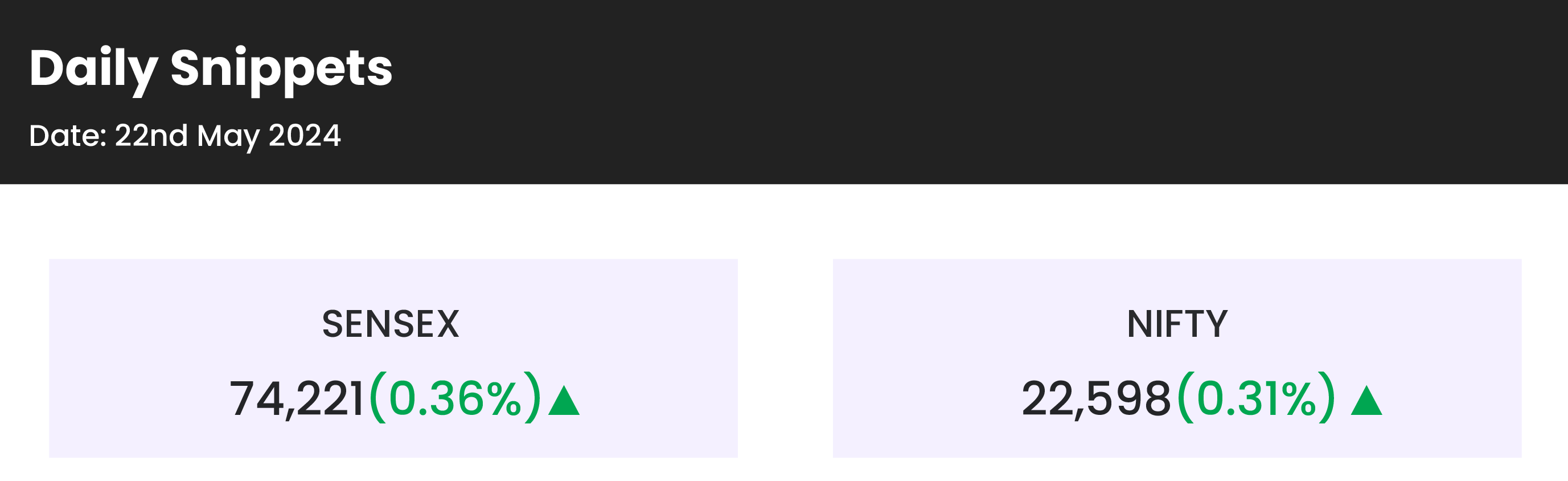

The benchmark NIFTY index increased to 22,598, up 68 points, or 0.31%. The bullish momentum from last week seems to be holding, the momentum’s velocity looks to be continuing around its all-time high. The benchmark index touched a low of 22,480 and dipped in the final 45 minutes of the session, though the benchmark index quickly recovered and reached a new high for the day.

The markets may get closer to levels of 22,800 because the 14-period momentum indicator (RSI), which shows that buyers are becoming more and more inclined to buy, is above 55. Call open interest rose by more than 100% at 22,650 levels. As it subsided, the INDIA VIX fell 1.5%. The fear zone of the Market Mood Index (MMI) indicates that investors are hesitant to take a long position.

The benchmark index’s 22,440 and 22,340 zones serve as support levels. The levels 22,670 and 22,800 might serve as resistance levels in subsequent sessions.

Technical Overview – Bank Nifty

By the end of the day, the BANK NIFTY index was down 266 points, or 0.55%, at 47,782. The final 45 minutes of the session saw a rollercoaster move that saw a low of 47,435 but managed to gain almost 500 points and close near 47,700.

The index spent most of the trading session moving between the 47,600 and 47,800 levels, suggesting that it has lost its upward momentum. For those who bought options, most of the day was boring until the final few minutes of the session, when an index of more than 500-point change occurred.

The index is currently encircling the lower band of the pole channel and the bottom flag. These levels can provide the index with a strong foundation of support. AU Bank and SBI were the index’s largest draggers, both declining by more than 1.5%.

Future session resistance levels are shown at 48,300 and 48,600, and future session support levels are shown at 47,500, and 47,300.

Indian markets:

- On May 22, the Indian benchmark indices closed positively, with Nifty surpassing 22,600 amidst a volatile session preceding the release of the Fed’s latest meeting minutes.

- The Indian stock market witnessed reduced volatility, marked by a 1.6% decline in the fear index India VIX to 21.5. Diminished concerns related to elections directed investor attention towards stock fundamentals, maintaining a positive medium-to-long-term outlook for the domestic market.

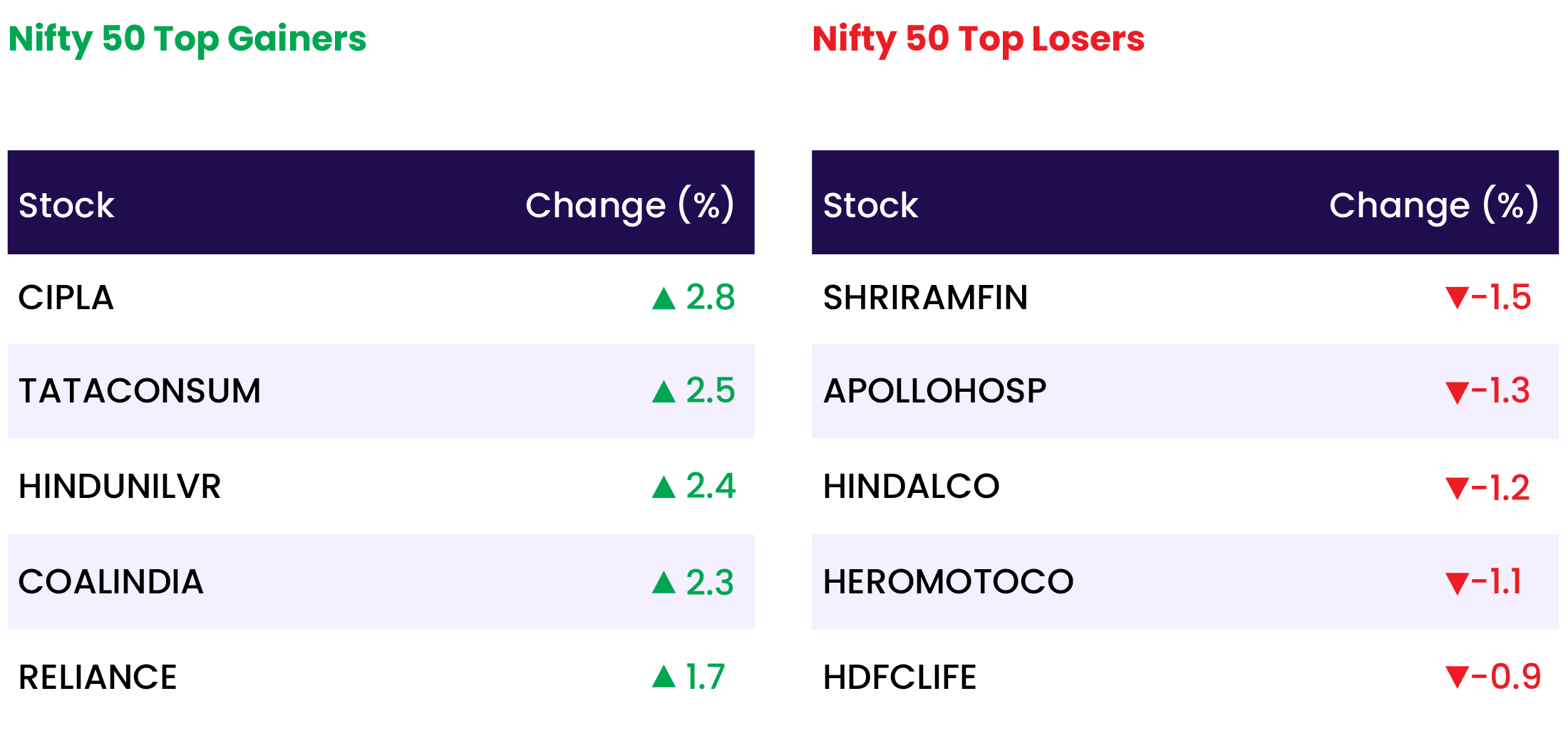

- Across sectors, realty and FMCG sectors each gained one percent, while capital goods, IT, and Media sectors each rose by 0.5%. Conversely, the bank index declined by 0.5%, and the meal index saw a 0.4% decrease.

- The BSE midcap index concluded the day flat, while the smallcap index edged up by 0.2%.

Global Markets:

- On Wednesday, 22 May 2024, Japan’s share market saw declines for the second consecutive session, with the Nikkei 225 index down 0.85% and the broader Topix index falling 0.81%.

- Singapore’s market was closed for Vesak Day. Hong Kong’s market ended slightly lower, with the Hang Seng Index dropping 0.13% and the Hang Seng China Enterprises Index down 0.05%.

- Mainland China’s market edged higher, led by slight gains in the Shanghai Composite, Shenzhen Composite, and CSI300 indices.

- In Australia, the stock market finished slightly lower, with the S&P/ASX200 down 0.05% and the All Ordinaries declining 0.02%.

Stocks in Spotlight

- Welspun Enterprises shares surged over 7% after the company emerged as the lowest bidder to construct an access-controlled multi-modal corridor from Navghar to Balavali, Maharashtra. The project, quoted at Rs 1,864.71 crore, is expected to be completed within 36 months from the date of notice.

- Suzlon Energy shares hit the upper circuit on May 22 after securing an order for the development of 402 MW wind energy projects for Juniper Green Energy. Suzlon will install 134 wind turbine generators (WTGs), each with a rated capacity of 3 MW, totaling 402 MW.

- BHEL shares tumbled as much as 5% to Rs 295 per share on May 22 after the company’s Q4FY24 results missed expectations. BHEL’s net profit fell 26% year-on-year to Rs 489 crore, while revenue rose marginally by 0.4% year-on-year to Rs 8,260 crore.

News from the IPO world🌐

- Beacon Trusteeship IPO to open on May 28

- Travel portal ixigo’s parent firm, Bansal Wire Industries get Sebi’s go-ahead to float IPO

- OYO withdraws DRHP, to refile IPO post refinancing:

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY FMCG | 1.4 |

| NIFTY REALTY | 1.4 |

| NIFTY MEDIA | 0.7 |

| NIFTY IT | 0.7 |

| NIFTY PHARMA | 0.6 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1902 |

| Decline | 1932 |

| Unchanged | 114 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,873 | 0.2 % | 5.7 % |

| 10 Year Gsec India | 7.0 | (1.1) % | (1.5) % |

| WTI Crude (USD/bbl) | 79 | (1.7) % | 11.8 % |

| Gold (INR/10g) | 73,801 | (0.2) % | 7.2 % |

| USD/INR | 83.29 | (0.0) % | 0.3 % |