We all know a kid who remained at the bottom of the class long enough for people to lose all faith in his progress only to be surprised when he lands a great opportunity and is perhaps more successful in life than most peers.

Even in Indian equities, many in the small/mid-cap space are assumed to be underdogs till one fine day when an opportunity comes knocking and it hits one out of the park. True, one cannot simply generalise all small/mid-cap stocks to be underrated, but the ones that offer a massive wealth-creation opportunity along with business turnaround.

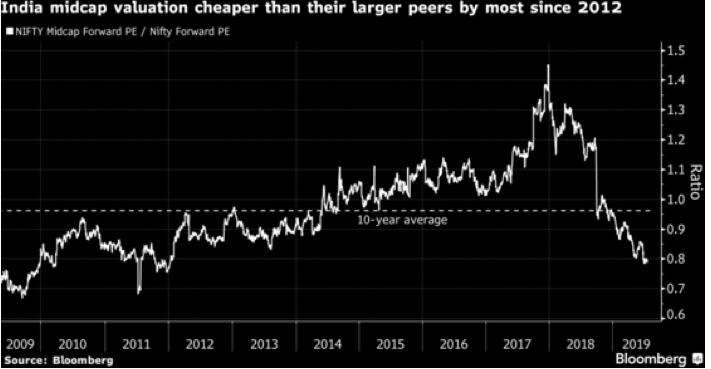

While Indian capital markets, along with other emerging nations, witnessed a difficult phase last year, bellwether index Nifty still managed to climb to an all-time high last month but the small-caps at the bottom of the market-cap was unable to keep pace. At the time of writing this NIFTY50 has delivered a one-year return of ~3% but the NIFTY Smallcap 100 recorded a steep -16% decline and NIFTY midcap 50 slumped by almost 7% for the same period. The valuation polarization is too sharp. We look at mid and small-caps creating new bottoms and the basket dragging quite a few high-quality stocks along – this pushes them into the undervalued zone.

While the street is abuzz with news that the value of Indian stock markets grew by almost $51 billion, there is merit in acknowledging that most of this can be attributed to the top 15 performers while the rest did not contribute much value if not deteriorate.

These are the two key pointers that strengthen the case for a turnaround in the small/mid-cap segment soon:

1. Reducing cost and increasing supply of capital:

RBI has been cutting interest rates in an unprecedented fashion with a hope to revive credit offtake and subsequent private capital expenditure. This rate-cut strategy in conjunction with the government’s expressed intent to recapitalise & economically support the banking and NBFC segments is expected to bolster economic activities beginning at the bottom of India Inc. – small and mid-cap corporations.

2. Cheap valuations:

For those who believe that every scrip has an underlying value and while intermittent volatility may make it deviate for a short time it has to converge with the intrinsic value, here’s a heads up on the current valuation scenario for India Midcap.

While we expect FY20 to be a turnaround year for the small/mid-cap segment, we cannot stress enough on the importance of stock-picking (and fund-picking for you) to benefit from the recovery in the most optimal fashion.

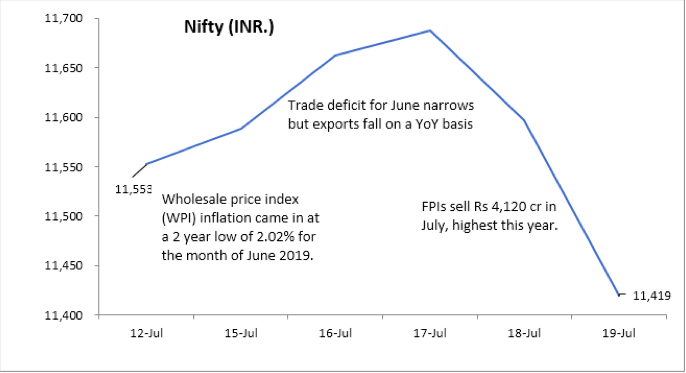

Meanwhile, the week was somewhat rough for bellwether indices, as well as the week, witnessed more news skewing towards negative than positive.

Key Takeaways:

Investors are advised to stick to asset allocation and not get jittery (especially around exposure to mid and small-caps) as long as your goal is at least another three to five years away. If the target date for your goal is closing in, write back and we will figure a way to get your portfolio on track.