Technical analysis is the bread and butter of traders. It is the study of price and volume movements that helps in understanding the prevailing market trends as well as any trend reversals. This study involves the analysis of various tools like charts, candlesticks, and other indicators. There are many traders that rely on Japanese Candlesticks for analyzing the market conditions. One such prominent Japanese candlestick pattern that is often used by traders across the globe is the Marubozu candles.

Given below is the meaning of the Marubozu candlestick pattern and how can traders use this pattern to trade.

What is a Marubozu candle?

Marubozu candlestick pattern, as mentioned above, is a Japanese candlestick pattern. The word ‘Marubozu’ literally means ‘bald’. These candles have a single solid body without any shadow. These candlesticks can be either bullish candles or bearish candles based on the price movements. The basic meaning of this candlestick pattern indicates that the opening and the closing price of the stock is the same and the bullish and the bearish trend is indicated based on such prices. The use of Marubozu candles helps in determining the prevailing price trends and future trends to take suitable positions.

Read more: Your complete guide to technical analysis

How can one identify a Marubozu candle?

It is fairly easy for traders and investors to identify the Marubozu candlestick pattern as it is a single solid body with virtually no shadows. There are two types of Marubozu candlestick patterns that indicate a bearish or bullish market. Such candles can represent the continuation of the current trend or the reversal of one depending on the period of the chart.

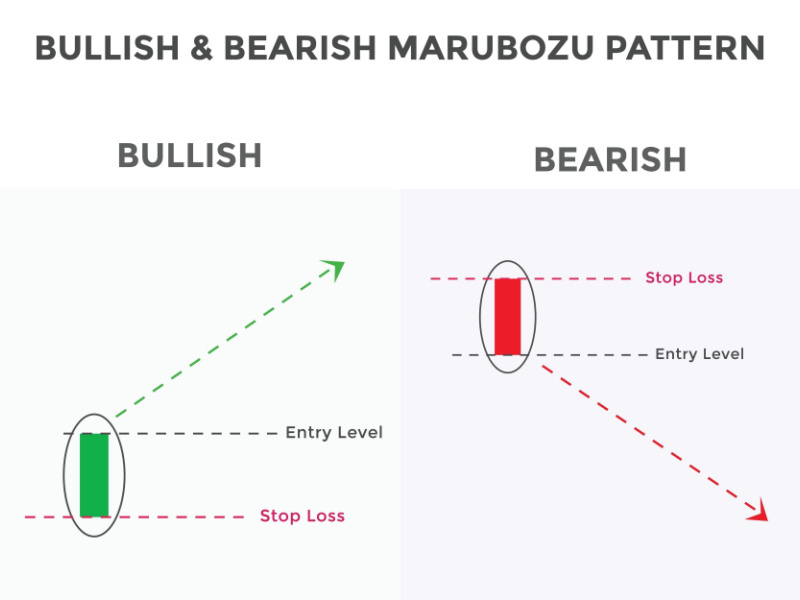

When the opening price of the stock is equal to the low of the day and the closing price of the stock is equal to the high of the day, it forms a green or a white body. This indicates a bullish trend and the dominance of the buyers in the market.

On the other hand, when the opening price of the stock is equal to the high of the day and the closing price is equal to the low of the day, it indicates a bearish trend. This trend can be identified by a red or a black candle. This candle indicates the dominance of the sellers in the market and the continual slide in the prices of the stock.

Read more: Different candlestick patterns that every trader should know

How can one trade using the Marubozu candle?

Marubozu candlesticks are quite simple to interpret and therefore can be a very handy tool for traders. When there is a formation of the green or white candle at an increasing uptrend, it indicates a continuation of the current trend. Traders are expected to go long in such cases as the prices are expected to continue to increase. When the white or green Marubozu candlestick pattern is formed at the downtrend, it indicates a possible trend reversal. In such cases, it is advisable for the traders to exit their long positions and use a stop loss (preferably a trailing stop loss, to minimize their losses.

Similarly, when the red or a black Marubozu candlestick is formed at the ongoing downtrend, it indicates the continuation of such a trend. The traders are expected to sell the stocks to gain the maximum advantage of the falling prices. When the red or black Marubozu candlestick is formed at an uptrend, it indicates a trend reversal and the rising presence of the buyers in the market. Traders can trade in this situation strategically using stop loss to minimize their losses.

Conclusion

The Marubozu candlestick pattern is one of the many Japanese candlestick patterns that are quite popular among traders. This pattern is easy to identify which adds to its widespread acceptance and popularity. However, it is important to note that this pattern cannot be solely used to make trading decisions as such decisions have to be backed by a thorough analysis and in-depth research and analysis of the company and its financials.

FAQs

No. Marubozu candle does not have virtually any shadow. It is a single solid body that indicates an uptrend and downtrend depending on the opening and closing stock prices.

A bullish Marubozu candle is formed when the opening price of the stock is equal to the day’s low and the closing price of the stock is equal to the day’s high. A green or white candle is formed as a result to indicate a bullish trend or a continuatio0n of this trend.

A Marubozu candle is easy to identify and interpret on account of the single-body candle without any shadows. Hence, even novice traders can use this candlestick pattern to trade.

Marubozu candlestick pattern through easy to identify, cannot be used on a standalone basis to determine the trend or a possible trend reversal. Traders should back their analysis with other indicators and fundamental analysis of the stocks.

The opening and closing Marubozu candlestick pattern can be bullish or bearish depending on the stock price. A bullish opening Marubozu candlestick pattern is formed when the opening price is equal to the low price of the day and when the opening price is equal to the high price a bearish opening Marubozu candlestick pattern can be formed. On the other hand, a closing bullish Marubozu candlestick pattern is formed when the closing price is equal to the high price, and a bearish closing Marubozu candlestick pattern is when the closing price is equal to the low price.