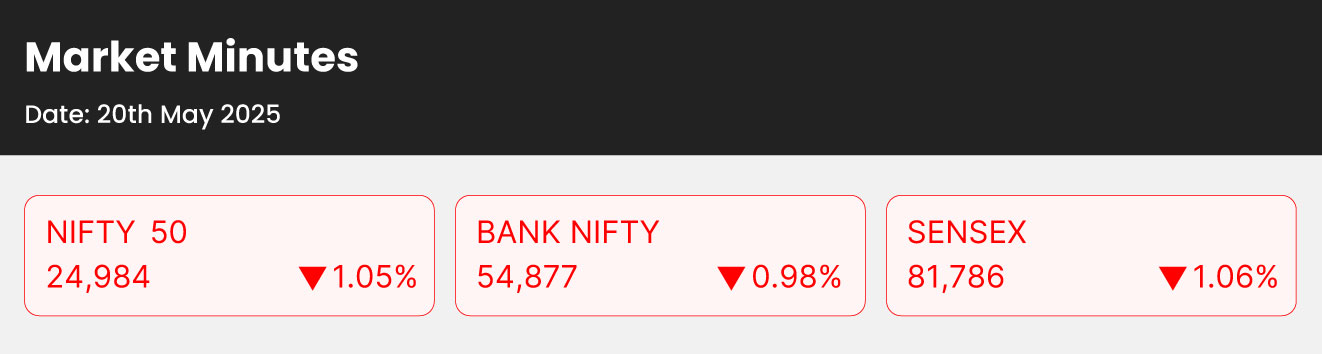

Market Snapshot

- Broader market indices ended in the red, breaking a six-session record rally.

- The decline was led by sharp corrections in midcap and smallcap segments.

- Profit booking at elevated valuations likely triggered the sell-off, especially in smaller stocks.

- Smallcap stocks had witnessed a sharp run-up, with the index’s market capitalization rising by over ₹1.9 lakh crore during the previous six sessions.

- The recent pullback reflects investor caution after a strong rally in the broader market.

Sectoral Trends

| Sector Name | % Change | Sector Name | % Change |

| NIFTY IT | -0.5 | NIFTY PSU BANK | -0.9 |

| NIFTY METAL | -0.6 | NIFTY PRIVATE BANK | -1.0 |

| NIFTY OIL & GAS | -0.8 | NIFTY REALTY | -1.1 |

| NIFTY CONSUMER DURABLES | -0.8 | NIFTY PHARMA | -1.3 |

Top News

- Auto stocks dragged the Nifty Auto index down by over 1.5% on May 20, with major names like Hero MotoCorp, Maruti Suzuki, and Eicher Motors falling over 1.5% amid profit booking after a four-day rally.

- Defence-related stocks extended losses for a second session, with Cochin Shipyard plunging 8% and several peers like Data Patterns and BEML also seeing sharp declines.

- Hindalco reported a 10% YoY rise in standalone net profit to ₹1,561 crore for Q4, supported by strong domestic aluminium and copper performance along with lower input costs.

Top Gainers and Losers

| Top Gainers | % Change | Top Losers | % Change |

| COALINDIA | 1.6 | ETERNAL | -4.2 |

| TATASTEEL | 1.3 | HEROMOTOCO | -3.2 |

| HINDALCO | 1.2 | BAJAJ-AUTO | -2.8 |

Technical Outlook: Key Indices

| Indices Name | Support | Resistance |

| Nifty | 24,500 | 25,000 |

| Bank Nifty | 54,500 | 55,500 |

Trade Ideas Update

- Our trade ideas success rate has 77% over the past month, even with increased volatility in the benchmark index. Follow Trade Ideas for timely stock insights.

Please visit www.fisdom.com for a standard disclaimer