In Equity funds, we have different kinds, Active and Passive funds are one among them. Generally to brief on these funds:

“Passive funds: A lazy man’s strategy to earn money

Active funds: weathered the storm to earn money.”

Before having these two in your portfolio, let’s understand the concept.

Active Funds:

Active funds usually incur high cost because investors pool money and hand it over to a fund manager whose job is to select investments based on scientific research, intuitions and his experience. The investors take risk of investing in these funds because the outcome will be more effective.

Passive Funds:

It eliminates humanly ideas in predicting market moves. Passive investing means owning the market rather than trying to beat the market. It sounds uninteresting, but it is a desirable investing.

There is no difference between passive funds and index funds. All the index funds form the part of passive investing.

Beating or matching the market?

Passive investors consider that beating the part is impossible whereas, on the contrary, active investors believe that they can beat the market by selecting the good stocks. But with an aim to overcome the market and beat the benchmark, the fund managers end up substantially raising the cost of buying and selling the stocks.

The idea behind passive investing is to take advantage of market moves and compensate for the risk with the returns.

Don’t look at investing as a medium to make more money in a short span. The successful investors are those who invest for the longer term and understand that the returns are compounded over a period of time along with risk. This is the strategy used by investors to build the money.

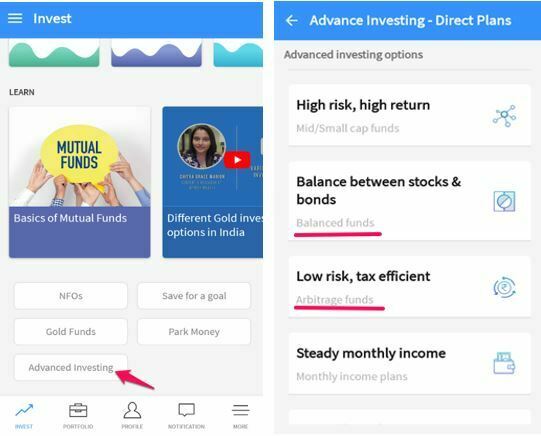

Balanced funds:

The fund manager will always try to handle the asset allocation to safe the fund of the investors. And balanced funds are new kinds of funds launched and gaining huge popularity. Let’s understand the balanced funds in deep. There are 3 kinds of balanced funds-

- Conservative Funds.

- Balanced Funds.

- Aggressive funds.

Conservative funds have 10-25% in Equity, balanced have 40-50% in Equities, aggressive funds have 65-80% in Equities.

Balanced funds are marketed as “Monthly Income Plans”. MIPs don’t offer any assured incomes, these are just the combination of debt funds with a small unit of equities that offer slightly higher returns than the pure debt funds.

Start investing in Fisdom – to see the fractions on your gains.

“Don’t gamble- take all your savings and buy some stocks, hold it till it goes up, then sell it. If it doesn’t go up, don’t buy it”

– Will Rogers