(Pritha wears many hats at Analytics Quotient, and her work day is a reflection of the chaos that only a high-energy, small company can generate. Her every-day is a cocktail of many diverse elements; marketing, training, delivering solutions for new clients, lending a patient ear to an aggrieved soul etc etc etc. Though she is a calm person by temperament, she sometimes finds it difficult to keep her balance amidst the frenetic drama of managing the “everyday” of AQ. When not flitting from role to role at AQ, Pritha loves hitting the road, getting lost in forests, listening to classical music, reading crime fiction, eating blue cheese, reading poetry and watching the trees from her home in Bangalore. Across her professional career, Pritha has lead large delivery teams and built offshore capabilities for organisations. Her analytics expertise lies in the areas of Consumer Segmentation, Pricing and Drivers’ Analysis)

What’s the inspiration behind your decision to launch Analytics Quotient?

The journey started with identifying a problem faced by many growing companies across industries. This problem was the gap between companies’ expectations and reality – this gap needed to be bridged by insightful analytics and structured consultancy. Identifying this gap was followed by an idea – an idea that there should be an organization to help solve challenges faced by other organizations. This was the inception story of Analytics Quotient.

What, according to you, are the biggest challenges Indian women face while taking financial decisions?

I believe that many women focus very little on financial education and have a high level of reluctance when it comes to managing personal finance. This could be happening due to a variety of reasons. For the longest time, men in Indian families have taken financial decisions, and even with greater financial independence for women, these habits are slow to change.

How different are women from men when it comes to investing and managing personal wealth?

I think women have a natural tendency towards commitment. In general they tend to look at the long-term. This personality trait bodes well for women as long-term investors.

I don’t know if there are specific gender differences when it comes to investment – I have woman friends that are aggressive, risk-taking investors, but also those that tend to be conservative and cautious. I’m sure it’s the same with men. In general most women I know do their research when it comes to investment and are unlikely to give in to short-term fads.

Can you share one of the worst financial advice you have received by someone you know?

I think it was probably from someone much older who told me very early in my career to only invest in bank fixed deposits and nothing else. I’m happy to say I didn’t listen to that piece of advice.

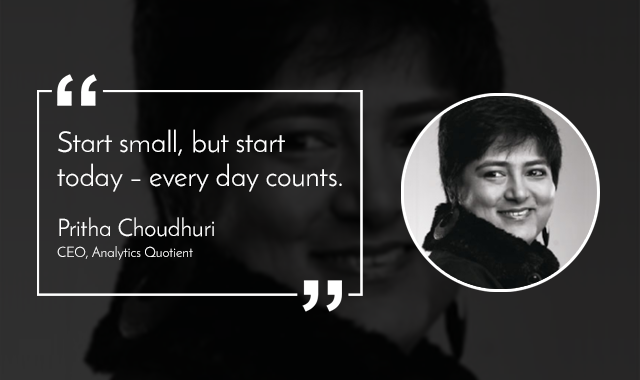

What’s your golden piece of financial advice to all our women readers?

My only piece of advice would be to take charge of your finance, take action and take it now. Start small, but start today – every day counts.