With the tax-return filing deadline just around the corner and changes in the process, understanding the key changes has become even more crucial.

The Central Board of Direct Taxes (CBDT), the income tax regulator has made an attempt to simplify the tax filing process and notified the new income tax return forms for the assessment year 2017-2018. These changes are effective from 1st July, 2017.

Note: The deadline to file ITR has been extended to 5th August, 2017

Here are the few changes & the thoughts behind them-

- Disclosure of Aadhaar Number:

Now Aadhaar number is mandatory for filing income tax return. You must mention the 12-digit Aadhaar number or the 28-digit Aadhaar enrolment number while filing the income tax return. Till last year it was optional to mention the Aadhaar number while filing the return.

Why?

This is in an attempt to ensure wider coverage under the vision of having an all-pervasive unique identification for all citizens.

- Prelinking Aadhaar and PAN card:

Both Aadhaar and PAN have already been made mandatory for filing tax returns, opening of bank accounts and financial transactions over Rs 50,000.

Why?

Linking Aadhar with PAN is expected to help check tax evasion through use of multiple PAN cards

- Disclosure of cash deposited more than Rs. 2 lakhs:

To account for those who have deposited Rs 2 lakh or more in a bank account during the demonetisation period, the tax department has introduced a new column where the person filing the tax will have to give details of the money deposited and bank account. If a person has deposited Rs 2 lakh or more he or she will mention the IFSC code, name of bank, account number along with the amount deposited in the income tax return.

Why?

This is to keep track of all deposits during the demonetisation and aid surveillance to ensure maximum tax coverage and fair disclosures.

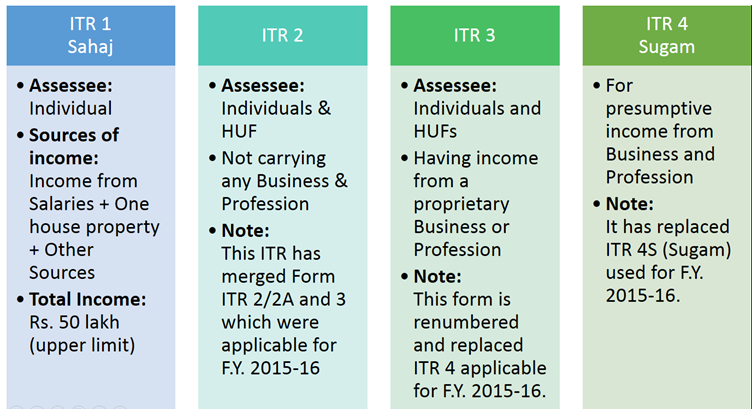

- Changes in ITR form numbers: