Yields have dropped significantly in February. RBI’s initiatives like the LTRO (Long Term Repo Auction) along with the migration of capital to safer harbours like the sovereign bonds have led to a softening in the yields of Indian government securities as well.

G-sec Yield Movement for Feb’20

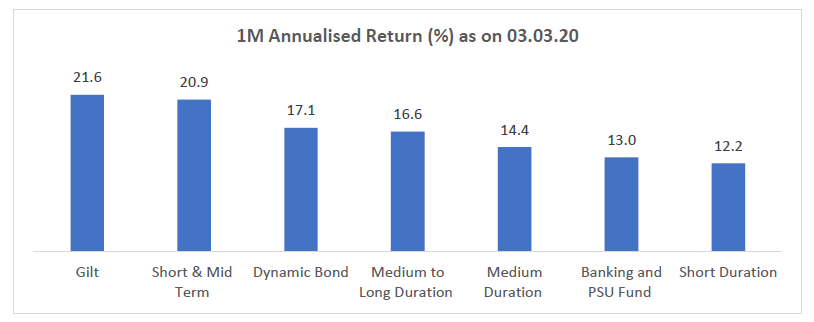

Cash & cash equivalents have been investor darlings during times of crisis, but considering other developing economics, the love has extended to duration-oriented debt funds as well.

In light of further global trade slowdown and increased probability of rate cut – taking cue from the US Fed’s emergency 50 bps rate cut, there’s a probability that RBI follows suit leading to further softening of the yield. However, we do not believe that the same is an absolute necessity.

Takeaways for debt fund investors

- Short to medium duration bonds (average effective maturity of 6 to 8 years) could deliver better than average returns.

- Investors must avoid taking on credit risks as far as possible and move to funds with a higher allocation to sovereign securities.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2ALpZrf||target:%20_blank|” button_position=”button-center”]