In recent times, mutual funds have undergone many regulatory changes. The primary motive behind most of these changes is to make mutual fund investments more transparent and safe for investors. One of the noteworthy changes that are being implemented by SEBI is the introduction of risk levels attached to all mutual fund schemes.

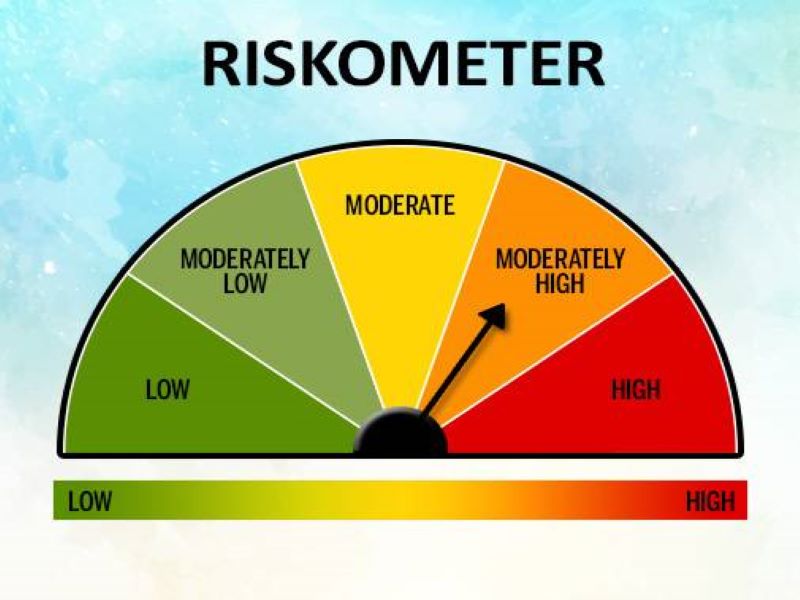

SEBI announced the introduction of a new riskometer back on October 5, 2020. This has come into effect on January 1 2021. Accordingly, all mutual fund houses have been instructed to notify investors about the risk level of their schemes. The risk levels must have a six-stage scale ranging from “Low” to “Very High”.

Are you curious about what this means for you as an investor and how it could help you invest better? Let’s have a look at some important aspects to note about the new mutual fund riskometer.

New-Age Risk Measuring Mechanism – Riskometer

There was an existing risk measuring mechanism before the new-age riskometer was introduced. However, it was only meant to display the risk of a particular fund category without notifying investors about the risk involved in the fund itself.

Why was the new riskometer introduced?

As per the recommendations of the Mutual Fund Advisory Committee, SEBI has reconsidered the existing categories of risk levels for mutual fund schemes. The earlier risk measurement mechanism lacked the ‘very high risk’ category of risk. To make mutual fund schemes more transparent and to allow investors to be fully aware of the associated risks, SEBI has introduced this additional risk level as part of the new risk-o-meter.

New riskometer to come into effect in 2021

From Jan 1, 2021, all mutual fund houses in India have been instructed to update the riskometer every month on their websites along with the AMFI website. In case there is a change in the riskometer level, they must effectively communicate the same to investors. The new circular also requires mutual fund houses to publish the exhaustive list of riskometer changes annually.

Additionally, SEBI has also introduced new labelling norms meant for the dividend options of mutual funds. Accordingly, mutual funds must rename the dividend options in their schemes as ‘income distribution cum capital withdrawal’ with effect from 1st April 2021.

How does the new risk-o-meter work?

The new riskometer has to display six levels of risks. Each category suggests a mutual fund scheme’s risk level. The 6 risk levels are:

- Low Risk

- Low to Moderate Risk

- Moderate Risk

- Moderately High Risk

- High Risk and

- Very High Risk

Based on a mutual fund scheme’s characteristics, the fund houses must assign a risk level during the launch of the scheme or a New Fund Offer. Any change to the risk level must be properly communicated to all the investors by either sending a Notice cum Addendum through e-mail or SMS. All unitholders of the scheme should be intimated accordingly.

The table below provides details of each of the risk levels as per the new riskometer, suitability of each level for investor types and the kind of mutual fund products to expect under each risk level.

| Risk Levels | Suitable for Investor Category | Mutual Fund Product Types |

| Low | Conservative | Gilt funds / Income fund with maturity less than 90 days |

| Moderately Low | Moderately Conservative | 91 to 3 years short term bonds |

| Moderate | Moderate | MIPs, / Hybrid debt-oriented funds |

| Moderately High | Moderately Aggressive | Index Funds / Gold ETFs / Balanced equity funds up to 20% in the portfolio / Generally large cap funds |

| High | Aggressive | Micro-cap funds / International funds / Sectoral funds |

| Very High | Overly aggressive | Not yet classified |

Where can you find the riskometer?

SEBI requires mutual fund houses to disclose the risk factor of all mutual fund schemes as below:

- On the front page of the initial offer form, Scheme Information Documents (SID) and Key Information Memorandum (KIM).

- Common application form.

- The product label risk level has to be prominently placed near the caption of the scheme where it should be clearly visible.

- On all of the scheme advertisements.

Benefits of Riskometer

The new riskometer has been designed to offer additional benefits to investors. Alongside, it will also mean extra caution on the part of all fund houses. Here’s what will change for investors and fund houses:

Benefits to investors

Every mutual fund investor must invest in schemes as per his/her risk profile. As an immediate help in decision-making, the riskometer or product labelling for every mutual fund will come in handy for investors. Although risk and return have an inverse correlation, investors must be aware of the level of risk that an MF scheme may expose them to. Thus, the new risk-o-meter introduced by SEBI is likely to help investors make an informed investment decision.

What does it mean for the fund houses

With the new riskometer, fund houses will likely not be adversely impacted. This is because they were required to categorize mutual fund schemes within five risk levels. The new risk measurement has only added one new risk level, which is the “Very High Risk”.

Mutual fund houses can now gain investors’ confidence and see more investments coming through because of the new risk mechanism. Since fund houses will have to calculate these every month, they can maintain or change their portfolios constantly. As investors will likely lose less money because of informed decision-making, fund houses can gain from the regular inflow of investors.

Other mutual fund rules introduced by SEBI in 2021

Apart from the riskometer changes, here are some of the other modified mutual fund rules introduced by SEBI for 2021.

Inter-scheme transfers

As per the rule changes, inter-scheme transfer of debt papers, specifically in close-ended funds, will be allowed only within three business days from the date of allotment of the scheme’s units to investors. This indicates that inter-scheme transfer can only be used by any fund house after exhausting all other avenues of raising liquidity. Additionally, the regulating body has also stated that such transfer cannot be used in case of negative news or rumours about the security as per internal credit risk assessment.

NAV calculations

Until now, mutual fund investors used to get the same-day NAV provided the investment value was below Rs. 2 lakhs and the investment was within the NAV cut-off timings.

With the latest announcement made by SEBI, investors will now get the same day’s NAV only in case the money reaches the mutual fund house on the same day as purchasing or redeeming mutual fund units from the mutual fund scheme held by the investor. This change came into effect on February 1, 2021.

Multi-Cap fund allocations

SEBI has mandated multi-cap funds to invest a minimum of 75% of their total assets in equity and equity-related instruments, as against the earlier requirement of 65%.

Before the announcement of new guidelines, there were no defined rules on how the fund manager of any multi-cap fund can allocate the total money invested. With the new rules, here are the requirements to be followed:

For all equity investments:

- A minimum of 25% to be invested in large-cap stocks

- A minimum of 25% to be invested in mid-cap stocks

- A minimum of 25% to be invested in small-cap stocks

End Note

The new mutual fund riskometer is expected to help investors in scrutinizing their portfolio carefully before making an investment choice. This will also create a good opportunity for new investors to better understand the various risks associated with mutual funds instead of solely relying on statements made by mutual fund houses.