2021 is >3 months away, and a 2019 disease is yet ever-so relevant. In fact, getting more so with every passing day. Yes, we are talking about the biggest socio-economic crisis humanity has faced in recent times – Covid 19.

Covid-19 has become as universal as water featuring in every headline across periodical in every nook-&-corner of the world. And just like the water crisis, this disease too has taken a severe toll on Health-&-Wealth infrastructures of continents and countries.

Bringing the world to a halt, Covid-19 highlighted many shortcomings across all nations, the effects of which spilled on border-agnostic markets wiping off trillions in a matter of 2 months. Nifty 50 recorded highest volatility levels at 80+ (more than during GFC’08), witnessing its biggest drop (-~40%) in 10 years!

But as the Rocky Movies have taught us, “It is how you get back up, that counts”. Cue “Eye Of The Tiger”

From Covid ‘Cry’sis To ‘Pharm’ing Opportunities

If Covid-19 pandemic has been a Bane so far, then countries have been quick to wear the Bat-suit, looking to curb illness and welcome wellness.

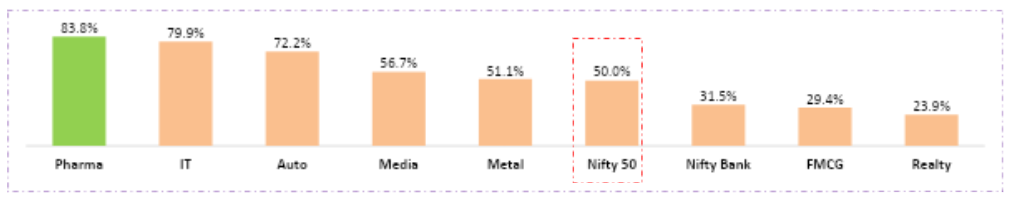

The world’s collaborative efforts on vaccines and relief packages is yielding results as is seen in unlocking of factories and markets. Graph below shows how Indian indices have rallied from 1st lockdown to 4th unlock:

As can be seen above, the near-to-medium future is going to defined by APIs and AI. Health has always been and will always be one of the most primary elements of societies everywhere. And the viral virus has just cemented this belief.

Banking on the renewed focus on upscaling the current healthcare sector, Edelweiss via their NFO – Edelweiss MSCI India Domestic & World Healthcare 45 Index Fund links investor wealth with world health.

Why Have 1 When You Can Have It All

The Edelweiss Fund will be Passively managed, Open-ended Equity Scheme replicating MSCI India Domestic & World Healthcare 45 Index.

The healthy exposure between Local and Global across the Healthcare market spectrum can help vaccinate your portfolio to market malaise. This is how:

- Bet Big – Win Bigger: Going Global Welcomes Growth Opportunities

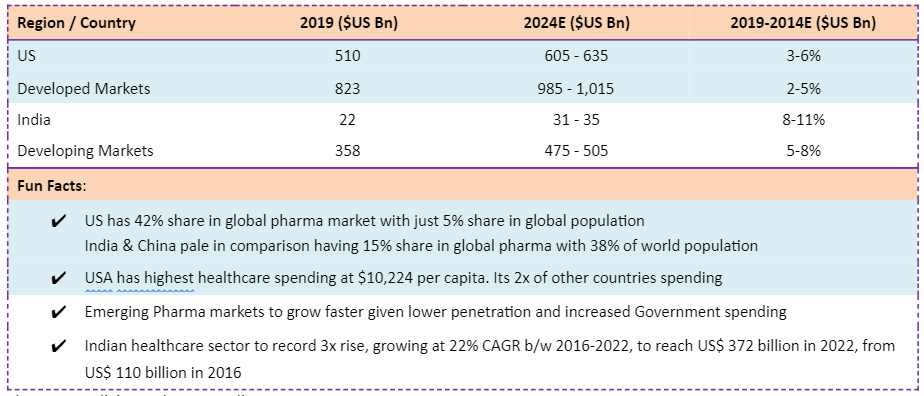

a. Global healthcare industry net-worth to cross $10 Tn by 2022 from being valued at $8.45 Tn in 2018 because of inflated capex and consumer expenditures in coming times

b. The Growth Gears Shifts From Linear To Exponential as can be seen in table below:

2. Where There Is Medicine – There Is India

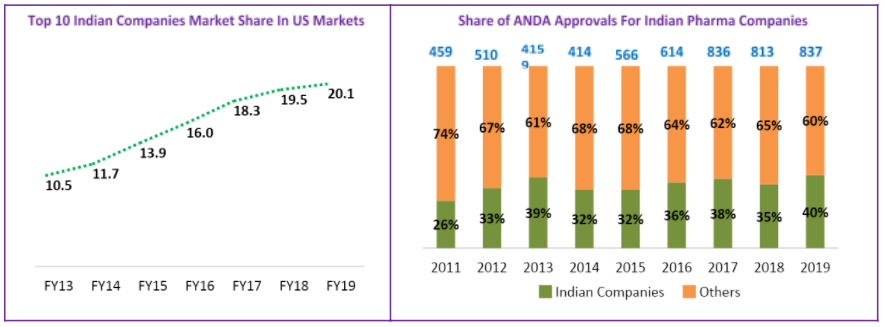

a. The Indian pharmaceutical industry is 3rd largest in world on volume terms accounting for 10% of global industry and >60,000 generic brands!

b. India drug exports account for 20% of total global exports by exporting to >200 countries. It was 3rd largest principal commodity exporter In FY19.

c. Graphs below highlight how India can continue to inject wealth in your portfolio by capitalizing on Corona Crunch

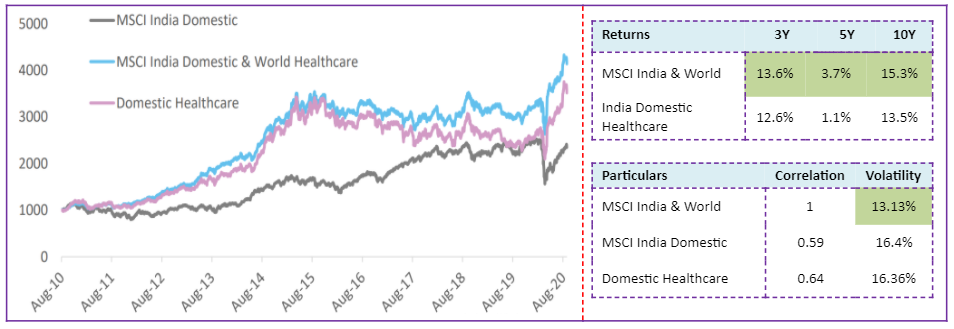

3. The Intelligence In Indexing

Covid-19 in market parlance means volatility. Indexing presents a smart way to regain upside fervor and bid adieu to downside fever. The data below highlights how indexing favors apt risk-return metrics in all capital climates.

Already excited to go hunting for your favorite healthcare fund? Edelweiss MF brings fight-&-flight to your portfolio!

Edelweiss MSCI India Domestic & World Healthcare 45 Index Fund

The Fund is a passive Index Fund investing in stocks comprising the underlying MSCI India Domestic and World Healthcare 45 Index which constitutes 45 healthcare sector stocks listed across India and US market

Fund Composition is as follows:

- 95-100% of portfolio allocated in MSCI India Domestic & World Healthcare 45 Index with 0-5% in Liquid/Money Market MFs

- 70% Weight to be given to India Healthcare:

- Top 25 Stocks based on Market-Cap

- Sub-sectors covered: Pharma, Hospitals, Diagnostics, Life Science Tools-&-Services, Biotech and other services

- 30% Weight to be given to World Healthcare:

- Global Healthcare companies listed in US

- 20 stocks – Top 5 stocks based on market cap size from 4 subsectors each – Pharma, Healthcare Equipment, Biotechnology and Life Sciences Tools and service

- Weights assigned based on FF market cap and capped at 20% and rebalanced on each calendar quarter end

About MSCI: Largest index provider in world with $13.1 Tn in AUM benchmarked to it & having 99.7% accuracy in index production.

Investor Takeaway

From hedging to a healthiness factor, this fund offers it all. Banking on the Healthcare segment to push India & world out of Covid era, the fund wears strong potential to grow in the coming decade. As health risks rise, so do its returns as govt.’s align their budgets to curb-stomp the spread of viral viruses.

Being highly thematic in nature, it comes with strong undertone of cyclicality. The indexing involved does reduce human bias offering some resilience. However, diverging from the broader market, the fund is apt for those willing to take tactical calls.

Those investing in this fund and category should wear High Risk appetites with investment horizon of up to 7 years & more

Key Details About The Fund