The Government of India is trying to embrace the digital age with open arms and is making every effort to fasten the adoption of new technology to revolutionize governance processes. One such endeavour that the Ministry of Labour and Employment is undertaking is to make the entire process of the Employees’ Provident Fund (EPF) automated.

Why Would Someone Wish to Transfer His or Her PF?

An individual would transfer the balance in his or her account in either of the following cases –

- When one is switching from one job to another.

- If one wishes to take a mid-career break.

Eligibility Criteria to Carry out EPF Online Transfer

- The employee must have already activated his or her Universal Account Number (UAN) on the EPF portal.

- The employee must have seeded his or her bank details before making the transfer request. It should have been verified by the employer at the time of making the said request.

- The employee must also seed the Aadhaar number with the UAN account.

- Only one transfer request can be made by the employee against one member ID.

It is also essential that the previous employer has digitally registered authorized signatories to enable this transfer process to be carried out.

Documents That Are to Be Kept Handy Before Initiating the Procedure

The following documents must be kept before starting the transfer process online –

- Identity Proof which could be PAN, Aadhar, Driving License, etc.

- An approved e-KYC

- Revised Form 13

- UAN details

- Current employer’s details and Establishment Number

- Bank account details of the salary account

- Account Number

- Old and current PF account details

Step-by-step Procedure to Carry out EPF Online Transfer

Step 1: Log into your EPF account via the UAN and password.

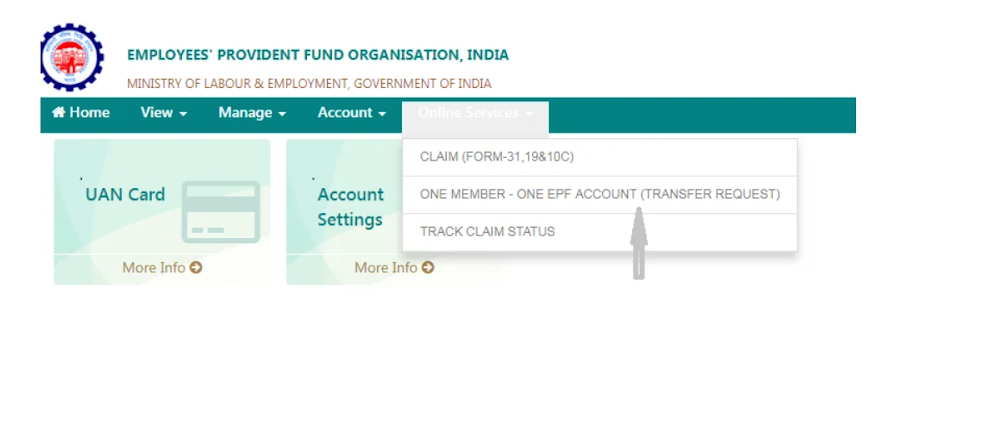

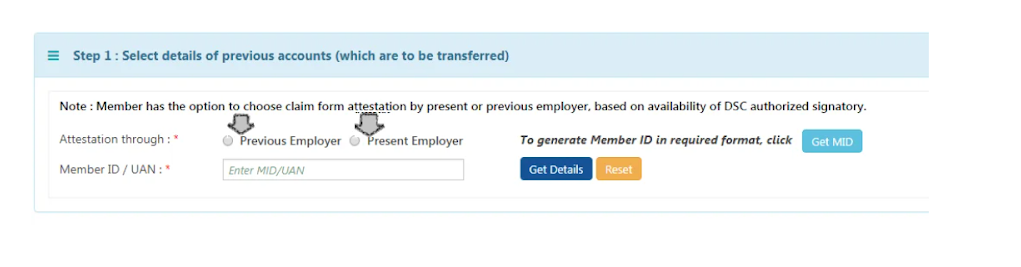

Step 2: Click the ‘Online Services’ section and select the ‘Transfer Request’ option.

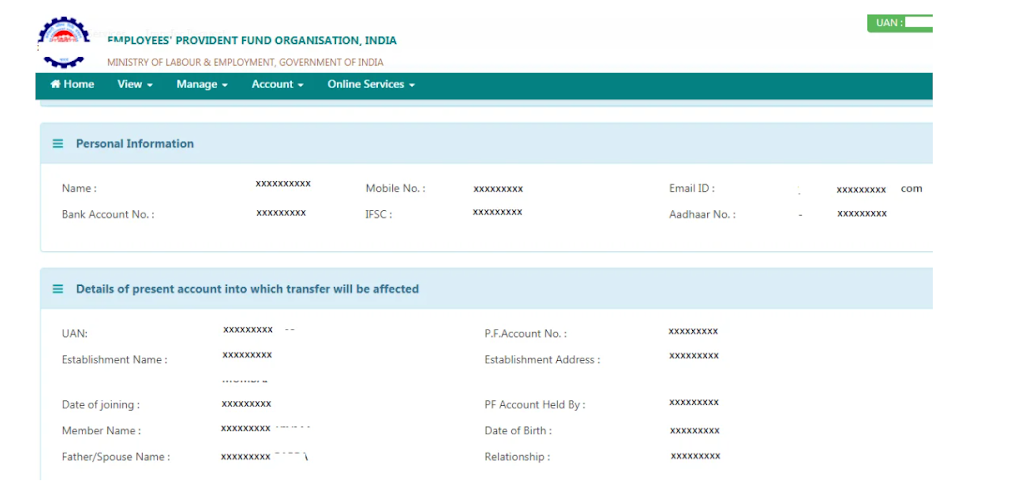

Step 3: Enter your Member ID and other EPF account details.

Step 4: Submit the transfer request to the employer.

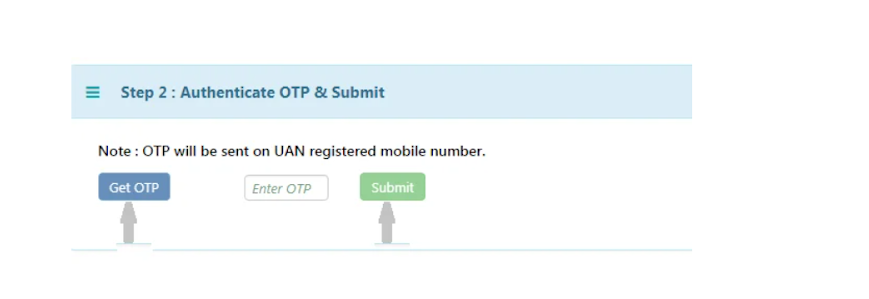

Step 5: Enter the UAN in the appropriate fields. Then, click the ‘Get OTP’ button. Enter it in the space provided. Click the ‘Submit button.

Advantages of doing the EPF Transfer Online

- It is a quick, hassle-free process that can be completed in just a few steps.

- It can be done at the comfort of one’s home or office without having to physically go to the EPF offices.

- The documents needn’t have to be verified by the employer physically, saving precious time.

- If one transfers their PF account and maintains it for 5 years, he or she will be eligible for tax-free withdrawal of your money.

Method to Check PF Transfer Status Online

It can be done in either of the methods listed below –

| Using the Member Claim Status Link | Using EPFO portal | Directly from the website |

| One must log in to the EPFO portal. Then click on the “Know your status” tab under the “Our Services” section. The UAN number and captcha must be entered on the screen displayed after which the search button must be clicked. Select the Member ID for the account for which you wish to check the status and then select the ‘View your Claim Status’ button. | One must log in to the EPFO portal. The UAN, password, and captcha must be entered. Thereafter, go to the ‘Online Services’ tab and select the ‘Track Claim Status’ option. | Go to the EPF India employee webpage. Then click on the ‘Click here for Knowing your Claim Status’ option. Select the state and regional office in the drop-down lists. The region and office code will get automatically filled. The establishment code has to be entered thereafter. Enter the 7 digit account number and click on ‘submit’ to know your status. |

FAQs

- Can EPF withdrawal be done without PAN?

Such a withdrawal is permissible; however, one will be liable for deduction of TDS at the maximum marginal rate of 34%. In case the claim amount is greater than Rs. 50,000, no TDS will be deducted.

- Can one transfer EPF to NPS?

Yes, it can be done. The PF must be contacted and they will initiate the fund transfer. This transfer amount is not taxable.

- What is the EPS to NPS transfer process?

One has to open an NPS Tier 1 account and thereafter ask the PF to initiate the fund transfer. The cheque of the demand draft will be issued in the employee’s name, and a letter providing information regarding the transfer will be issued.

- What is the use of UAN for the online transfer of PF?

UAN has three main functions when it comes to transferring of PF, they are as follows –

- One can update the UAN card and PF passbook dynamically using this.

- One can receive SMS updates regarding the monthly credits against one’s account.

- There is automatic transferring of the account on change of the employer.

- What are the forms required while transferring funds online?

The PF transfer form and Form 13 are required to transfer PF online.

- Are details that are mentioned in the EPFO database editable?

Details such as date of birth, date of joining, father’s name, etc. are not editable on the database.

- Can one check the status of one’s EPF claim online?

Yes, I can be done. One has to log in to the portal and click on the “View status of transfer claim’ under the Claim tab.