Introduction to Purchasing Managers’ Index (PMI)

PMI, as an index, tracks and reflects changes in manufacturing volumes derived from a five-hundred company survey. Different elements are attributed distinct weights and the resultant index is accepted to be indicative of current business activity and projected confidence levels.

Key elements covered by the index include new orders, output, employment, suppliers’ delivery time, and inventory build-up, in descending weights ranging between (30-10) %.

The index is considered important as an economic indicator helping compare a country’s activity competitiveness vis-à-vis peers.

Update: Manufacturing PMI Reading – May 2021

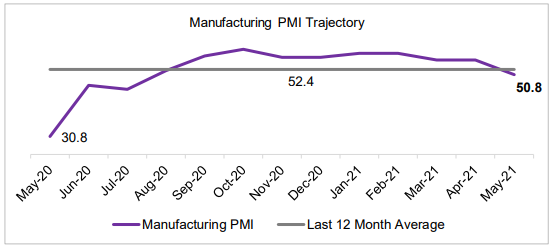

India Manufacturing PMI drops to ten-month low of 50.8 vs 55.5 in the prior month. after declining to a seven-month low of 55.4 in the month prior. In a failed attempt to hold steadfast, the index fell below its long-run average of 53.6. The manufacturing sector finally succumbed to intensification of the viral virus after remaining surprisingly favorable in the year so far.

A reading above 50 denotes expansion and below 50 denotes contraction.

Analyst Commentary

The manufacturing index is starting to show signs of weakness as all subcomponent indices were down vs. their April readings.

New orders, the largest sub-component, increased at the slowest since the current stretch of expansion started in August 2020. In spill-over effect, companies observed the slowest rises in new work and output for ten months. Following suit were conservative input buying and continued job shedding as pandemic restrictions rained rust on the developing ladder-al economy.

Vaccination drives tried pushing production metrics to greener territory but to no avail, as its expansion was the weakest in the current ten-month period of growth. The wounding demand cut the already taped and re-taped pipes of the supply side.

Lengthier delivery times and vendor performance worsened for third straight month. This was mainly accredited to global shortage of raw materials, which further intensified rising cost worries. As was a learned practice, firms resorted to passing prices to consumers to alleviate deforested margins.

In a year where corporate profits are scaling new highs, there are many who are questioning its longevity. This is reflected by business confidence dipping to tenmonth low as the makers become increasingly concerned about operational efficiencies as uncertainty becomes the market mood.

A key positive trend that we can chart from latest reported PMI figures is the lesser severe impact of the second lockdown on than manufacturing sector vis-à-vis the premier.

Going ahead, the widening of vaccination programs will be instrumental in printing manufacturing sector’s next leg of growth. The numbers today highlight the nascent and fragile stage of recovery that the Indian economy is in. We continue to keep an eye on efficient implementation of public policies which can be expected to bolster the economy at large.

Click here to read HIS Markit’s original press release on ‘IHS Markit India Manufacturing PMI’ for the month May, 2021