Introduction to Services Purchasing Managers’ Index (PMI)

PMI, as an index, tracks and reflects changes in services’ volumes derived from a four-hundred company survey. Different elements are attributed distinct weights and the resultant index is accepted to be indicative of current business activity and projected confidence levels.

Being a diffusion index, it poses questions to measure changes in the volume of business activity versus headline figure in the month prior.

The index is considered important as an economic indicator helping compare a country’s activity competitiveness vis-à-vis peers.

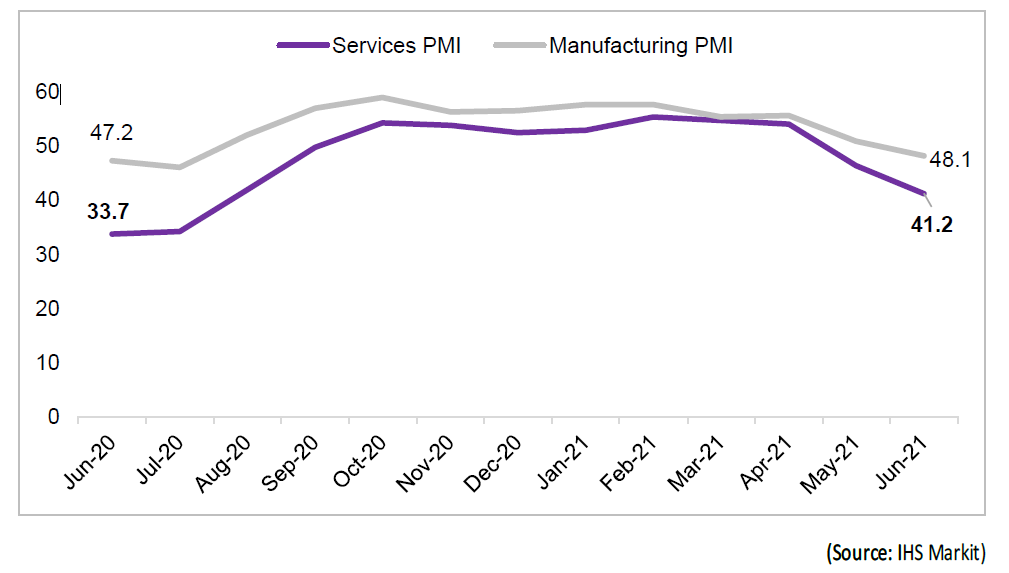

Update: Services PMI Reading – June 2021

India Services PMI recorded 41.2 in June vs 46.4 in the month prior, touching its lowest levels since August 2020. Contracting for the second consecutive time, the services sector succumbed to the intensification of the viral virus, snuffing out business confidence.

A reading above 50 denotes expansion and below 50 denotes contraction

Analyst Commentary

The latest reading points to a solid rate of reduction, albeit slower than that seen in aftermath of first COVID-19 wave. Key worries are seen in new inflows and old outputs, as both contracted at fastest rates since July 2020. Tensions have marred overall outlook as positive sentiment slipped to ten-month low, supported with seventh convective month of jobs shedding, with current cut being fastest over study period.

Adding insult to injury is the cost inflationary pressure of raw materials. Increased prices of metals and fuels have increased operating expense, thus crunching margins in midst of an already prolonged business stress period. Rate of inflation came at five-month low, but out-paced long-term average. As was expected, companies shared rising cost burden with consumer by raising selling prices. ‘Info & Comm’ was only segment of five to keep rates unchanged.

Distributing cost pressures across the economic chain can further dampen demand mood as companies forecast lower and disturbed volumes in coming times.

Cross-border trades were left wounded too, as new export business fell for sixteenth consecutive month. The pace of contraction remained sharp, despite easing from May. Drop was attributed to international travel restrictions and business closure.

Amongst the five monitored segments, Consumer Services recorded quickest declines in business activity. Transport & Storage was only segment to post growth.

The private sector followed suit with second consecutive monthly decline in business activity. New orders fell fastest since July 2020, seceding for second straight month. Employment was quick in facing the brunt via sixteenth consecutive month of shedding. Poor producing is seen as main culprit for poor private service sector numbers.

As is seen globally, manufacturing PMI continues to out-perform its services counterpart, courtesy of the latter being hit harder by Covid-19.

Going ahead, the race between vaccine vs virus will print services sector’s future. The numbers today highlight the nascent and fragile stage of recovery that the Indian economy is in. We continue to keep an eye on efficient implementation of public policies which can be expected to bolster the economy at large.

Click Here to read IHS Markit’s original press release on ‘IHS Markit India Services PMI’ for the month June, 2021