An economy’s success is a derivation of its banking & financial system.

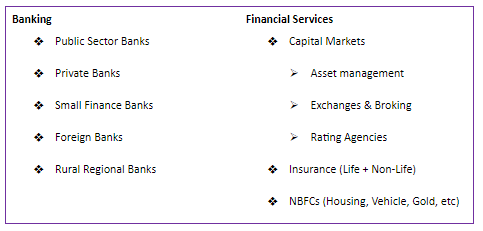

The table below highlights the universe coverage under this umbrella sector, thus fully explaining its function as a growth engine for the country:

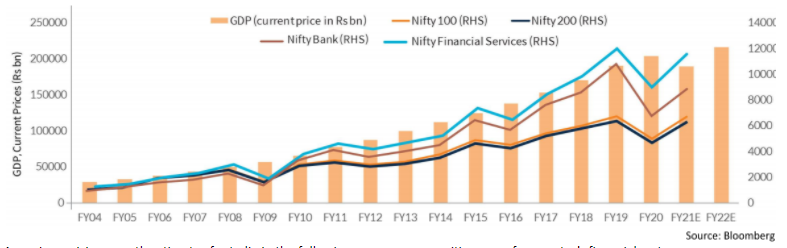

As the country eyes its ambitious target of scaling GDP tally to $5 Tn, the financial sector is bound to be one of its major beneficiaries.

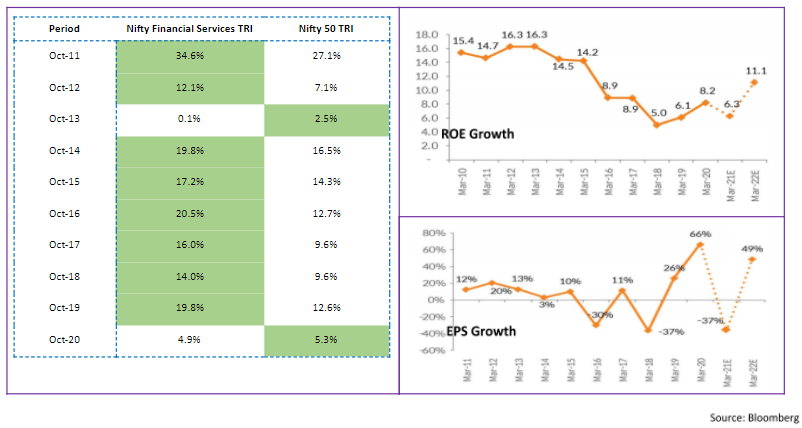

Being the backbone of the country, money invested in the banking and financial services sector has grown more than the broad market benchmark. The graph below highlights the same:

Agencies revising growth estimates for India in the following years augurs positive news for country’s financial system.

From Macro to Micro, all elements signal strong potential for growth in the coming years after cumulative stresses in the recent past.

Macro Growth Outlook

Following are key elements which can strengthen macro engines of growth for banking sector in coming times:

Savings Rate

- India enjoys a very high savings rate standing in at 19% vs world average of 9%. The 2x multiple in difference is expected to narrow in future as avenues to invest in diversify

- The trend in country to shift from physical to financial assets is alive and well as was highlighted by RBI annual report. The net financial assets jumped from 13.73 lakh crore in FY19 to Rs 15.62 lakh crore in FY20, with growth expected to garner higher momentum as financial literacy is driven through multiple verticals

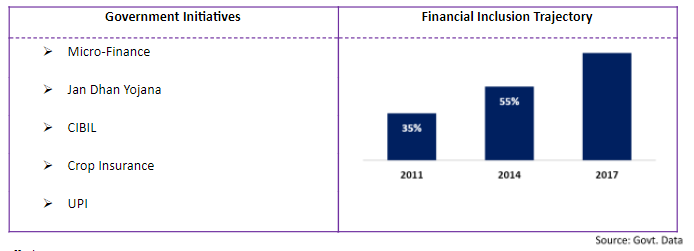

Govt. Initiatives

- The most populous states have lacked baking infrastructure in the past. The new initiatives introduced have however been landmark in welcoming higher quantum of financial inclusion.

- The table below highlights the same

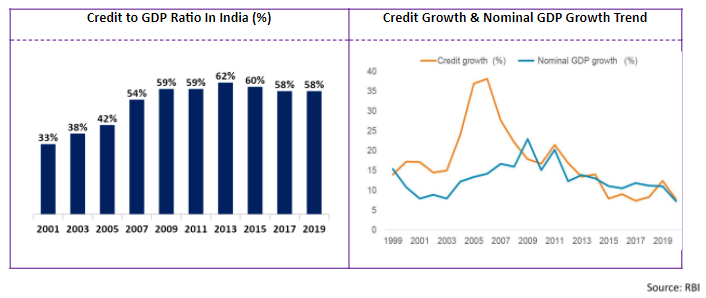

Credit Offtake

- Credit Growth has grown ~2x in last 20 years, with private consumption increasing linearly with the former

- The growth in household income and consumption further promotes room for credit growth in near and far future

Micro Growth Outlook

Following are key elements which can strengthen micro engines of growth for banking sector in coming times:

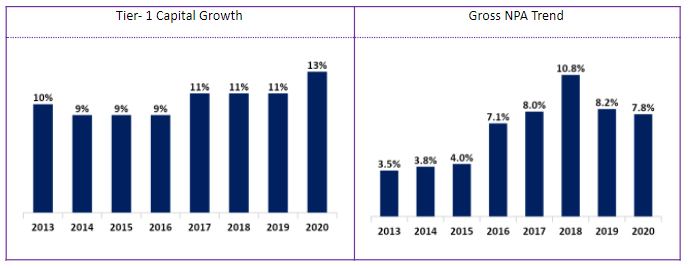

Banking NPA Count Cushioning

- Tier I Capital today stands at 13% vs regulatory 9.25%. With few banks raising capital in FY21, capital structure on has seen further solidification

- Asset quality has seen significant reduction in NPAs from 2018 levels, with coverage touching the OECD average

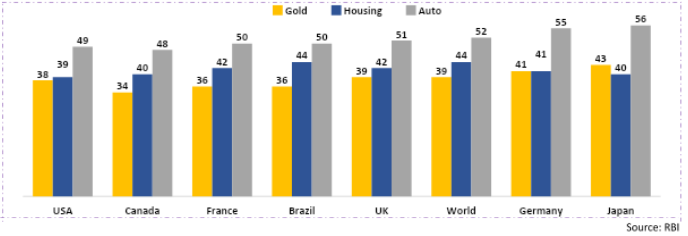

NBFCs Story – A Shadow System Fore-Shadowing Growth

- India houses ~10,000 NBFCs of which ~100 are listed. New RBI norms w.r.t receiving financial activity licences gives impetus for quicker and healthier growth

- NBFCs, in their short duration, have diversified into multiple streams such as Auto, Housing and Gold verticals

- The table below highlights NBFCs market share across key products

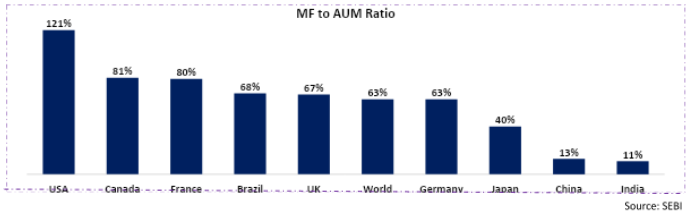

Mutual Funds – Its Growth Is “Mutual” With The Country’s

- MF Industry has grown 4x in 10 years from INR 7.1 Lakh Cr in 2010 to INR 28 Lakh Cr in 2020

- MF to GDP ratio at 11% as of FY20 is well below comparable peers. Table highlights the same

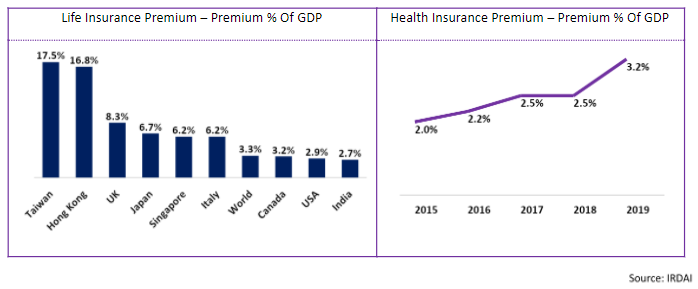

Insurance – Between Its Sub-Elements Lies Growth Insurance For The Sector

- Sophistication of the segment has broadened market coverage, auguring broad-based growth in last 5 years

- Penetration statistics – Current Narrow coverage presents room for growth in coming times

-

- General: 8% penetration in protection products vs Asian peers

- Life: 4% Penetration even after growing 10x in last 10 years

- The graph below highlights insurance premium as % of GDP

As other elements such as digital penetration and capital markets carry their contribution to sector growth, we gear up for the hunt of this sector-focused fund.

Mirae MF introduces their Banking & Financial Services fund to help you tailor your funds growth with that of the country’s.

Mirae Asset Banking and Financial Services Fund

The fund endeavours to participate in growth of banking sector by investing primarily in financial-activity oriented stocks.

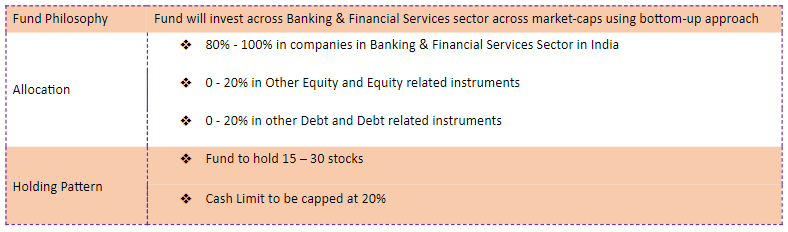

Fund Breakdown is as follows:

Investor Takeaway

- The 2 graphs above the potential for Banking & Services to investor garner wealth on coming times.

- Lift in ROE and EPS growth in coming quarters merits the fund in accumulation of upside potential.

- The fund is suitable for investor with a high risk appetite, with an ideal time horizon of 5 years & more

Key Details About The Fund: