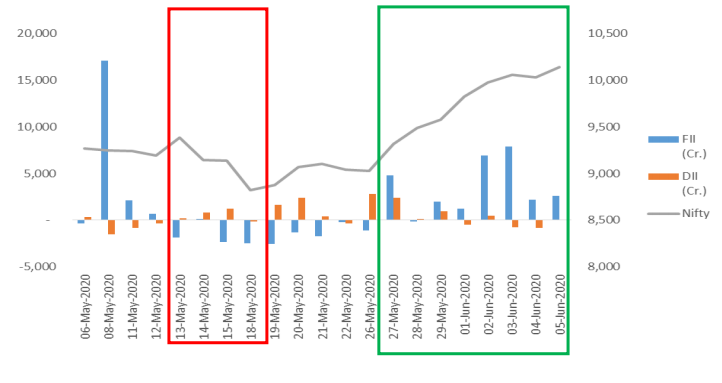

Indian equities ended the week positive. Nifty and Sensex were up by 6.0% & 5.7%, respectively. Investors seem to have welcomed the Unlock 1.0 warmly.

The Unlock 1.0 seems to have achieved what most policy reforms couldn’t – the return of bulls residing abroad. Unlike recent times, the uptick was supported by foreign institutional investments. Markets witnessed an influx of ~INR 22,000 Cr. this week.

Key happenings of the week that went by

Forex reserves keep climbing

The RBI on Friday announced forex reserves in the country for the week ended on 29th May surged to its all-time high of ~$493 billion. One of the key drivers of the recently heightened forex reserves was the lower cost of oil, a major expense on the forex front.

The reserves which are the backbone of the country in uncertain times like these saw an increase of ~$3.4 billion

in the mentioned week.

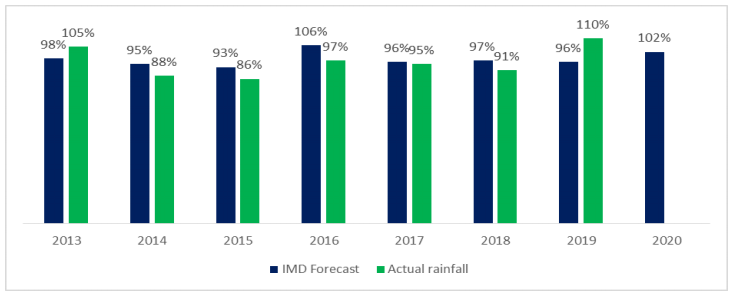

IMD’s expects rainfall to be at 102% of its long period average compared to 100% earlier.

It has only added to cheer and markets responded positively to it.

Positive Corporate Earnings:

Britannia Net Profit increased 26% to Rs374.75 crore

Britannia Industries reported consolidated profit of INR. 374.75 Crore for March quarter, registering a 26.1 percent yoy growth driven by lower tax cost (down45percentYoY).

Aurobindo Pharma’s net increased 45% to INR. 850 crore in Q4FY20

Aurobindo Pharma consolidated net profit grew by 45.2 percent to INR 849.8 crore for the quarter. Diversified product basket helped company to maintain the growth momentum in core geographies like USA and Europe. Net Debt stood at US$359mn as against US$724 mn in Mar-2019.

SBI posted a Q4 net profit of INR.3, 581 crore

The profit was supported by one-time gain of INR. 2,731.34 crore from the stake sale in SBI Cards done during the quarter.

Life ahead – at least in the near term

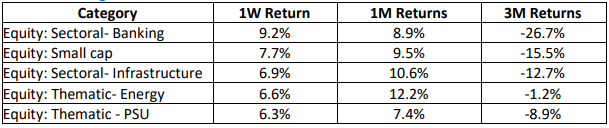

Indian equities are currently playing catch-up and the sentiment is likely to percolate to stress sectors. Small and Midcaps are likely to witness buying interest. Markets witnessed buying from FPIs and DIIs on improved sentiments.

Hence, investors may deploy fresh funds at current levels keeping in mind appropriate diversification and individual risk-taking abilities. Going ahead, the flow of liquidity in the Indian markets will give hint of a possible long-term direction. The markets will focus on the US Fed interest rate decision, IIP for April and inflation data for May among few data point to be released next week.

Star Fund Categories

Mutual Fund news:

1. Mirae Asset Mutual Fund has launched Mirae Asset Arbitrage fund on 3rd June 2020 and the NFO will be

open till 12th June 2020.