Here’s a little background for the uninitiated.

In its move to bolster liquidity and leave more disposable income in the hands of Indians, RBI announced a loan repayment moratorium wherein it gave banks the right to offer small 7 medium enterprises & individuals the option to defer their monthly instalments by three months – effectively, leaving them with more cash flow for three months.

This is applicable on a wide variety of loans including home loans, personal loans, credit card dues, and similar.

To support lenders & borrowers, RBI assured that this deferment will have no impact on the lender’s asset classification (need not classify as Non-Performing Assets) nor on the borrower’s credit score.

Key points to take note of:

- RBI has given lenders the option to offer this facility; lenders are not mandated to facilitate this scheme. Please check with your lender if they are offering you this deferment facility.

- This is not an EMI or interest waiver. This is a deferment. You will eventually have to pay up after the three-month period.

- Interest continues to be accrued on the outstanding amount. Nothing about this facility equates to “free”, except for some free cash flow for three months.

Now, back to the dilemma – should you avail this facility?

No, if you can afford to NOT accept it. Here’s why.

The deferment facility is to ensure that people & entities with genuine cash-crunch get benefit from some liquidity without being officially classified as a defaulter. The key point here is that interest continues to accrue for the period.

Typically, interest is computed on the outstanding loan amount at the end of every repayment cycle. Hence, as you continue to pay up, the interest component reduces in tandem with the reduced outstanding loan amount.

If you defer payment for three months, the interest continues to accrue on the amount outstanding as of now and simple interest is expected to be computed on the current outstanding till the end of the three-month period. This means that by the end of this moratorium period, you will have to pay more as interest that you could have otherwise saved by repaying.

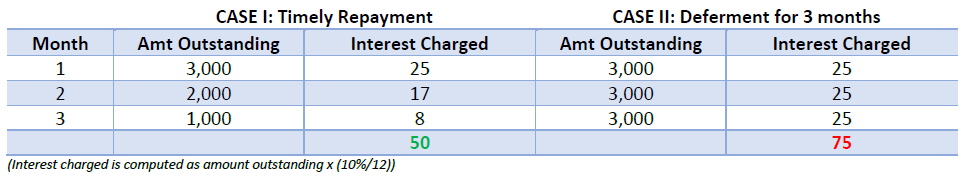

Here’s a crude illustration on an outstanding loan amount of INR 3,000 & monthly EMI of INR 1,000 – rate of interest considered at 10% p.a. for simplicity.

As can be observed in the above illustration, a deferment translates to higher effective interest payment due at the end of deferment period.

Now, this facility makes sense for those who genuinely need the liquidity & do not mind the interest cost since they can now benefit without worrying about a lower credit score or being classified as a defaulter.

While borrowers in need of liquidity may choose to prioritize certain loan repayments during this period, this decision should primarily revolve around the interest rate structures – for instance, a credit card interest structure could vary in the 40% ranges while home loan structures in the 8% ranges. It always makes sense to pay down debt with a heavier cost structure first.

[tek_button button_text=”Download Fisdom App” button_link=”url:https%3A%2F%2Fbit.ly%2F2zJ2L4u||target:%20_blank|” button_position=”button-center”]