Technical Overview – Nifty 50

It was a promising reversal from the lower levels of the Nifty50 where prices recorded a day low in the first 30 minutes of the trade and post that witnessed a shape V shape reversal from the lower levels. The Benchmark index on the daily chart is trading in an upward-rising channel pattern and the recent correction prices have taken support near the lower band of the pattern.

In terms of candle sticks the prices have formed a hammer pattern near the low of the pattern on the weekly time frame. On the daily chart, prices have increased above their 9 and 21 EMA adding strength to the reversal confirmation.

Technically, the Index has closed above its psychological level of 22,000 levels. The immediate support for the prices is placed at 21,700 levels and the upside is capped below 22,400.

Technical Overview – Bank Nifty

The Banking Index on the daily chart is trading in an upward-rising channel pattern and the recent correction prices have taken support near the lower band of the pattern.

In terms of candle sticks the prices have formed a hammer pattern near the low of the pattern on the weekly time frame. On the daily chart, prices have increased above their 9 and 21 EMA adding strength to the reversal confirmation.

The momentum oscillator RSI (14) has taken support near the upward-rising trend line which is placed at 45 levels. The oscillator has just witnessed a bullish crossover and just closed above 50 levels.

Technically, the Banking Index is in the process of forming a V-shaped reversal. The immediate support for the prices is placed at 46,000 levels and the upside is capped below 48,000.

Indian markets:

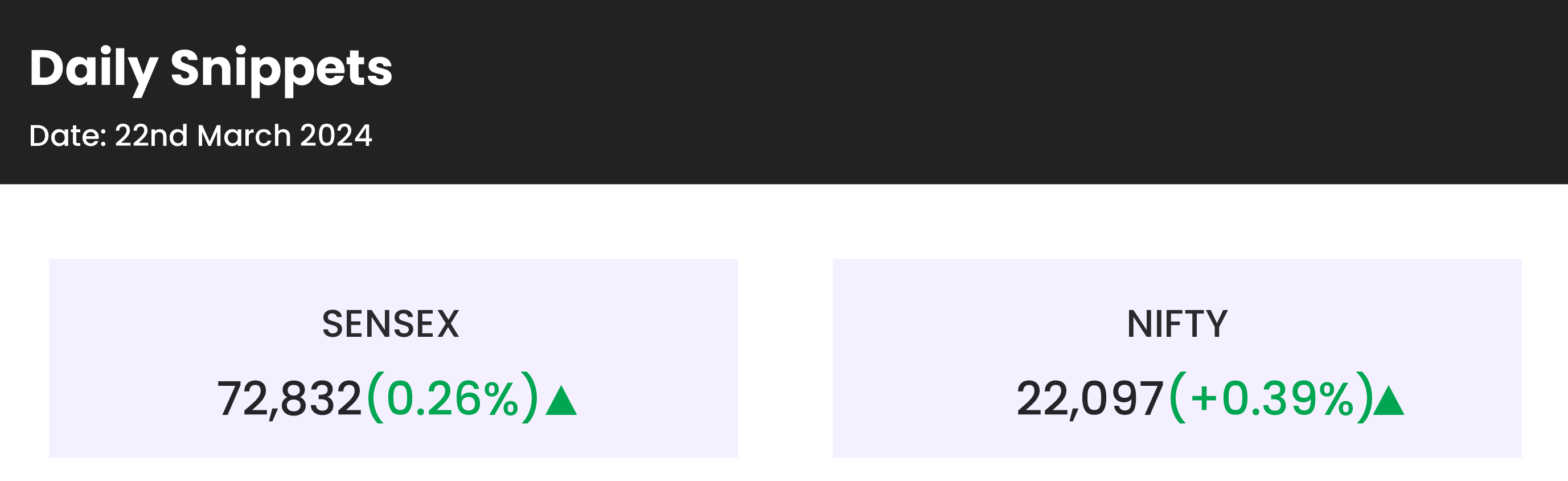

- Domestic equity benchmarks the Sensex and the Nifty 50 closed higher for the third straight session on Friday, March 22, despite varied global signals.

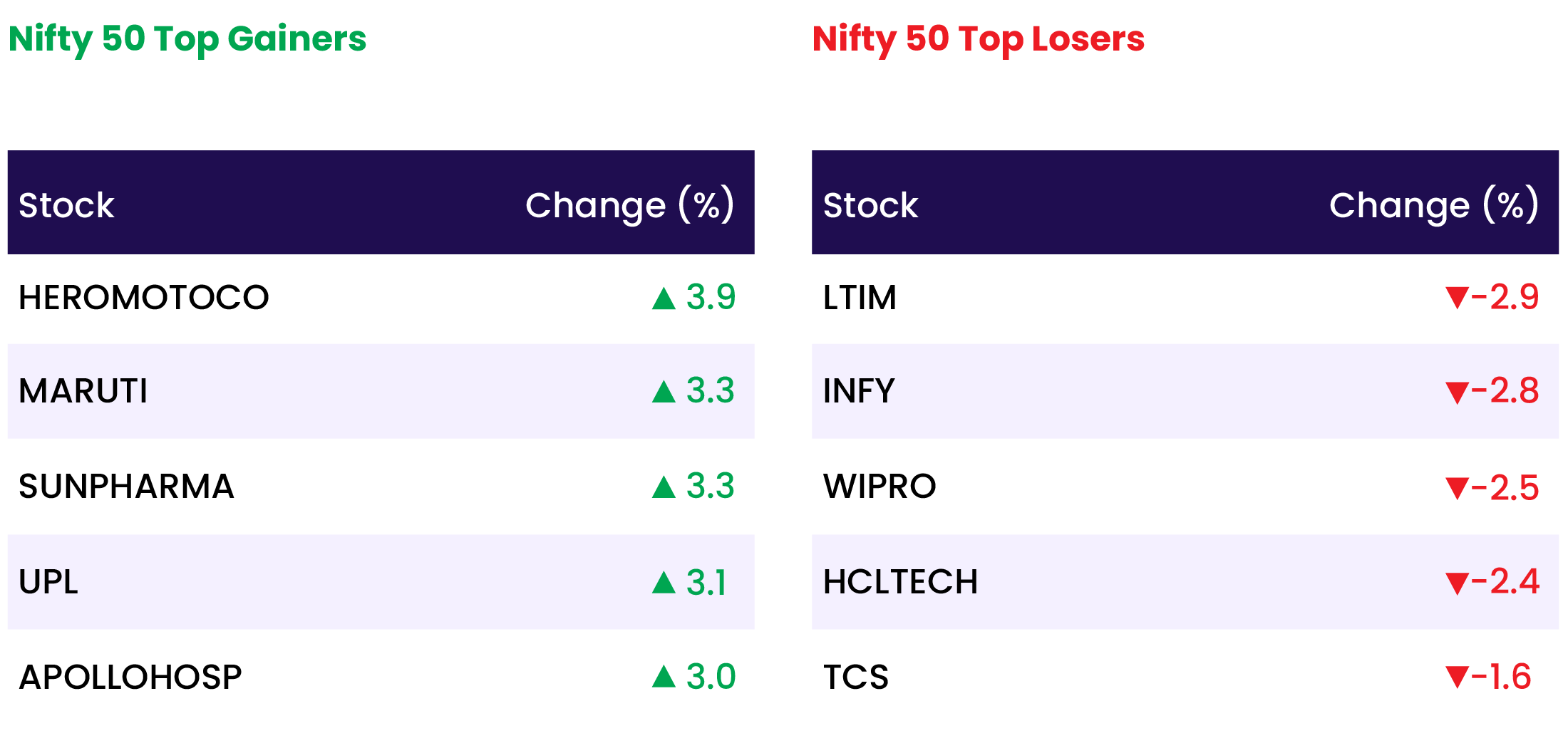

- Nifty IT recorded a decline of 2.33 percent among the sectoral indices, while all other sectoral indices concluded with gains.

- Nifty Realty and Auto witnessed rises of 1.76 percent and 1.67 percent respectively, with the Media and Pharma indices also climbing by 1.25 percent each.

- The BSE midcap index saw a modest increase of 0.3 percent, while the smallcap index surged by 1 percent.

Global Markets:

- Japan’s Nikkei 225 soared above 41,000, hitting a new record high on Friday amidst accelerated inflation in February, contrasting with declines in other Asia-Pacific markets.

- Japan sees a surge in February inflation to 2.8%, with the core rate matching at 2.8% as well; the Bank of Japan (BOJ) reiterates its commitment to the 2% target.

- Hong Kong’s Hang Seng index plunged by as much as 3%, primarily influenced by electric vehicle stocks, although it recovered slightly to be down 1.88%. Meanwhile, Mainland China’s CSI 300 decreased by 1.01%, closing at 3,545.

- The Hang Seng Tech index experienced a notable decline of 3.18%.

- South Korea’s Kospi concluded 0.23% lower at 2,748.56 after leading gains in Asia on Thursday, while the small-cap Kosdaq ended marginally down by 0.03% at 903.98.

- In Australia, the S&P/ASX 200 edged down by 0.15% to 7,770.6, while the Taiwan Weighted Index hovered close to the flatline following the central bank’s unexpected decision to raise its policy rate on Thursday.

Stocks in Spotlight

- Amber Enterprises shares experienced a 4 percent rally following a “buy” rating from global brokerage firm CLSA, citing appealing valuations and an increased target price of Rs 4,300, indicating a potential upside of over 19 percent from the current level.

- Maruti Suzuki’s stock surged by 3 percent, accompanied by high trading volumes. Eleven lakh shares were traded, exceeding the monthly average of 5 lakh shares.

- Prestige Estates shares soared by 4.9 percent subsequent to the company’s acquisition of 62.5 acres of land in Indirapuram Extension, NCR. The acquisition cost amounted to Rs 468 crore, inclusive of a revenue sharing component.

News from the IPO world🌐

- Reddit set for hotly anticipated debut after pricing IPO at top of range

- SRM Contractors sets IPO price band at Rs 200-210 per share; issue to open on March 26

- Trust Fintech sets IPO price band at Rs 95-101; issue to open on March 26

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 1.8 |

| NIFTY AUTO | 1.7 |

| NIFTY HEALTHCARE INDEX | 1.3 |

| NIFTY MEDIA | 1.3 |

| NIFTY PHARMA | 1.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2430 |

| Decline | 1375 |

| Unchanged | 101 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,781 | 0.7 % | 5.5 % |

| 10 Year Gsec India | 7.1 | 0.3 % | (0.8) % |

| WTI Crude (USD/bbl) | 81 | (2.6) % | 15.5 % |

| Gold (INR/10g) | 65,846 | (0.1) % | 2.6 % |

| USD/INR | 83.11 | 0.1 % | 0.1 % |

Please visit www.fisdom.com for a standard disclaimer