Technical Overview – Nifty 50

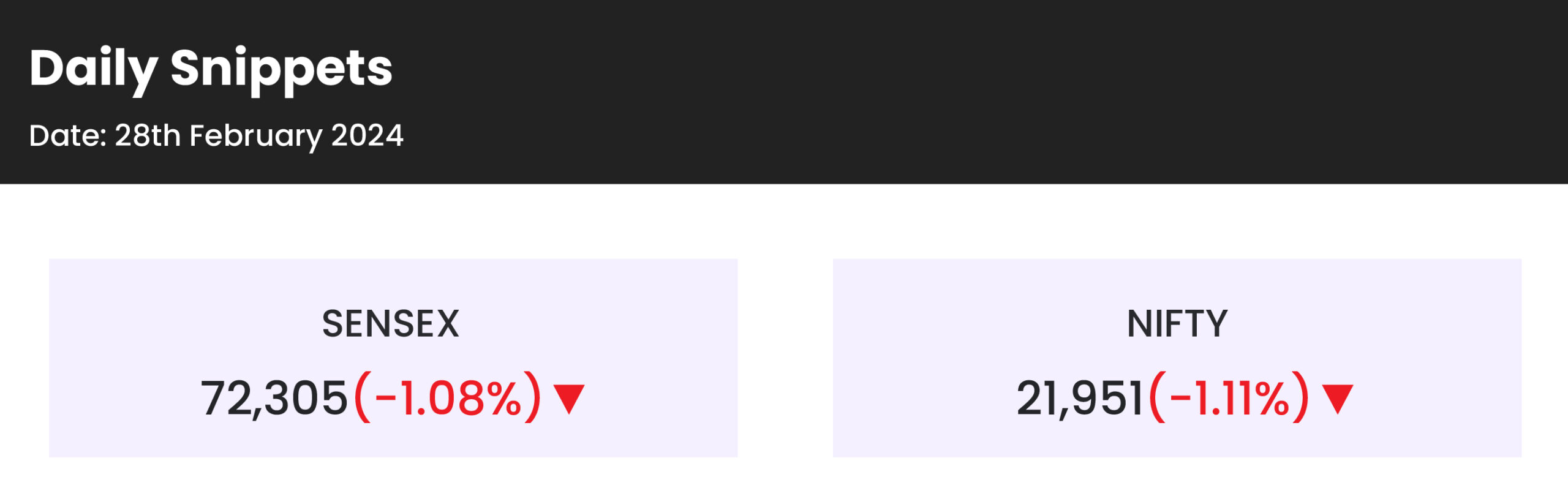

The Nifty50 on 28th February witnessed a flat opening and traded above 22,200 levels for the initial first hour of the trade. But the prices couldn’t hold on to their initial support and drifted strong lower below its 9 EMA. The selling intensified later and the index started to hover below 22,000 levels and formed a tall bearish candle on the daily chart.

In terms of candle sticks the prices have formed a bearish pattern that engulfed a previous couple of days’ candles. The Index on the daily chart has closed below the 9 EMA and has also closed below its psychological support of 22,000 levels.

The momentum oscillator has again entered below the breakout levels and has moved near 50 levels with a bullish crossover. As the Index has witnessed a breakdown on the intraday chart the immediate support for the Nifty stands at 21,800 levels and an upside is likely to be capped near 22,100 levels.

Technical Overview – Bank Nifty

The Bank Nifty on the daily chart has formed a tall bearish candle and has closed below its 9, 21, and 50 EMA indicating a bearish breakdown. The Bank Nifty has failed its triangle pattern breakout as prices have closed below the pattern indicating a whipsaw on the daily chart.

This week’s Index has already lost more than 1.50% and the further price pattern indicates more downside on the cards. The momentum oscillator RSI (14) has formed a rounding top formation near 60 levels and has drifted below 50 levels with a bearish crossover on the cards.

The View for the Banking Index remains as a sell on rise and an immediate resistance for the index is placed at 46,300 levels and a move below 45,500 will drag the index further lower till 45,000 levels.

Indian markets:

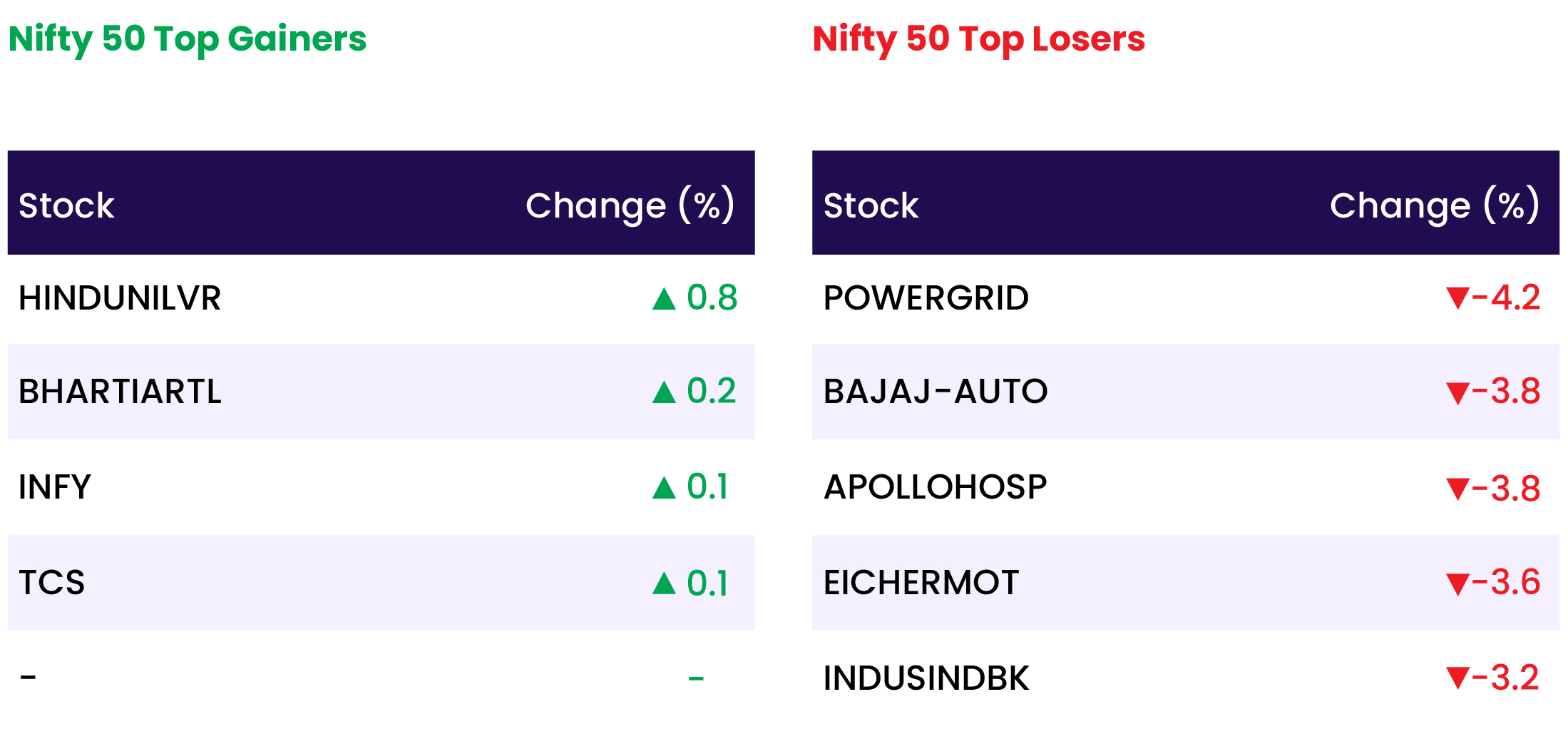

- On February 28, benchmark indices witnessed a decline of over 1 percent, driven by a substantial sell-off in media, PSU bank, and energy stocks.

- According to analysts’ domestic equities are consolidating within a range, with buyers stepping in during each dip, indicating resilience at lower levels. Investors are currently anticipating India’s GDP growth data.

- All the sectoral indices ended in the red with auto, oil & gas, power and realty. down 2 percent each.

- FIIs selling off substantial amounts of Indian stocks may have likely contributed to the market’s fall FII has continued to be a net seller, with month-to-date (MTD) net sales of Rs 17,650 crore.

Global Markets:

- Asian stocks showed caution on Wednesday, anticipating a U.S. inflation report that could impact the Federal Reserve’s easing strategy. The New Zealand dollar experienced a significant drop after the central bank eased its previously hawkish stance on interest rates.

- Asia-Pacific shares, excluding Japan, were slightly down at 527.14 points, staying close to a nearly seven-month high of 531.56.

- In early trading, China stocks displayed a mixed trend, with Hong Kong’s Hang Seng index declining by 0.31%, while China’s blue-chip index CSI300 rose by 0.46%.

- European markets mixed; Vodafone confirms advanced talks with Swisscom over Italian unit sale

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Asian Paints extended its decline, experiencing a roughly 7 percent drop over the last four days. The entry of Grasim into the paints industry with its new brand, Birla Opus, has raised concerns about heightened competition in the sector. Birla Opus is targeting the second spot in the decorative paints market, presently dominated by Asian Paints.

- Following the board of directors’ decision to raise Rs 45,000 crore, Vodafone Idea’s stock experienced a significant 13.88 percent decline. Brokerages expressed caution, indicating that the fundraising initiative alone might not be sufficient to salvage the financially strained telecom operator.

- Top of Form

- Olectra Greentech experienced a 2.76 percent decline as investors took profits, following the stock’s previous session gains driven by securing a Rs 4,000 crore contract from Brihanmumbai Electricity Supply and Transport Undertaking (BEST) for the provision, operation, and maintenance of 2,400 electric buses.Top of Form

- Shares of Zee fell 6.44 percent a day after the media company said it had set up a panel to examine the allegations levelled against the company, its promoters and key managerial personnel by regulatory bodies.

News from the IPO world🌐

- Tata Group eyes mega $1-2 billion IPO for its EV business

- Bharat Highways Invit was subscribed 22% so far on the first day

- Mukka Proteins IPO opens tomorrow

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY CONSUMER DURABLES | -0.3 |

| NIFTY IT | -0.3 |

| NIFTY PHARMA | -0.6 |

| NIFTY FMCG | -0.9 |

| NIFTY HEALTHCARE INDEX | -0.9 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 886 |

| Decline | 2957 |

| Unchanged | 78 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,972 | (0.3) % | 3.3 % |

| 10 Year Gsec India | 7.1 | (0.1) % | (1.6) % |

| WTI Crude (USD/bbl) | 79 | 1.7 % | 12.1 % |

| Gold (INR/10g) | 61,650 | (0.3) % | (1.6) % |

| USD/INR | 82.88 | (0.0) % | (0.2) % |

Please visit www.fisdom.com for a standard disclaimer