Technical Overview – Nifty 50

The Nifty50 witnessed a gap-down opening after a holiday and traded in a lower high lower low formation throughout the day and drifted below 22,600 levels. The index has formed a tall red candle on the daily chart suggesting a profit booking from the higher levels.

The Index on the daily chart is trading in a rising channel pattern and presently the prices have reached the upper band of the pattern and witnessed a reversal from the higher levels. The Index has formed a shooting star candle stick pattern on the weekly chart near the upper band of the rising channel pattern.

The prices have drifted near their 9 EMA which is placed at 22,500 levels. The momentum oscillator RSI (14) has topped near 70 levels and drifted lower below 60 levels with a bearish crossover on the cards.

Presently the market sentiments have shifted to sell-on-rise mode with immediate resistance placed at 22,800 levels and if prices drift below 22,500 levels then the gate is open till 22,200 levels.

Technical Overview – Bank Nifty

The Bank Nifty witnessed a gap-down opening after a holiday and traded in a lower high lower low formation throughout the day and drifted below 48,700 levels. The Banking index has formed a red candle on the daily chart suggesting a profit booking from the higher levels.

The Index on the daily chart is trading in a rising channel pattern and presently the prices have reached the upper band of the pattern and witnessed a reversal from the higher levels. The Index has formed a shooting star candle stick pattern on the weekly chart near the upper band of the rising channel pattern.

The Bank Nifty is still trading in a higher high higher low formation as the prices are retesting the breakout levels on the daily chart. The momentum oscillator RSI (14) has topped near 75 levels and drifted lower near 65 levels.

The prices are expected to trade within the range from 49,100 – 48,000 levels with a bullish to sideways trend.

Indian markets:

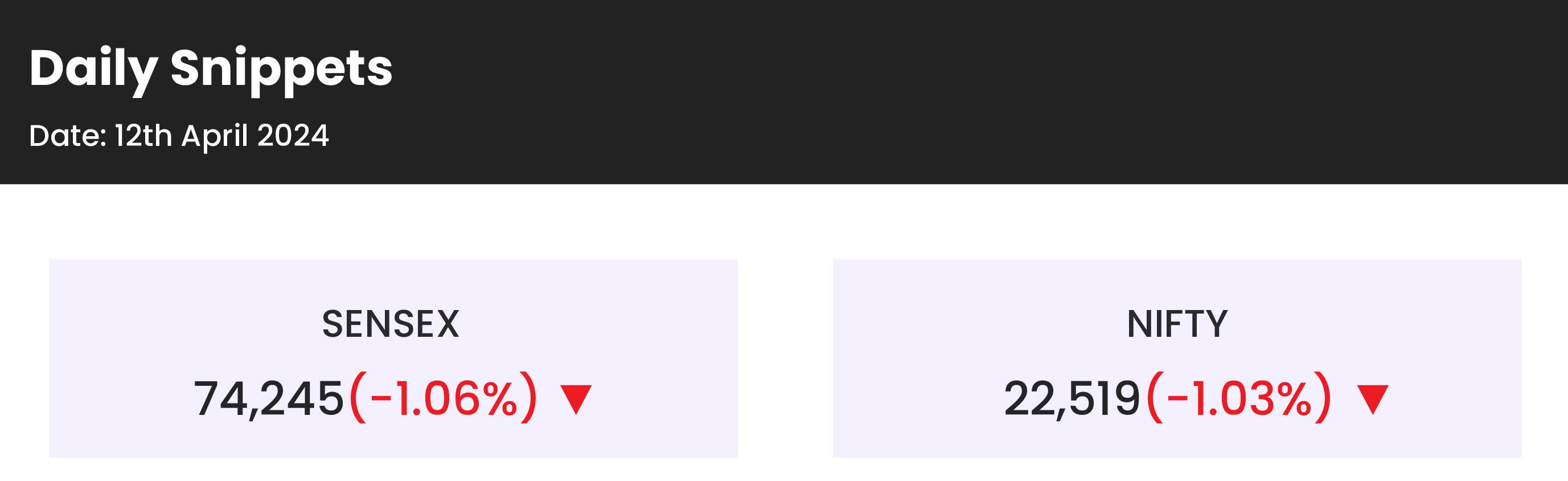

- Indian stock market benchmark witnessed an across-the-board selloff on Friday, April 12, influenced by a notable surge in the US dollar and long-term bond yields. This occurred as expectations of a rate cut in the US in June diminished following higher-than-anticipated US CPI figures for March.

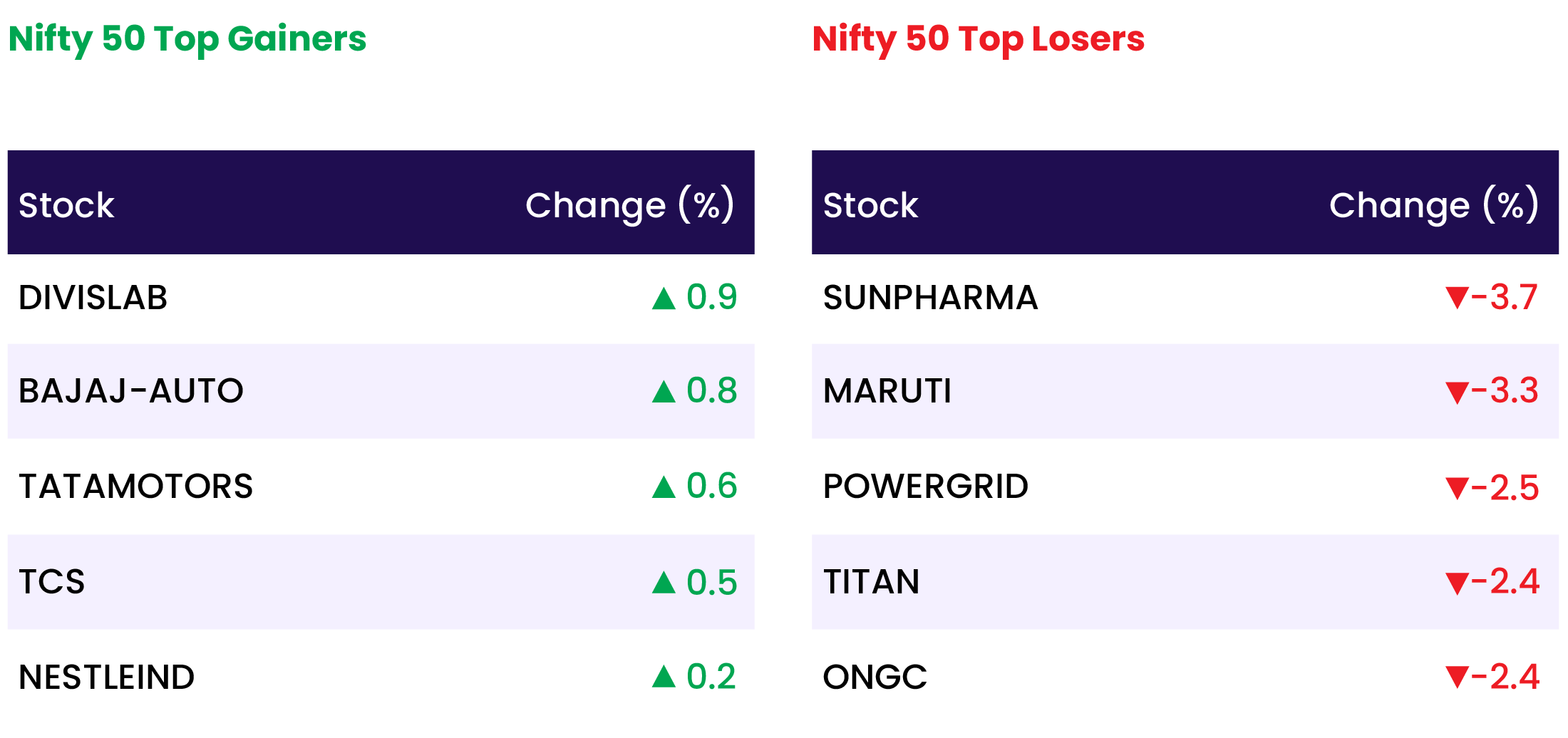

- All sectoral indices concluded the day in negative territory. Nifty Pharma and Nifty Healthcare experienced the most significant declines, dropping by 1.8 percent and 1.5 percent, respectively. Additionally, Nifty Media, Nifty PSU Bank, and Nifty FMCG each closed more than 1 percent lower.

- The BSE midcap index witnessed a decline of 0.4 percent, while the smallcap index registered a loss of 0.5 percent.

Global Markets:

- On Friday, markets across the Asia-Pacific region showed a mixed trend following a sell-off driven by inflation concerns in the previous session. Investors were closely analyzing economic indicators from Singapore and South Korea.

- South Korea witnessed a rise in its March unemployment rate to 2.8%. Consequently, the country’s main Kospi index experienced a decline of 0.93%. However, the small-cap Kosdaq managed to gain 0.28% as South Korea’s central bank maintained its policy rates at 3.5%, which is a 15-year high.

- Hong Kong’s Hang Seng index led the losses in the region, plummeting by about 2%, while mainland China’s CSI 300 also fell by 0.81%.

- Japan’s Nikkei 225 showed a modest climb of 0.21%, accompanied by a 0.46% rise in the broad-based Topix index. Meanwhile, the yen continued its weakening trend against the dollar, reaching as low as 153.29.

- In Australia, the S&P/ASX 200 slipped by 0.33%, extending the losses observed on Thursday.

Stocks in Spotlight

- Computer Age Management Services (CAMS) saw a 2 percent increase in its stock price following approval from the RBI to function as an online payment aggregator. In March, CAMSPay, the company’s payment division catering to clients such as mutual funds, insurance firms, banks, and NBFCs, recorded over 1.2 million mandates for UPI Autopay.

- Neuland Laboratories witnessed a surge of over 7 percent in its shares after Goldman Sachs initiated coverage with a ‘buy’ recommendation and raised the target price by 46 percent to Rs 9,100, up from the current market value. Goldman Sachs recently expanded its coverage to include the Indian CRO/CDMO sector, acknowledging the increasing significance of Indian firms in the global pharmaceutical supply chain.

- Sun Pharmaceuticals experienced a decline of 4 percent after the US FDA categorized its Dadra facility as ‘official action indicated’ (OAI), suggesting recommended regulatory or administrative measures. Sun Pharma disclosed this classification status in an exchange filing subsequent to an inspection conducted from December 4 to 15, 2023.

News from the IPO world🌐

- Blackstone-backed Aadhar Housing Finance gets Sebi nod to launch Rs 5,000 crore IPO

- Raghuvir Exim files IPO papers with Sebi

- Voda Idea FPO to open April 18, close April 22, prices it at Rs10-11

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MIDSMALL HEALTHCARE | -0.4 |

| NIFTY METAL | -0.5 |

| NIFTY AUTO | -0.6 |

| NIFTY IT | -0.8 |

| NIFTY PRIVATE BANK | -0.8 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1466 |

| Decline | 2373 |

| Unchanged | 104 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,459 | (0.0) % | 2.0 % |

| 10 Year Gsec India | 7.2 | 0.9 % | 1.8 % |

| WTI Crude (USD/bbl) | 85 | (1.9) % | 21.1 % |

| Gold (INR/10g) | 72,620 | 1.6 % | 7.4 % |

| USD/INR | 83.29 | 0.1 % | 0.3 % |

Please visit www.fisdom.com for a standard disclaimer