Hot Stuff this week: S&P BSE Capital Goods index hits 52 week high

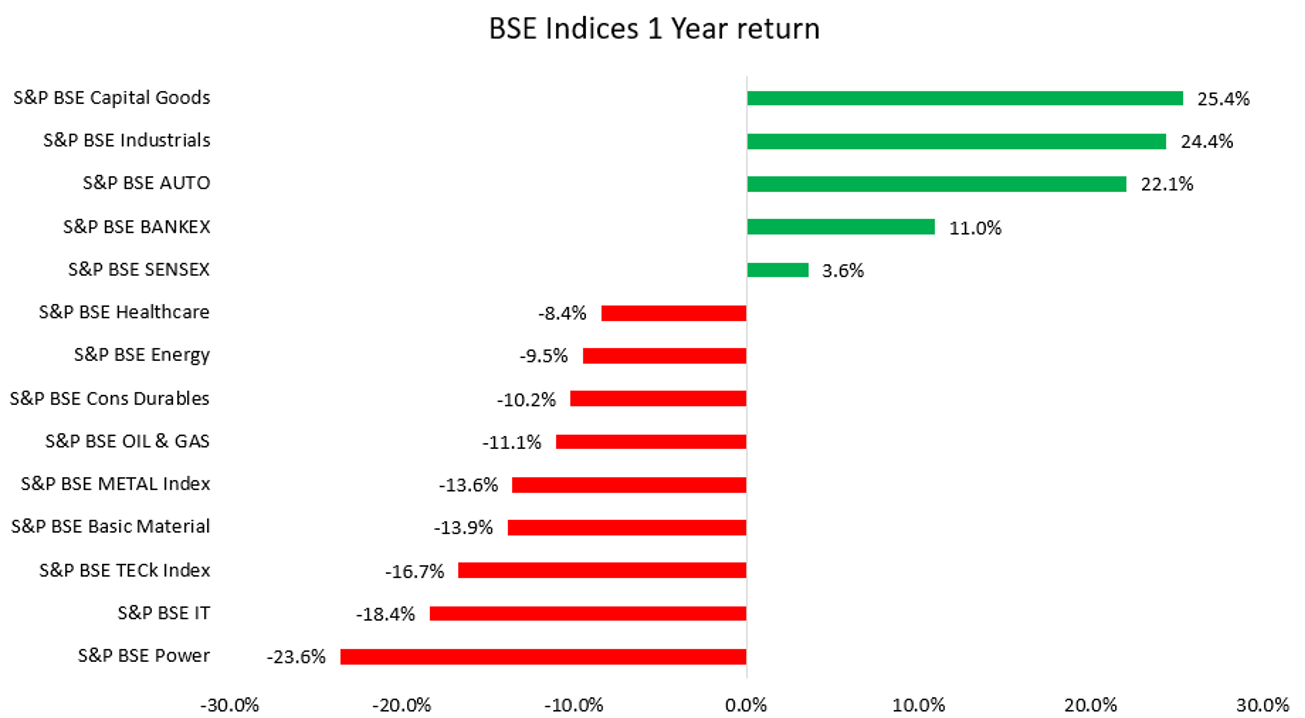

On 10th April 2023, BSE capital goods indices closed at 52 weeks high. The chart below indicates the performance of capital goods indices vis a vis other indices.

Source: BSE India, Fisdom Research

Government’s emphasis on capex, increase private capex by corporates, strong order books and easing supply side constraints are some of the reasons for this solid uptick in BSE Capital Goods indices which has outperformed BSE Sensex by a wide margin in the last one year.

Let us dive deeper to understand how various vectors are playing out in favour of capital goods segment:

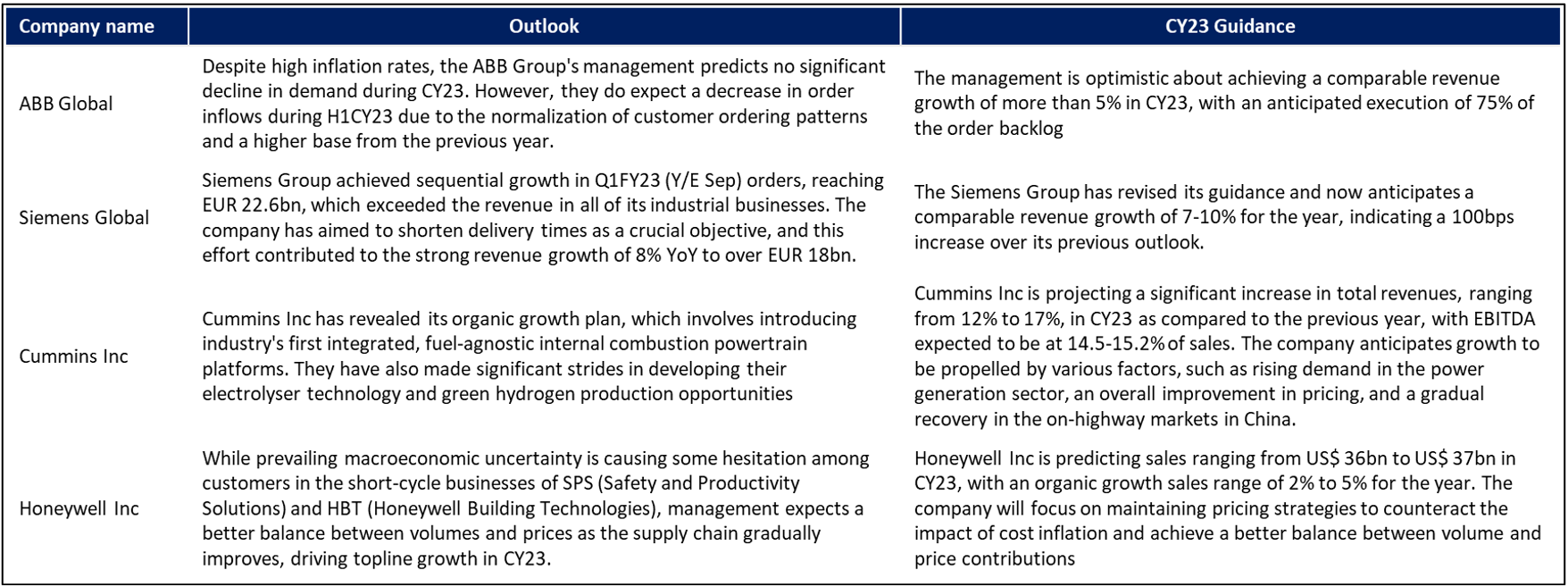

- Global capital goods companies are optimistic: Global capital goods companies reflected optimism about growth and profitability in their December‘22 quarterly results commentary. This was on the back of normalisation of ordering patterns along with expectation of cooling down of inflation in 2HCY23. The same is being reflected in the guidance commentary of global capital goods companies which are having businesses in India as well:

Source: BoBCaps, Fisdom Research

Declining logistic costs, easing of supply issues, and improved chip supplies have been beneficial, and softening commodity prices could further drive better margin performance in the quarters to come.

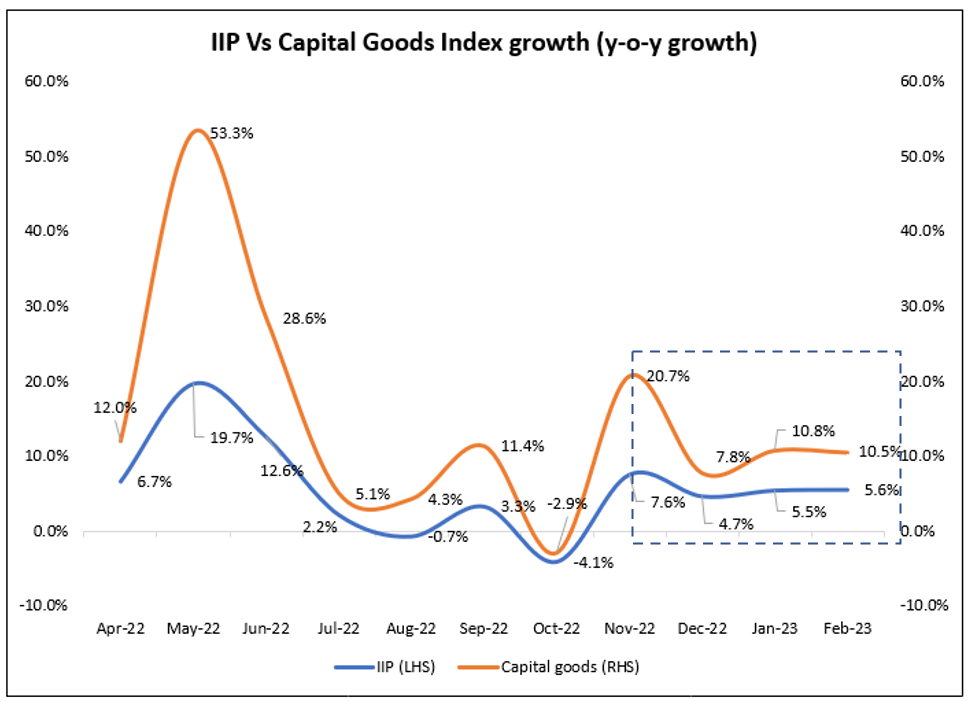

- Domestic fundamentals remain strong: Recent economic indicators have shown a strong uptick in economic activity, signalling a positive outlook for the economy.

Source: CMIE, Fisdom Research

The Indian government’s emphasis on capex and infrastructure development has led to accelerated economic activity in the country, as reflected by the capital goods industry’s performance.

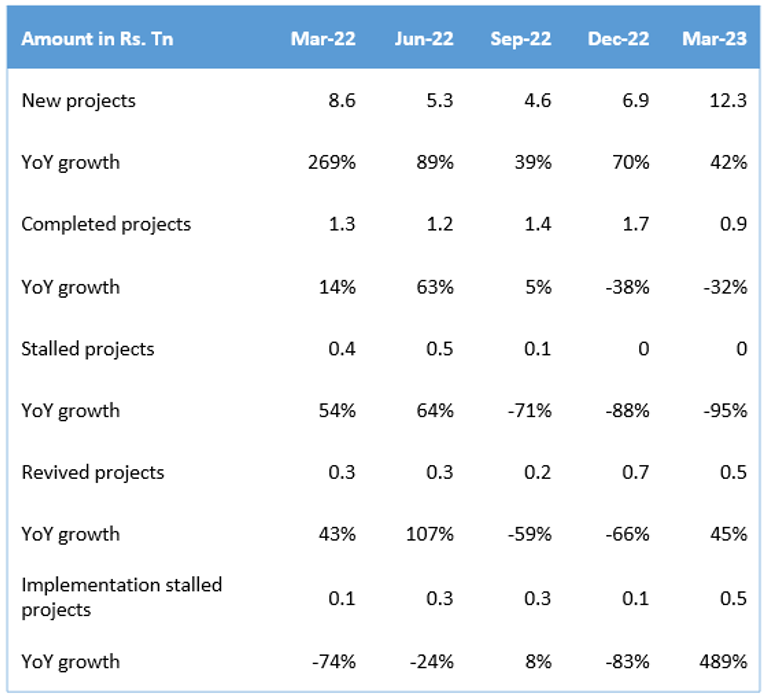

Here are a few highlights:

|

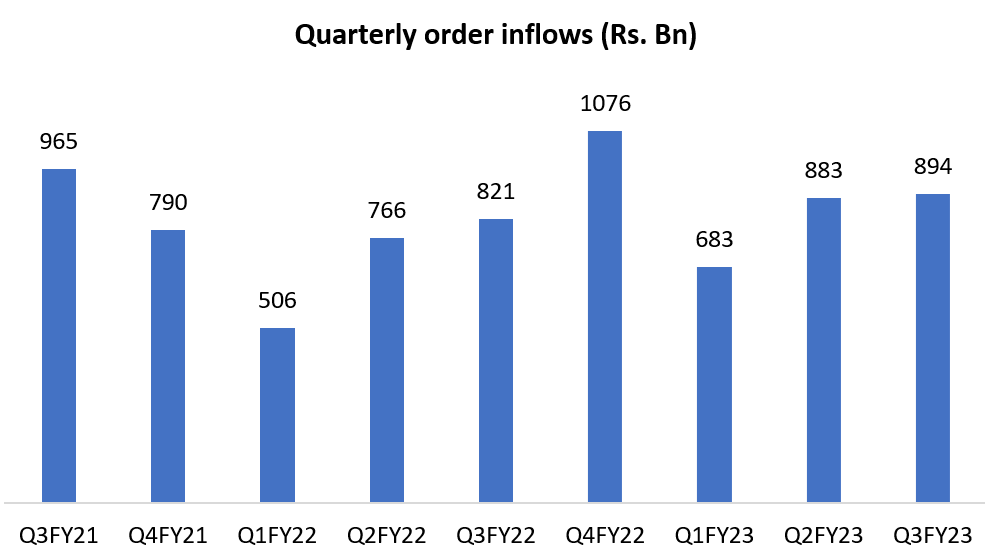

- Order books remain resilient: Last week we covered a story on defence sector, where government had awarded contracts worth Rs. 44,000 in March 2023 to defence sector which also form a part of capital goods sector. Here is a link if you want to read about the order books of defence companies in India.

Coming back to the overall capital goods segment here’s how order book of capital goods companies look like:

Source: PL, Company financials, Fisdom Research

KEC International, a leading infrastructure engineering, procurement, and construction company, has reported a record-high order inflow of ₹22,378 crore for FY23, representing a 30% increase from the previous year. The surge was mainly due to international order inflows for the company’s transmission and distribution vertical. KEC’s management is optimistic about the company’s growth prospects and believes that the latest orders, including the ones received in the urban infrastructure segment, will strengthen its position in the civil business. These developments demonstrate the management’s confidence in achieving the targeted growth going forward.

During March and April, several companies announced significant order inflows from various segments, such as transmission and distribution, water, hydrocarbon, railways, defence, data centres, digitization, and energy efficiency. Kalpataru Power Transmission Ltd received new orders worth ₹3,079 crore for its railway and water businesses, which enhanced its order book and market share. The company’s building and factories vertical also diversified into new areas such as data centres, education complexes, and institutional buildings. In the same quarter, Larsen and Toubro announced order inflows ranging from ₹20,000-31,500 crore, while KEC and Kalpataru announced robust order inflows worth ₹6,800 and ₹8,120 crore, respectively, in the T&D EPC segment, according to analysts.

Further enhancements in automation solutions, digitization, diversified businesses and exports are a poised to be beneficial for companies like ABB and Siemens.

Conclusion:

Companies in capital goods sector witnessed strong margin growth in the 3rd quarter of FY23. Going head, for defence, transmission and distribution, water, railways, and metro, among others, domestic tendering activity is expected to remain healthy. While international queries have been encouraging, improving private capex cycle is likely to sustain order flows.

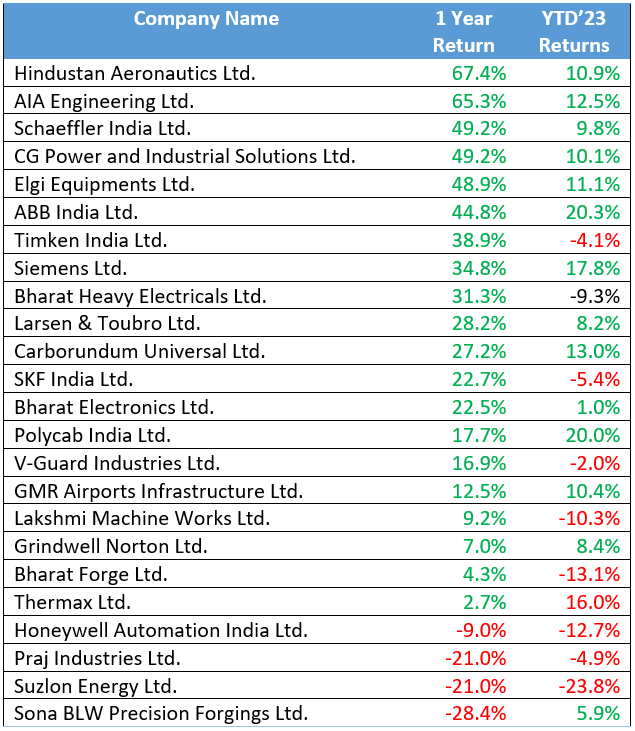

Below is the performance of constituents of S&P BSE Capital Goods index:

Source: BSE India, Fisdom Research. Data as on 13th April 2023.

Markets this week

| 10th April 2023 (Open) | 13th April 2023 (Close) | %Change | |

| Nifty 50 | 17,634 | 17,828 | 1.1% |

| Sensex | 59,857 | 60,431 | 1.0% |

Source: BSE and NSE

- Markets witnessed ended on a positive note.

- The Indian equity market saw an extension of gaining momentum in the third consecutive week ended April 13.

- The gains were driven by persistent FII (Foreign Institutional Investor) buying, positive quarterly business updates, and better macro data.

- Foreign institutional investors (FIIs) continued to buy equities for the third consecutive week with a total investment of Rs 3355.16 crore. Domestic institutional investors (DIIs) continued profit booking in the second week by selling equities worth Rs 411.42 crore

- In the current month, FIIs invested a total of Rs 4,959.72 crore in equities. On the other hand, DIIs sold equities worth Rs 2,683.95 crore.

- India’s retail inflation, measured in the all-India Consumer Price Index (CPI), fell to a 15-month low of 5.66% in March 2023. This is a drop from 6.44% in February 2023.

Weekly Leaderboard:

| NSE Top Gainers | NSE Top Losers | ||

| Stock | Change (%) | Stock | Change (%) |

| Divi’s Lab | ▲ +8.99% | Infosys | ▼ -2.30% |

| Eicher Motors | ▲ +8.49% | HCL Technologies | ▼ -1.83% |

| Tata Motors | ▲ +7.28% | Tata Consumer | ▼ -1.49% |

| Adani Enterprises | ▲ +6.65% | NTPC | ▼ -1.23% |

| Kotak Bank | ▲ +6.40% | Nestle India | ▼ -1.23% |

Source: BSE

Stocks that made the news this week:

?TCS reported a consolidated net profit of Rs 11,392 crore for Q4FY23, marking a YoY growth of 14.8% and an improvement from the previous quarter’s figures. However, the profit numbers fell short of analysts’ projections, despite exceeding revenue growth expectations. TCS added 821 employees during the quarter, taking its total workforce to 614,795, while IT services attrition on an LTM basis continued to trend down and was at 20.1%.

?DivisLab experienced a notable surge of 10% in response to improved market sentiment and optimistic expectations of increased sales due to rising COVID-19 cases. Market analysts have expressed their belief that the worst for the pharmaceutical industry is now over, with trends in the US market indicating that the price erosion may have reached its peak. These positive developments have provided a boost to DivisLab and its peers, leading to renewed confidence in the industry’s outlook.

?Several real estate developers have reported record provisional sales during the March quarter, leading to a surge in buying of realty stocks on April 10. Sobha, for instance, has achieved its highest-ever quarterly sales value of Rs 1,463 crore, which is a 3 percent QoQ and 32 percent YoY increase. The company has also recorded its highest-ever annual sales of Rs 5,198 crore. Another developer, Godrej Properties, has reported its highest-ever quarterly and annual project deliveries in Q4.