Technical Overview – Nifty 50

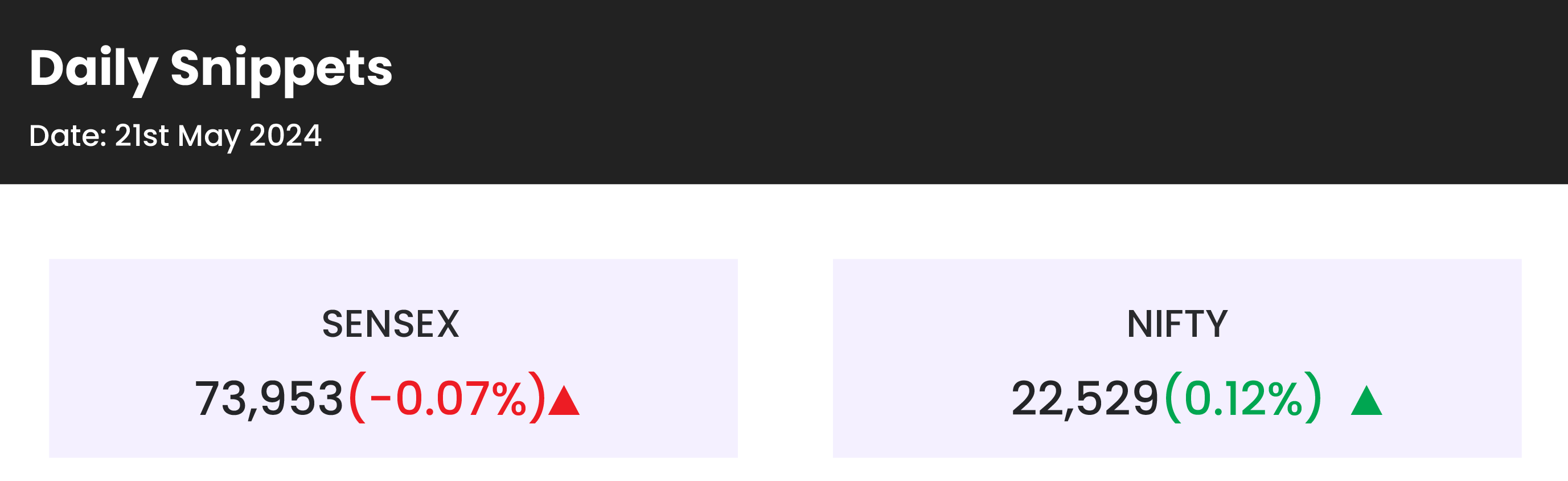

By 0.12%, or 27 points, the benchmark NIFTY index increased to 22,529 closed flat. On Monday, the benchmark index’s open and low are the same. The index increased from the day’s low by about 200 points. indicating a continuation of the index’s upward momentum.

14-period momentum indicator RSI is over 55 indicating that buyers are becoming more and more eager to purchase, which might drive the markets closer to 22,800 levels. The VIX seemed to be growing despite the rising index; it increased by 6% more to reach a day high of 22.30 levels on the INDIA VIX. The fear zone on the Market Mood Index (MMI) indicates that investors are hesitant to take a long position.

Support levels for the benchmark index are found at the 22,440 and 22,340 zones. The levels of resistance employed in the next sessions are 22,670 and 22,800.

Technical Overview – Bank Nifty

The BANK NIFTY index ended the day at 48,048, down 151 points, or 0.31%. The index appeared to be losing upward momentum as it closed flat and underperformed the benchmark index for the day. The index’s open and low were the same, but it was unable to hold onto its day high and ended the day about 200 points down.

The index finished close to the 10 and 20 DEMA; nevertheless, even if it is trading above the trend line, there appears to be less upward momentum. At the crucial channel lower band, a bearish Flag and Pole pattern is developing.

Future session resistance levels are shown at 48,300 and 48,600, and future session support levels are shown at 47,700, and 47,300.

Indian markets:

- Ending the day flat, Indian stock market benchmarks, the Sensex and the Nifty 50, experienced cautious trading on Tuesday, May 21, with most stocks recording losses.

- Domestic market sentiment remained cautious ahead of the Lok Sabha election outcome. Weak global cues, the lack of fresh triggers, and the market’s rich valuation hindered the Indian stock market’s upward movement.

- The BSE Midcap index reached a fresh all-time high before closing 0.34 percent higher.

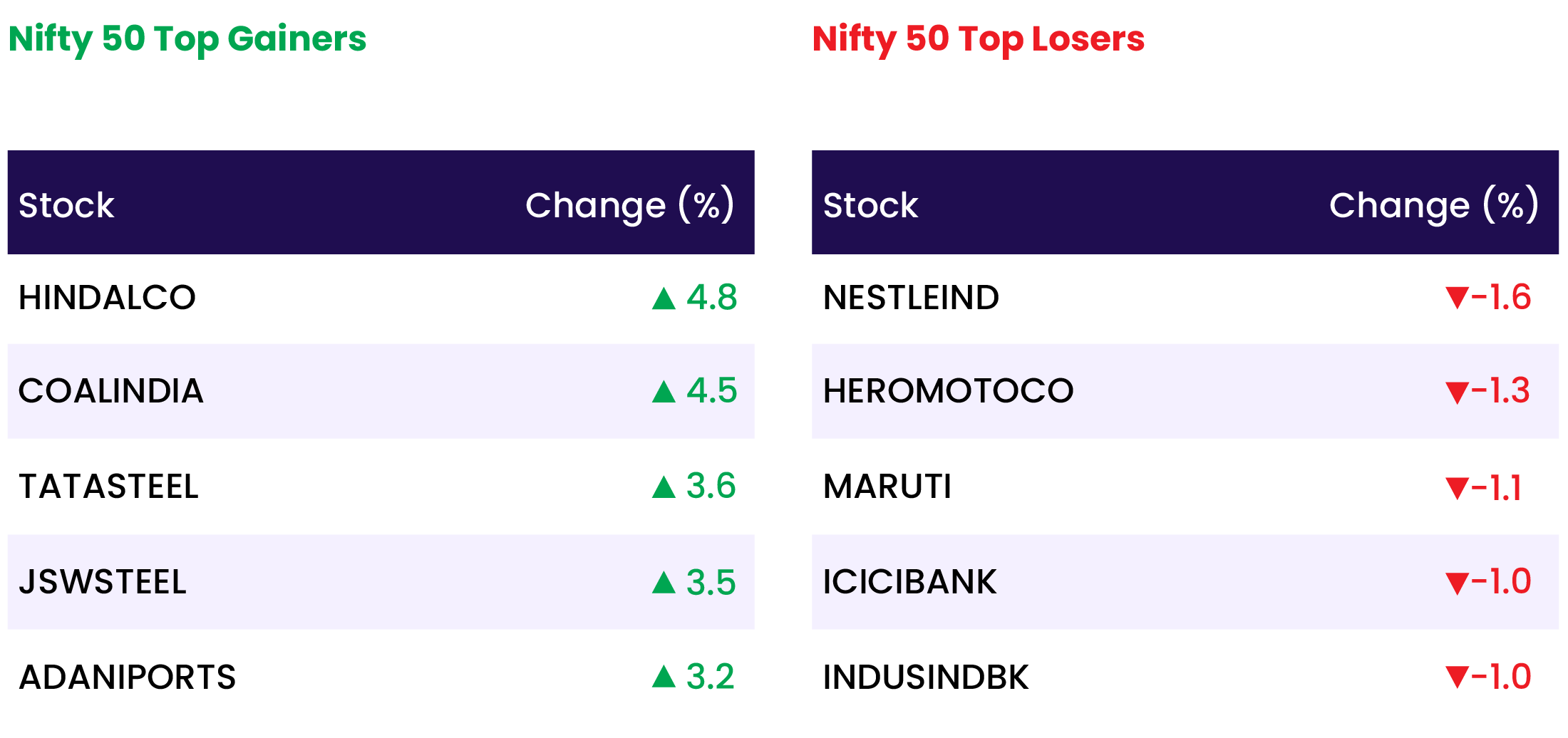

- Among sectors, the metal index rose four percent, the power index gained two percent, the PSU Bank index increased by 1.5 percent, while the FMCG index fell by 0.5 percent.

Global Markets:

- European markets were lower on Tuesday, reversing the more positive sentiment seen at the start of the week.

- Hong Kong’s Hang Seng index led losses in Asia-Pacific markets, falling about 2% as basic materials and industrial stocks declined.

- The CSI300 index in mainland China dropped 0.4%, retreating from an eight-month high.

- This occurred despite a tech rally on Wall Street that saw the Nasdaq hit record highs overnight.

- South Korea’s Kospi fell 0.65%, while the small-cap Kosdaq lost 0.07%.

- Japan’s stocks reversed earlier gains, with the Nikkei 225 ending down 0.31% and the broad-based Topix down 0.3%, snapping a three-day winning streak.

- Australia’s S&P/ASX 200 slipped 0.15% as investors assessed the minutes of the central bank’s May meeting, which revealed the RBA considered raising rates due to higher inflation risks.

Stocks in Spotlight

- Delhivery shares slumped over 10 percent after the company reported a loss in Q4FY24. Delhivery posted a loss of Rs 68.5 crore in Q4, compared to a surprising profit of Rs 11.7 crore in the previous quarter.

- Shares of Rail Vikas Nigam, the Mini Ratna PSU, surged 15 percent following the company’s successful bid for an order valued at Rs 148 crore from the South Eastern Railway. The order entails designing, supplying, erecting, testing, and commissioning for the upgrade of an electric traction system for the Kharagpur division.

- Hindustan Zinc shares surged 20 percent, continuing their upward trajectory for the fifth consecutive session. This surge is fueled by expectations that the substantial increase in metal prices will bolster the company’s margins. Moreover, with stable production costs and elevated selling prices, a rise in profits per unit sold is expected.

News from the IPO world🌐

- Despite healthy response to IPO, Go Digit GMP slips on allotment day

- Awfis Space Solutions Limited IPO to open on May 22

- OYO withdraws DRHP, to refile IPO post refinancing:

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY METAL | 3.9 |

| NIFTY PSU BANK | 1.5 |

| NIFTY MEDIA | 1.3 |

| NIFTY OIL & GAS | 0.6 |

| NIFTY PHARMA | 0.5 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1622 |

| Decline | 2311 |

| Unchanged | 154 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,807 | (0.5) % | 5.5 % |

| 10 Year Gsec India | 7.1 | (0.2) % | (0.4) % |

| WTI Crude (USD/bbl) | 80 | (4.7) % | 13.8 % |

| Gold (INR/10g) | 73,970 | (0.4) % | 7.4 % |

| USD/INR | 83.30 | (0.2) % | 0.3 % |

Please visit www.fisdom.com for a standard disclaimer