Technical Overview – Nifty 50

The Benchmark Index started with a bullish note and recorded its lifetime high at 22,697 levels and formed a bullish candle on the daily time frame. The higher high higher low formation is acting as a strong base for the bullish momentum.

The Nifty50 on the daily chart is trading within the rising channel pattern and the prices are approaching near the upper band of the pattern. The index is trading above its 9 & 21 EMA and the slope is tilted on the higher side.

The momentum oscillator RSI (14) supported a horizontal trend line near 40 levels and moved above 60 with a bullish crossover. The outlook for the Nifty Remains bullish with an immediate resistance placed at 22,800 levels and support placed at 22,500 levels.

Technical Overview – Bank Nifty

The Banking Index traded within the defined range and it underperformed the Nifty50 on the daily charts. The Bank Nifty has formed a Doji candle stick pattern on the daily chart after a tall bullish candle suggests a consolidation phrase for the index.

The Bank Nifty on the daily chart is trading within the rising channel pattern and the prices are approaching near the upper band of the pattern. The index is trading above its 9 & 21 EMA and the slope is tilted on the higher side.

The momentum oscillator RSI (14) has taken support of an upward rising trend line near 50 levels and moved higher near 70 levels with a bullish crossover. The outlook for the Bank Nifty Remains bullish with an immediate resistance placed at 49,000 levels and support placed at 48,100 levels.

Indian markets:

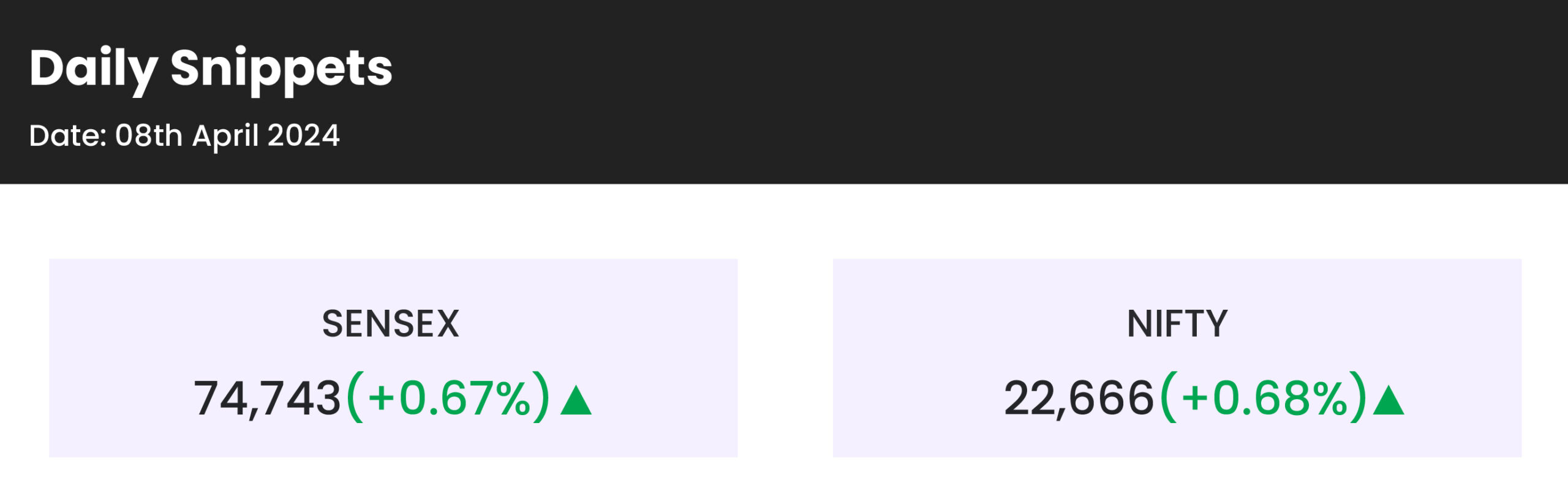

- Indian stock market benchmarks, the Sensex and the Nifty 50, concluded at new closing peaks on Monday, April 8, buoyed by positive global indicators and a decline in crude oil prices. The upbeat global sentiment influenced the domestic market outlook.

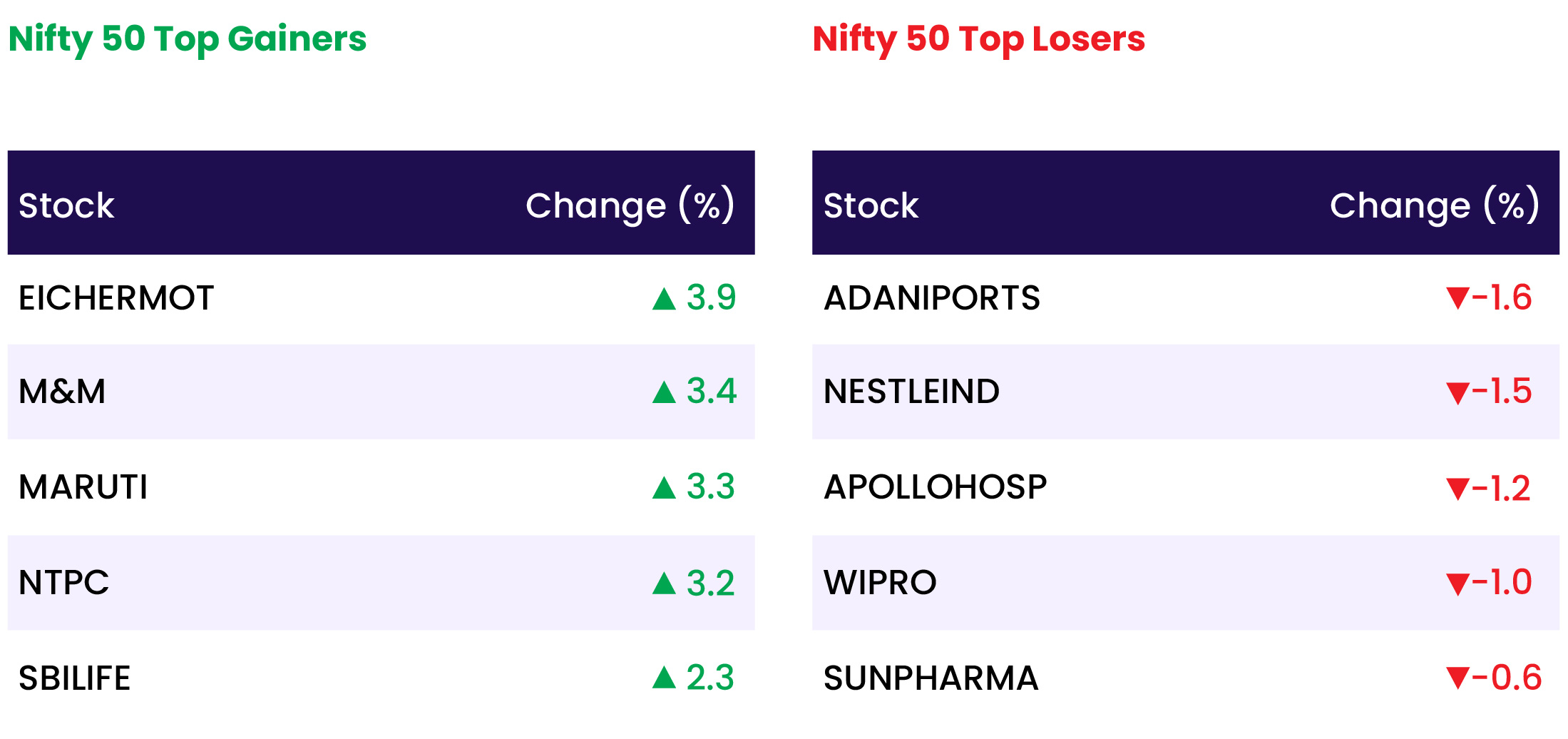

- The benchmark Nifty 50 and the Sensex opened higher and commenced trading higher and maintained their upward trajectory, achieving fresh record levels on April 8. Favorable signals from international markets, coupled with a surge in large-cap auto stocks and select heavyweights such as Reliance Industries, bolstered market momentum.

- In addition to the primary benchmarks, the Nifty Bank index surged to an all-time high, breaching the 48,700 level for the first time. The rally in banking shares was propelled by renewed investor confidence, driven by expectations of political stability ahead of the 2024 Lok Sabha Elections.

- This renewed optimism is anticipated to contribute to the overall economic momentum, with investors interpreting the prospect of political continuity as a positive catalyst for the market.

- Across other sectors, auto, energy, infrastructure, metal, and realty witnessed significant gains of 1-2 percent, while PSU bank, information technology, and media indices experienced marginal declines of 0.5-1 percent.

- The BSE midcap and smallcap indices closed the day with slight gains.

Global Markets:

- Asia-Pacific Markets Rally Amid Central Bank Meetings and Inflation Data Anticipation” Investors in Asia-Pacific markets are optimistic ahead of central bank decisions this week, coupled with keen anticipation for inflation figures from the U.S. and China.

- Scheduled monetary policy meetings for this week include the Bank of Korea, the Reserve Bank of New Zealand, the Bank of Thailand, and the central bank of the Philippines.

- Japan’s Nikkei 225 made a strong rebound, surpassing the 39,000 milestone with a 0.91% increase to close at 39,347.04, while the broader Topix index also rose by 0.95% to finish at 2,728.32.

- South Korea’s Kospi index edged up by 0.13% to reach 2,717.65, whereas the small-cap Kosdaq experienced a decline of 1.34%, settling at 860.57.

- Australia’s S&P/ASX 200 index advanced by 0.16%, closing at 7,785.4.

- Hong Kong’s Hang Seng index traded close to neutrality, while mainland China’s CSI 300 index dropped by 0.88% upon resuming trading after a public holiday, ending the session at 3,536.4.

Stocks in Spotlight

- Exide Industries witnessed a remarkable surge of nearly 17 percent in its share price following an announcement by Hyundai Motor Company and Kia Corporation regarding a partnership with the indigenous battery manufacturer for localizing electric vehicle batteries in India.

- FSN E-Commerce, the parent company of Nykaa, experienced a notable uptick of over 6 percent in its stock value after revealing expectations of substantial year-on-year revenue growth, anticipated to be in the “high twenties” for the March quarter. Additionally, Nykaa reported a robust “early 30s” growth in Gross Merchandise Value (GMV), reflecting the total value of goods sold through its e-commerce platforms before deductions.

- Info Edge, the holding company of Naukri, observed a significant surge of nearly 10 percent in its shares following a strong performance in the fourth quarter. The company’s standalone billings exhibited a year-on-year growth of 5.48 percent, amounting to Rs 2,495.9 crore in FY24. Notably, its recruitment solutions segment, encompassing Naukri and iimjobs, contributed Rs 1,883.2 crore in standalone billing, marking a rise of 1.81 percent year-on-year.

- Godrej Properties witnessed a surge of 3 percent in its share price subsequent to the announcement of selling homes worth over Rs 3000 crore in Gurugram. The company achieved this feat by selling more than 1,050 units, amounting to a total value exceeding Rs 3,000 crore, within three days in the Godrej Zenith project in Gurugram.

News from the IPO world🌐

- Blackstone-backed Aadhar Housing Finance gets Sebi nod to launch Rs 5,000 crore IPO

- Gujarat-based Vasuki Global files IPO papers with Sebi

- Vishal Mega Mart said to pick Kotak, ICICI for mega IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 2.2 |

| NIFTY OIL & GAS | 1.5 |

| NIFTY REALTY | 1.3 |

| NIFTY METAL | 1.1 |

| NIFTY CONSUMER DURABLES | 0.8 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1898 |

| Decline | 2033 |

| Unchanged | 124 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,904 | 0.8 % | 3.2 % |

| 10 Year Gsec India | 7.2 | 0.5 % | 0.9 % |

| WTI Crude (USD/bbl) | 87 | (0.0) % | 23.5 % |

| Gold (INR/10g) | 70,720 | 0.6 % | 6.8 % |

| USD/INR | 83.43 | (0.0) % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer