Technical Overview – Nifty 50

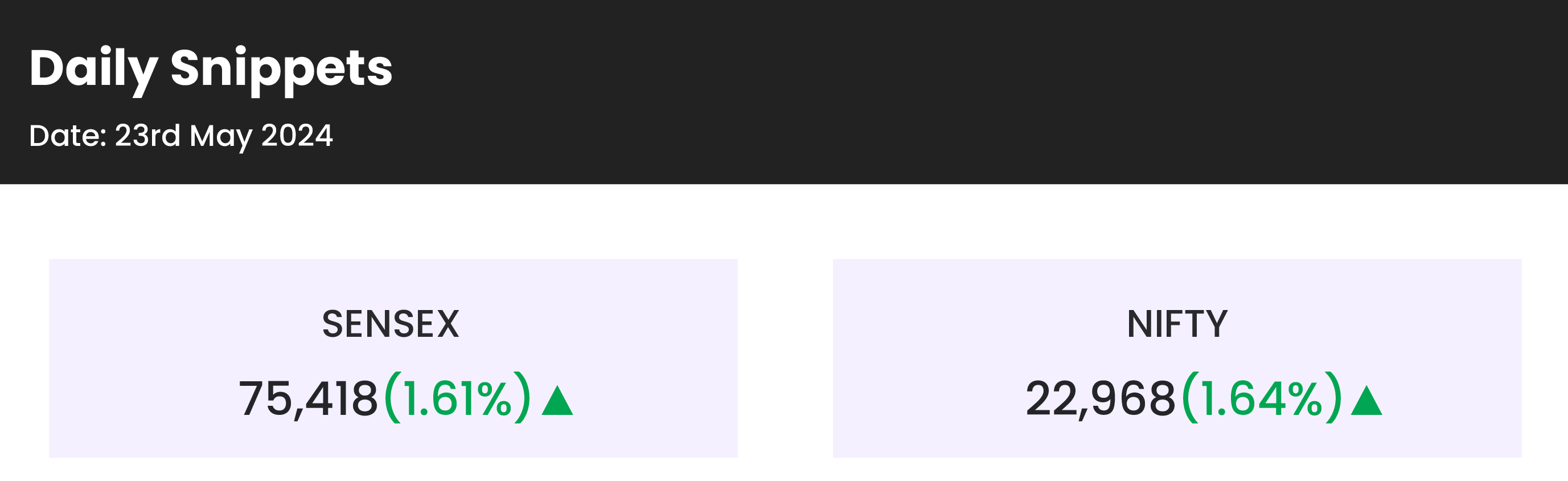

The benchmark NIFTY index moved 370 points, or 1.64%, to 22,968. A historic day for the benchmark index, which saw a 350-point increase to a new All-Time High at 22,994, very almost approaching 23,000 levels. The market appears to be dominated by bulls, who also exude extreme bullishness. In just 10 sessions, there was a 1000-point or 4.56% surge throughout the volatile election period.

On the daily time frame, a large bullish candle has developed. The price has broken through the 22,800 level of prior resistance with a very bullish momentum. The channel lower band turnaround appears to have gone quite well, and the benchmark index’s bullish trend appears to be continuing. Momentum indicator 14-period RSI 68 levels and is probably going to move over 70 into the overbought zone.

Furthermore, as per derivatives data, the call writer has shifted the CE writing from 22,600 to 23,150 strike prices, indicating a change in range.

The 22,750 and 22,600 zones of the benchmark index act as support levels. In later sessions, levels 23,050 and 23,200 could be employed as resistance levels.

Technical Overview – Bank Nifty

The BANK NIFTY index closed the day at 48,769, up 987 points, or 2.06%. The index had an incredible day, rising 1000 points or 2% in a single session. The Banking Index has witnessed a 10-day consolidation breakout on the daily chart above its horizontal trend line. A large bullish candle that has developed indicates that bulls are determined to control the market.

The upward trend line support reversal was extremely successful, as the index is currently trading above the 10, 20, and 50 DEMA. The 14-period RSI momentum indicator has slowly approached 59, indicating a bullish increase.

Furthermore, as per derivatives data, the call writer has shifted the CE writing from 48,500 to 49,000 strike prices, indicating a change in range. The index’s gain was spearheaded by AXIS Bank, and all of its components concluded the day higher.

Future session resistance levels are shown at 48,300 and 48,600, and future session support levels are shown at 47,700, and 47,300.

Indian markets:

- On Thursday, Indian benchmark indices closed at record highs, with both Sensex and Nifty rising over 1.6 percent each. During intra-day trading, Sensex nearly reached 75,500 points, while Nifty surpassed 22,900 points.

- This surge followed the Reserve Bank of India’s (RBI) announcement of a substantial ₹2.1 lakh crore dividend to the government. This significant macroeconomic event positively impacted the market, directly affecting the fiscal deficit and bond yields.

- The BSE Midcap index increased by 0.5 percent, while the Smallcap index rose by 0.3 percent.

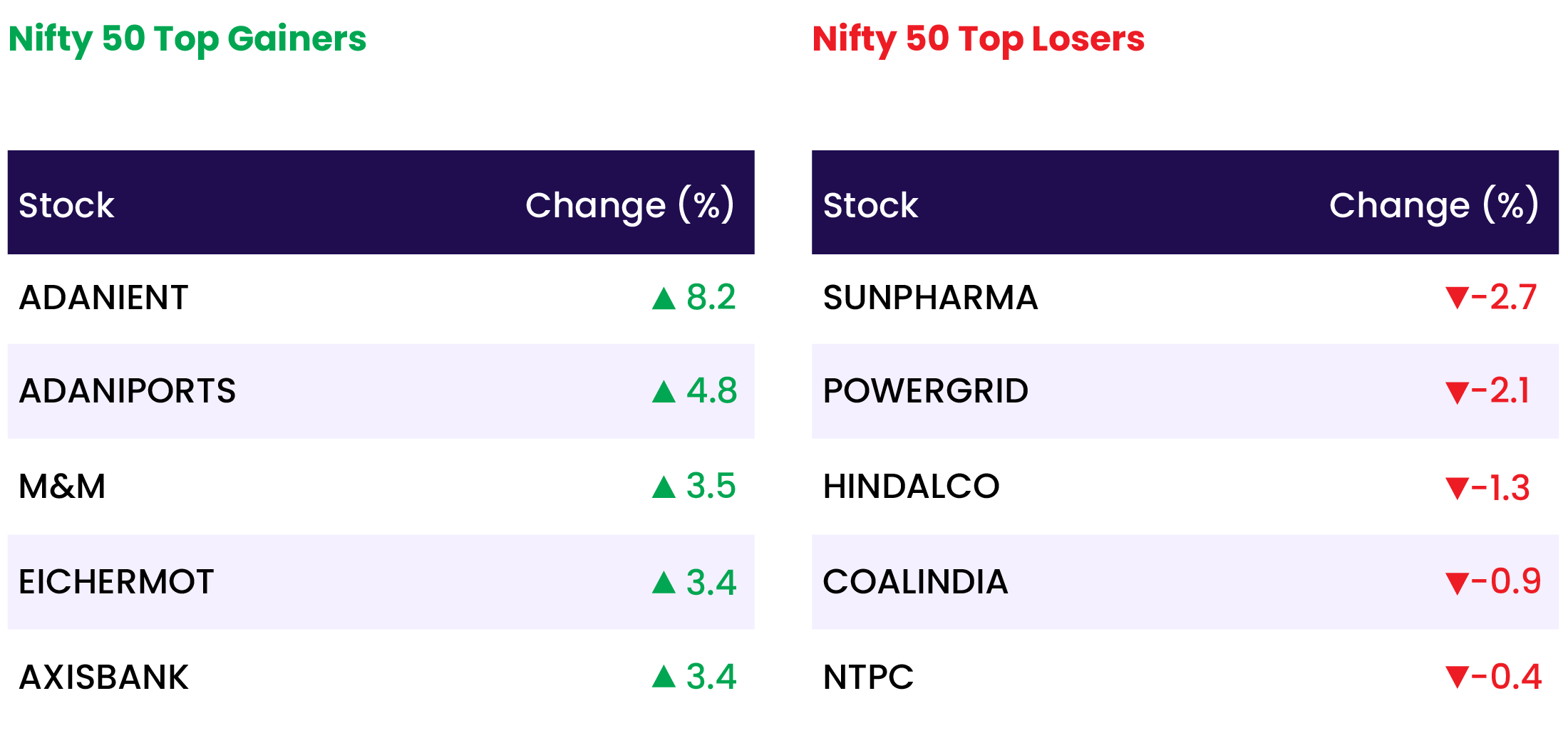

- Except for the metal and pharma sectors, all other sectoral indices ended in the green. The auto, banking, and capital goods sectors each saw gains of 2 percent.

Global Markets:

- Asia-Pacific markets were mixed after the U.S. Federal Reserve minutes revealed concerns about persistent inflation and hesitancy over potential interest rate cuts.

- Hong Kong’s Hang Seng index dropped 1.77%, leading regional losses, while the CSI 300 fell 1.16%. In contrast, Japan’s Nikkei 225 rose 1.26%, and the Topix gained 0.64%.

- South Korea’s central bank held its policy rate at 3.5%, as expected. The Kospi dipped 0.06%, while the Kosdaq edged up 0.10%.

- Singapore’s final Q1 GDP remained at 2.7%, and investors assessed business activity data from Australia and Japan. Australia’s S&P/ASX 200 declined 0.46%.

Stocks in Spotlight

- Garden Reach Shipbuilders Shares surged 19 percent as investors celebrated the company’s strong fourth-quarter results. In Q4, the company’s revenue exceeded Rs 1,000 crore, a 69 percent increase compared to the same quarter last year. Additionally, the company’s net profit doubled to Rs 112 crore on an annual basis.

- Cochin Shipyard PSU multi-bagger Shares soared over 16 percent, marking a gain of more than 50 percent in the past month. The shipbuilding firm is scheduled to announce its quarterly earnings on May 24, 2024.

- Jio Financial Services shares rose 3 percent after the company announced it is seeking shareholder approval to attract foreign investments, including up to 49 percent through foreign portfolio investments in equity.

News from the IPO world🌐

- Beacon Trusteeship IPO to open on May 28

- Travel portal ixigo’s parent firm, Bansal Wire Industries get Sebi’s go-ahead to float IPO

- OYO withdraws DRHP, to refile IPO post refinancing:

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 2.3 |

| NIFTY BANK | 2.1 |

| NIFTY PRIVATE BANK | 2.0 |

| NIFTY FINANCIAL SERVICES | 1.9 |

| NIFTY PSU BANK | 1.7 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1762 |

| Decline | 2071 |

| Unchanged | 112 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,671 | (0.5) % | 5.2 % |

| 10 Year Gsec India | 7.0 | 0.0 % | (1.5) % |

| WTI Crude (USD/bbl) | 78 | 0.7 % | 12.5 % |

| Gold (INR/10g) | 72,425 | (0.8) % | 6.4 % |

| USD/INR | 83.31 | 0.0 % | 0.3 % |

Please visit www.fisdom.com for a standard disclaimer