Technical Overview – Nifty 50

The Benchmark Index continued its bullish run for the third straight day and sustained above 22,000 levels and formed a bullish candle. On the weekly chart, the index has gained more than 1% and formed a bullish candle.

Strictly speaking, the market’s mood has improved considerably. And that’s in line with our call of the day which suggests the bullish narrative is likely to last longer amidst improving technical conditions. Technically, on the daily charts, a long bullish candlestick pattern is being witnessed both in Nifty and Bank Nifty’s charts.

The momentum oscillator RSI (14) indicates a sign of reversal from the pivot levels and moved above 60 levels with a bullish crossover on the cards. The MACD continues to sustain above its polarity levels.

The index still managed to close above the previous day’s high which adds bullishness. Immediate support for now is near 21,900 levels while resistance is near 22,200 levels

Technical Overview – Bank Nifty

The Bank Nifty on the daily chart has given a triangle pattern breakout and prices have closed above the same suggesting a continuation of a bullish trend. The Banking index rose with a gain of more than 1.50% and formed a bullish candle.

The prices on the weekly time frame are trading above their 21 and 50 EMA and it is taking support near the lower band of the rising wedge pattern. The momentum oscillator RSI (14) is reading within the rectangle pattern between 70 – 45 levels suggesting sideways momentum.

Technically speaking, Bank Nifty’s technical picture on the daily chart shifts to bullish from neutral amidst bullish breakout technical conditions on the daily charts. Immediate support for now is near 45,600 levels while resistance is near 47,000 levels.

Indian markets:

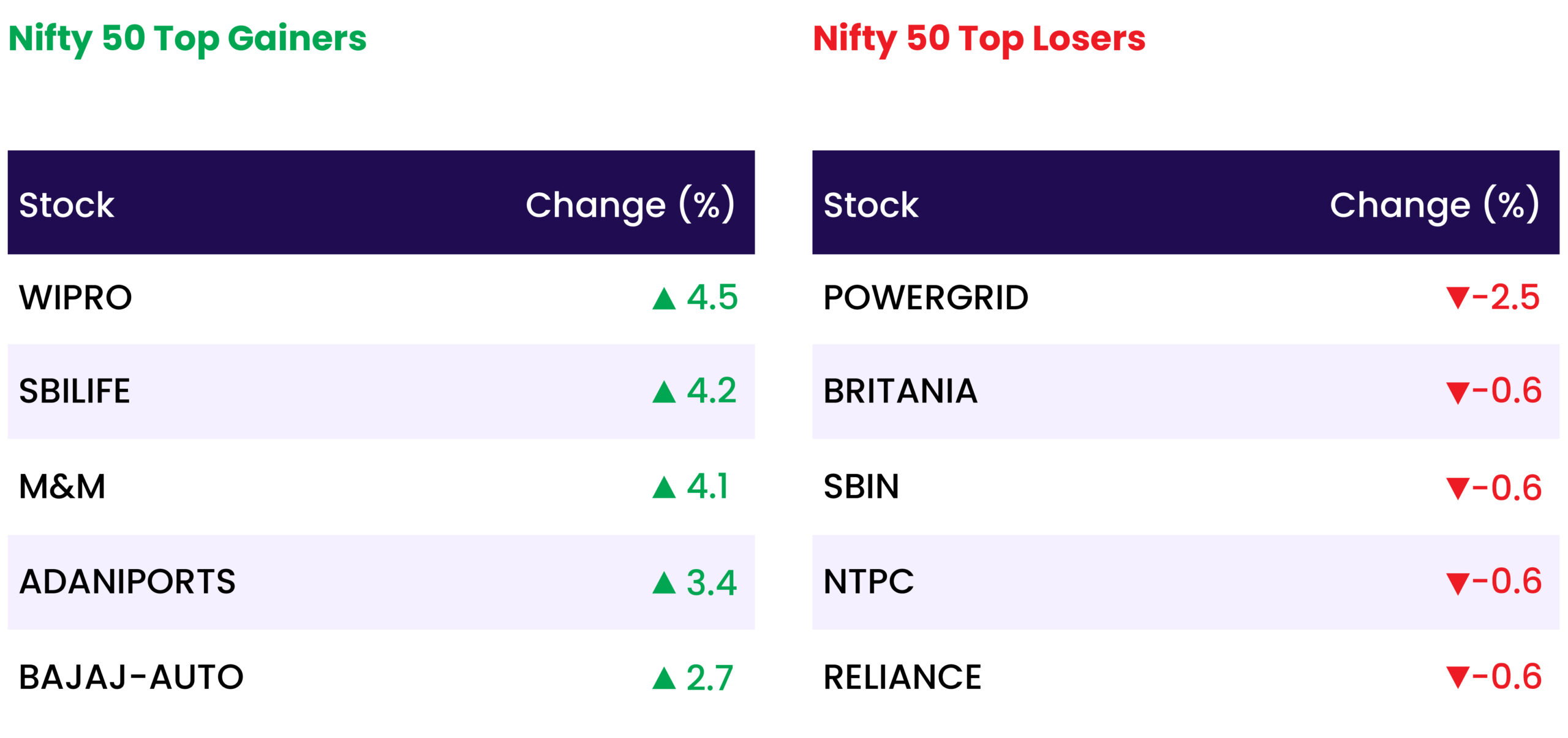

- The market extended gains for the fourth consecutive session on February 16, with Nifty surpassing 22,000, driven by strength in auto, Information Technology, and pharmaceutical stocks.

- Positive global cues supported Indian equity indices, which opened in the green and maintained a positive trajectory throughout the session, with Nifty staying above the 22,000 mark.

- Across sectors, buying activity was prevalent, except for oil & gas and power, with auto, realty, and pharmaceutical sectors emerging as top gainers.

- Market breadth favored advances, fueled by sustained buying in the midcap and smallcap segments.

Global Markets:

- Asia-Pacific markets rebounded after experiencing mostly declines on Wednesday, although Japan faced challenges as it entered a technical recession with its GDP contracting for a second consecutive quarter.

- Japan’s GDP for the fourth quarter declined by 0.4% on an annualized basis, significantly below the 1.4% growth anticipated by economists surveyed by Reuters, following a 3.3% contraction in the third quarter.

- Oil prices retreated on Friday due to a forecast indicating slowing demand by the International Energy Agency, countering support from geopolitical tensions and optimism regarding the possibility of the U.S. Federal Reserve implementing interest rate cuts sooner than previously expected.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Glenmark Pharma witnessed a significant surge of 7 percent in its stock price, buoyed by positive commentary from the company’s management that delighted investors. The management’s optimistic outlook includes expectations for improved EBITDA and consistent margin enhancement in the forthcoming quarter, further bolstering market confidence in the pharmaceutical firm.

- Mahindra and Mahindra saw a notable increase of 4.13 percent in its stock value following the announcement of an agreement with Volkswagen for the utilization of its components in Mahindra’s electric vehicles. This collaboration marks a significant milestone, building upon a partnering deal and term sheet signed by the two companies back in 2022. The partnership underscores Mahindra’s commitment to advancing its electric vehicle offerings and signifies Volkswagen’s confidence in contributing to this endeavor.

- Following IPCA Labs’ release of its Q3FY24 earnings, the company’s stock surged by 7.87 percent. IPCA Labs reported earnings that were in line with expectations, prompting investor enthusiasm. The company disclosed a significant 66.8 percent year-on-year increase in consolidated net profit, amounting to Rs 179.88 crore for the December quarter. Additionally, its revenue showed robust growth, climbing 32 percent year-on-year to Rs 2,052.86 crore. This strong performance underscores IPCA Labs’ solid financial position and operational resilience.

News from the IPO world🌐

- IPO bound Ola Electric slashes prices of e-scooters by up to Rs. 25000

- Hyundai seeks expansion higher valuation with India IPO

- Ullu Digital files papers for Rs. 135-150 crore IPO biggest ever for an SME

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY AUTO | 2.21 |

| NIFTY PHARMA | 1.63 |

| NIFTY REALTY | 1.53 |

| NIFTY IT | 1.26 |

| NIFTY HEALTHCARE INDEX | 1.12 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2194 |

| Decline | 1659 |

| Unchanged | 82 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,773 | 0.9 % | 2.8 % |

| 10 Year Gsec India | 7.1 | 0.2 % | (0.5) % |

| WTI Crude (USD/bbl) | 78 | 1.8 % | 9.9 % |

| Gold (INR/10g) | 61,282 | 0.2 % | (2.3) % |

| USD/INR | 83.0 | (0.1) % | (0.0) % |

Please visit www.fisdom.com for a standard disclaimer