Technical Overview – Nifty 50

The index opened negative with a gap, though the index recovered and closed near a day high. Index has formed a bullish candlestick and sustained above the rising trend line on a 75-minute time-frame.

The momentum indicator RSI (14) on a 75-minute time-frame has hidden positive divergence and took support on 20-EMA on the same. The upward trend should continue because the MACD is rising and above its polarity on a daily basis.

Over the past few sessions, the benchmark index’s equity breadth of stocks above the 50-day moving average (200SMA) increased from 76% to 88% and stocks above momentum indicator RSI (14) 50 levels increased from 70% to 84%.

Based on benchmark index OI data, a base formation may take place at the 24,200 level, where put writing is almost 57 lakhs. At 24,400, or almost 51 lakhs, call writing, resistance might arise. The PCR value of the benchmark index is 0.95.

The support and resistance levels for the next sessions are at 24,150 and 24,050 and 24,300 and 24,400, respectively.

Technical Overview – Bank Nifty

The banking index developed a DOJI candlestick on a daily timeframe after opening with a gap to the downside. The neckline of the index has formed a double top formation near the 52,000 level. The rising trend line in a 75-minute timeframe provided support for the index.

The momentum indicator RSI (14) shows a concealed positive divergence over a 125-minute timeframe and a negative divergence over a daily timeframe. The index is above the major DEMA and found support at the 10-DEMA, suggesting general bullishness. The MACD is consistently rising and above its polarity, indicating that the upward trend should continue.

The resistance and support levels for the upcoming sessions are 52,850, 53,200 for resistance, and 52,000, 51,600 for support.

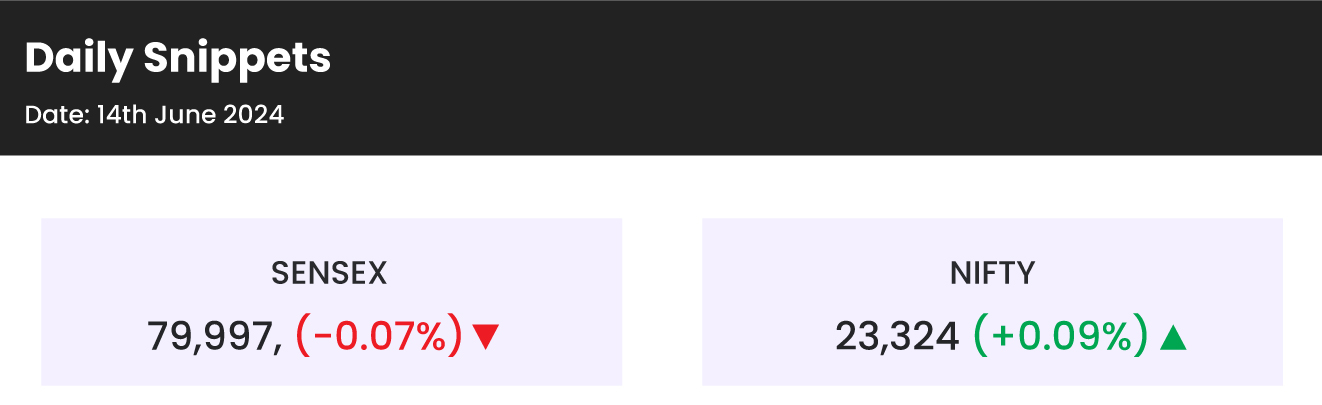

Indian markets:

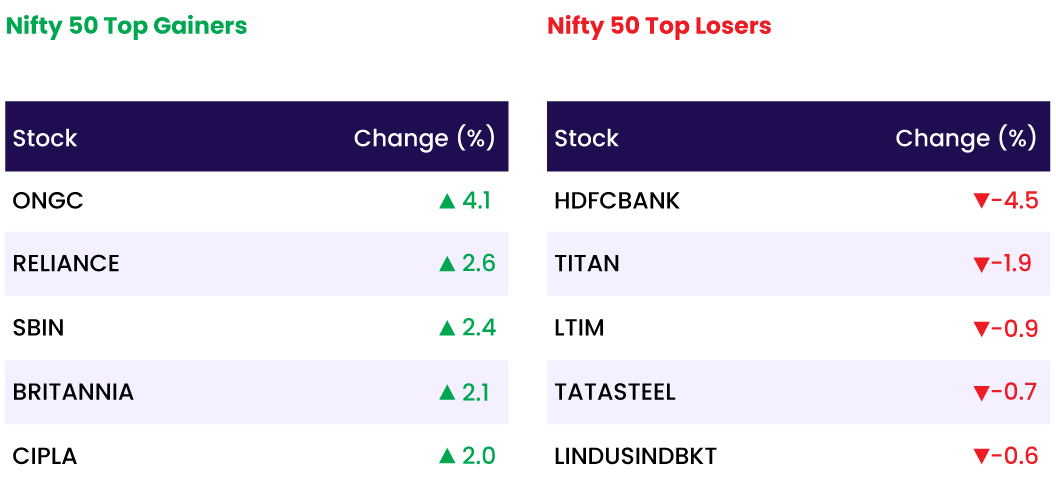

- Indian shares recovered from early losses to finish flat on July 5. Gains in Reliance Industries, State Bank of India, and Hindustan Unilever offset losses in HDFC Bank Ltd.

- Among sectoral gainers on the Nifty, Nifty Oil & Gas led with a gain of 1.9 percent, followed by Nifty Pharma and PSU Bank, both up by 1.3 percent each.

- Nifty FMCG also showed strength with a gain of one percent. Conversely, Nifty Bank was the top decliner among sectoral losers, down by 0.8 percent, followed by Nifty Consumer Durables, which was down 0.2 percent.

- Additionally, the stock’s weight on the MSCI India Index is set to double as its foreign shareholding dropped below 55 percent at the end of June.

Global Markets:

- Asia-Pacific markets were largely lower on Friday, with Japan’s Nikkei 225 paring gains after crossing the 41,000 mark and hitting fresh record highs.

- South Korea’s Kospi was 1.32% higher at 2,862.23, and the small-cap Kosdaq rose 0.79% to end at 847.49.

- Hong Kong’s Hang Seng index dropped 1.13% as of its final hour of trade, while mainland China’s CSI 300 was down 0.43% to close at 3,431.06, its lowest closing level in almost five months.

- Australia’s S&P/ASX 200 dipped 0.12% to close at 7,822.3.

- Overnight in the U.S., markets were closed for the Independence Day holiday, but futures were little changed ahead of Friday’s trading session.

Stocks in Spotlight

- HDFC Bank, India’s largest private lender, saw its stock decline by over 4 percent on July 5 following a soft business update for the April-June quarter (Q1FY25). The bank reported a robust 52.6 percent year-on-year (YoY) growth in gross advances, reaching Rs 24.87 lakh crore. However, this figure represented a 0.8 percent quarter-on-quarter (QoQ) decline from Rs 25.07 lakh crore in Q4FY24, driven by a decrease in corporate and wholesale loans.

- YES Bank’s stock surged over 11 percent on July 5 following a 15 percent year-on-year (YoY) increase in advances for Q1FY25.

- Angel One’s shares saw some respite from a four-day losing streak, driven by revised market intermediary charges, rising by 3 percent as the company registered an increase in client base and the number of orders in June. Angel One’s client base grew by 3.7 percent month-on-month to 2.47 crore in June. On a yearly basis, the client base increased by 64.2 percent.

News from the IPO world🌐

- Emcure Pharmaceuticals IPO booked over 13 times so far on Day 3.

- Softbank backed Firstcry, Unicommerce get SEBI approval for IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY OIL & GAS | 1.9 |

| NIFTY PHARMA | 1.3 |

| NIFTY HEALTHCARE INDEX | 1.3 |

| NIFTY PSU BANK | 1.3 |

| NIFTY FMCG | 1.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2242 |

| Decline | 1686 |

| Unchanged | 88 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,308 | (0.1) % | 4.2 % |

| 10 Year Gsec India | 7.0 | (0.1) % | 1.3 % |

| WTI Crude (USD/bbl) | 83 | (0.7) % | 17.7 % |

| Gold (INR/10g) | 72,274 | 0.2 % | 7.6 % |

| USD/INR | 83.50 | 0.0 % | 0.6 % |

Join us on Telegram for stock market news & updates, quizzes, tidbits on personal finance, investing, and much more.

Please visit www.fisdom.com for a standard disclaimer