Technical Overview – Nifty 50

The Benchmark index witnessed another gap-up opening by following the global clues and traded within the predefined range for the day. The Index witnessed a dip in prices near 22,400 levels and lost the majority of its gains.

Overall, a spinning top candle stick pattern formed on the daily chart indicating a sideways trading range for the Index. The Index continued to sustain above its 9 & 21 EMA is one of the positive signals for the Index.

The Nifty50 has formed a hammer candle stick pattern on the weekly chart and has taken support near its 21 EMA. The immediate support for the Index is placed at 22,200 levels and resistance is capped at 22,500 levels. If the Index witnessed a breakdown below 22,200 levels, then the gate is open till 21,900 marks. Similarly, a close above 22,500 will trigger more upside till 22,700 levels.

Technical Overview – Bank Nifty

The Banking Index witnessed another gap-up opening by following the global clues and trading within the predefined range for the day with a bullish bias. The Bank Nifty continued to sustain above its 9 & 21 EMA is one of the positive signals for the Index.

The momentum oscillator RSI (14) is reading in a higher low formation above the upward-rising trend line on the daily chart. The oscillator presently has taken support of a trend line and has moved above 50 levels with a bullish crossover.

The Bank Nifty has formed a hammer candle stick pattern on the weekly chart and has taken support near its 21 EMA. The immediate support for the Banking Index is placed at 47,500 levels and resistance is capped at 48,600 levels. If the Index witnessed a breakdown below 47,500 levels, then the gate is open till 47,000 mark. Similarly, a close above 48,600 will trigger more upside till 48,900 levels.

Indian markets:

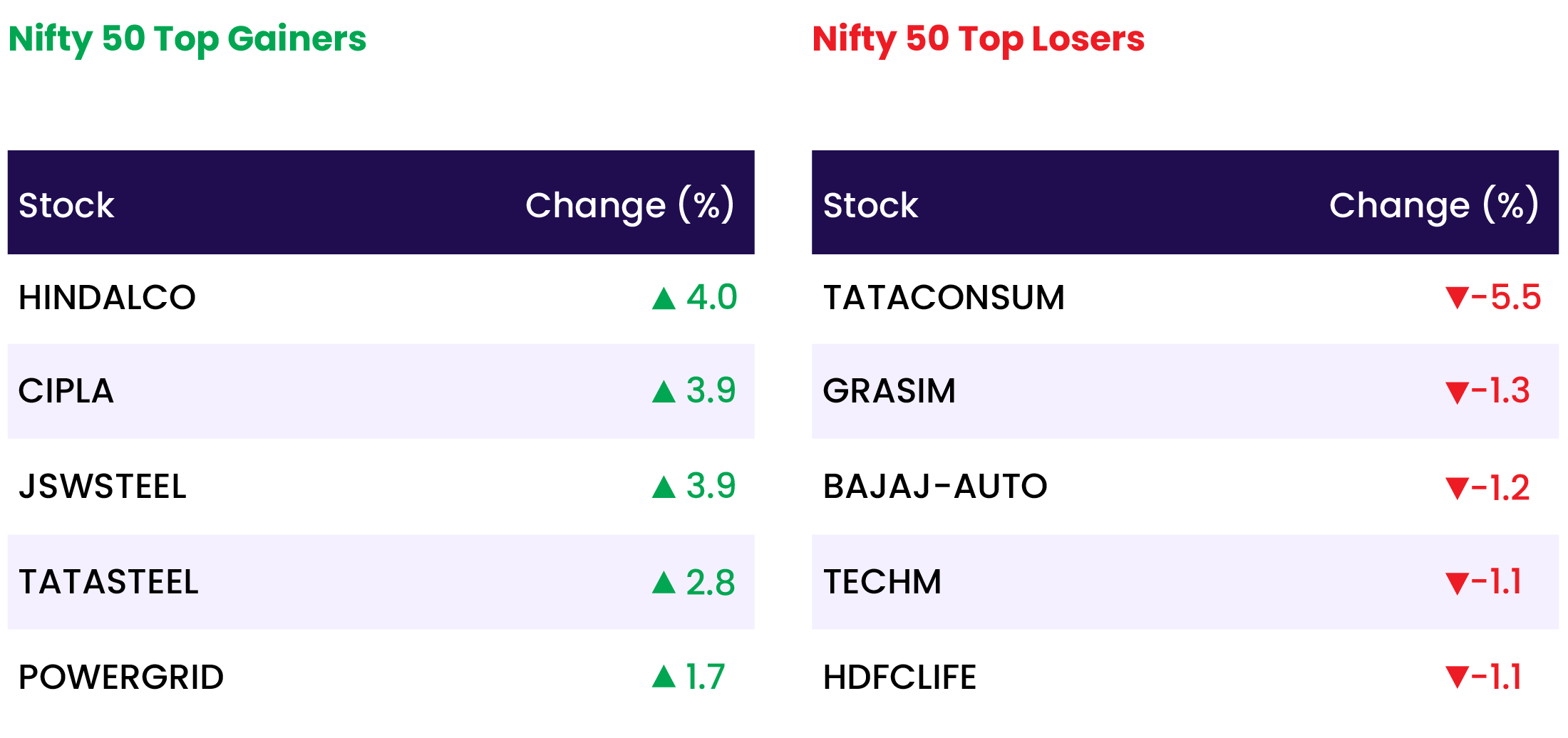

- The Indian stock market continued its upward trend on Wednesday, April 24, with both the Sensex and the Nifty 50 marking their fourth consecutive session of gains. driven by gains in select heavyweights including Hindalco, Cipla, JSW Steel, Tata Steel, amid broadly positive global cues.

- While most of the NSE sectoral indices showed positive movements, sectors such as Nifty media, PSU bank, auto, and IT experienced some declines. Notably, Nifty Metal surged by over 2%, leading the gains, followed by the Nifty healthcare and realty indices, which saw increases of up to 1%.

- Investor interest was evident in infrastructure, energy, and pharmaceutical stocks. Additionally, Nifty FMCG managed to recover from early losses and ended the day slightly higher.

Global Markets:

- The Nikkei 225 in Japan led the charge in Asian markets, buoyed by Wall Street’s consecutive days of gains.

- South Korea’s Kospi surged by 2.01%, with Samsung Electronics driving a notable 4.11% increase, while the Kosdaq also saw a robust uptick of 1.99%.

- Hong Kong’s Hang Seng index climbed by 2.08%, and the Hang Seng Tech index recorded a significant gain of 3.5%.

- China’s CSI 300 edged up by 0.44% to close at 3,521.62.

- European markets kicked off Wednesday on a positive note, extending the momentum from earlier in the week.

Stocks in Spotlight

- Hindustan Unilever Ltd disclosed a 6% decrease in standalone net profit, amounting to Rs 2,406 crore for the fourth fiscal quarter. According to an exchange filing on April 24, the household goods manufacturer’s total income climbed to Rs 15,441 crore for the three months ending on March 31. Additionally, HUL declared a dividend of Rs 24 per share.

- Crafts Automation witnessed a 7% surge in its stock following the announcement that its board would review a proposal for fundraising during the upcoming meeting scheduled for April 27. The board will also finalize Craftsman Automation’s Q4 FY24 earnings at the same session.

- Cyient DLM shares soared by 5% post the company’s robust Q4 results. The net profit (PAT) skyrocketed by 80% year-on-year to Rs 22.7 crore, while revenue surged by 30% YoY to Rs 361.84 crore, buoyed by significant growth in the defence, med-tech, and aerospace sectors.

News from the IPO world🌐

- JNK India IPO booked 75% so far on Day 2

- RCRS Innovations files draft papers with NSE Emerge to raise funds via IPO

- TBO Tek, Awfis Space IPOs get Sebi go-ahead

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY METAL | 2.7 |

| NIFTY MIDSMALL HEALTHCARE | 1.5 |

| NIFTY HEALTHCARE INDEX | 1.3 |

| NIFTY CONSUMER DURABLES | 0.9 |

| NIFTY REALTY | 0.9 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2253 |

| Decline | 1567 |

| Unchanged | 109 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,504 | 0.7 % | 2.1 % |

| 10 Year Gsec India | 7.2 | 0.3 % | 1.1 % |

| WTI Crude (USD/bbl) | 83 | (3.1) % | 17.5 % |

| Gold (INR/10g) | 71,450 | (0.2) % | 4.9 % |

| USD/INR | 83.39 | (0.0) % | 0.4 % |

Please visit www.fisdom.com for a standard disclaimer