Technical Overview – Nifty 50

Initially, the Nifty50 witnessed a gap opening above 22,200 levels and recorded its day high at 22,326 levels post that prices tumbled from the top and drifted below the 22,100 mark and formed a tall bearish candle with a spike on the higher end.

2024 is Expected to Unleash More Volatility in Equities than 2023. In contrast, in 2023, there were only 14 instances of daily falls exceeding 1%. Therefore, compared to last year, 2024 is expected to have brought more volatility to the equity market.

NIFTY50 on the daily chart has reached near the lower band of the rising channel pattern and prices are trading above its trend line support. The index has also taken support near 61.80% Fibonacci retracement which adds additional confirmation to the support.

The immediate support for the Index is placed at 21,900 levels and resistance is capped at 22,350 levels. If the Index witnessed a breakdown below 21,900 levels, then the gate is open till 21,600 mark.

Technical Overview – Bank Nifty

Initially, the Bank Nifty witnessed a gap opening above 47,700 levels and recorded its day high at 47,829 levels post that prices tumbled from the top and drifted below the 47,200 mark and formed a tall bearish candle with a spike on the higher end.

The Banking index has lost almost 1,900 points in the last four trading sessions indicating an intensity of sellers in the market. 2024 is Expected to Unleash More Volatility in Equities than 2023.

The Bank Nifty on the daily chart has drifted below its 9 and 21 EMA and the momentum oscillator RSI (14) has drifted near 50 levels with a bearish crossover on the cards. The MACD indicator has given an early crossover signal above its line of polarity.

The Bank Nifty is trading in a rising channel pattern and presently it has taken resistance near the upper band of the pattern and drifted lower. Presently the market sentiments have shifted to sell-on-rise mode with immediate resistance placed at 47,800 levels and if prices drift below 46,800 levels then the gate is open till 46,400 levels.

Indian markets:

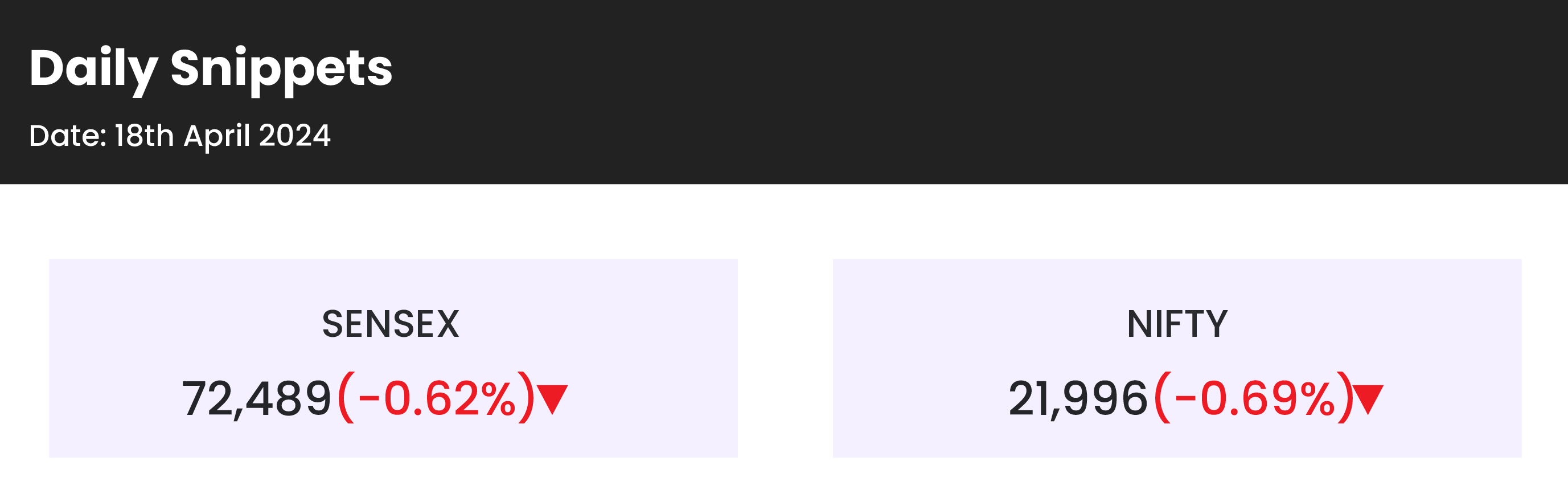

- Indian stock market benchmarks, the Sensex and the Nifty 50, faced continued selling pressure on Thursday, April 18, marking their fourth consecutive session in negative territory amid mixed global cues.

- Although the market began positively, maintaining a green trajectory in the first half, it experienced significant volatility in the latter half, eventually closing near the day’s low.

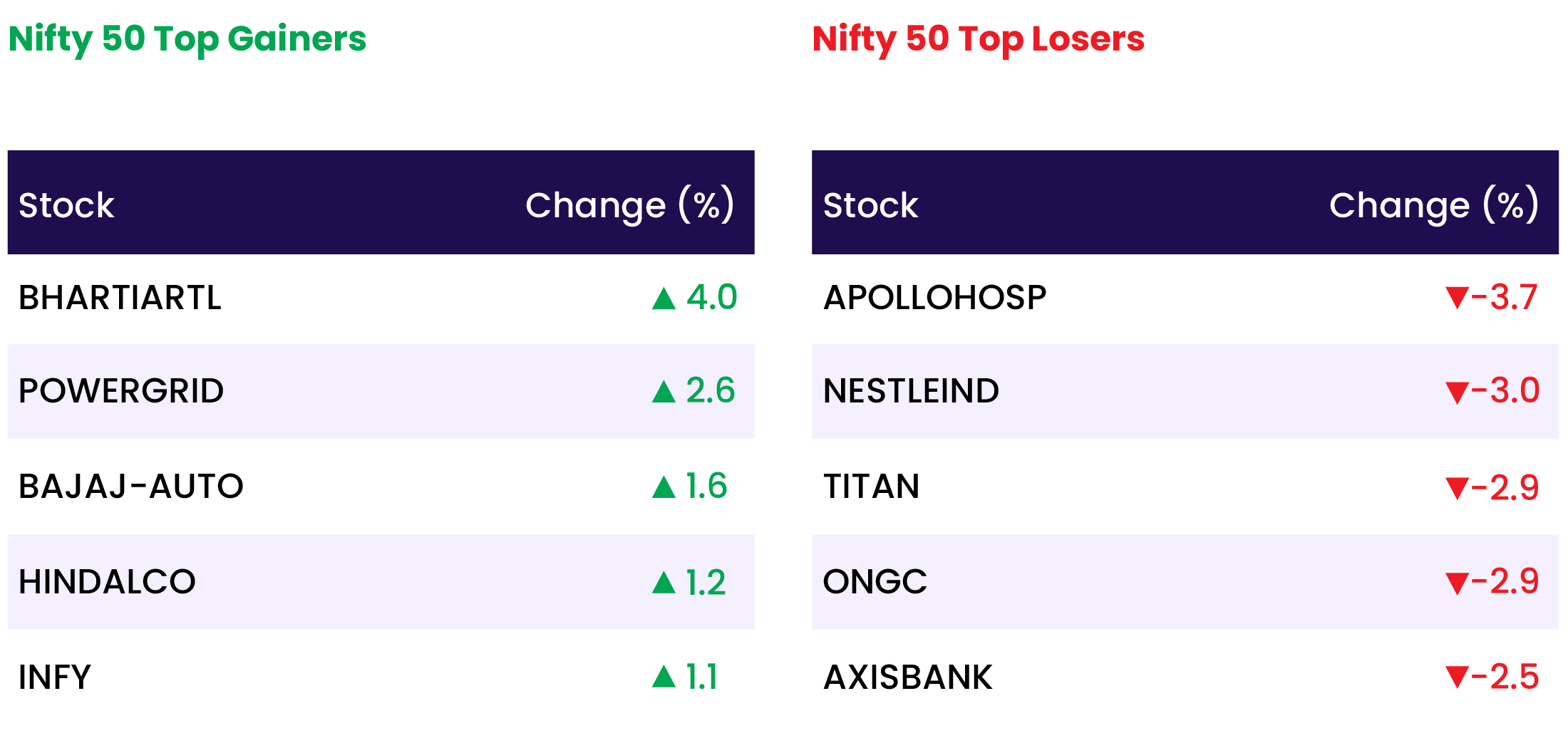

- With the exception of the telecom and media sectors, all other sectoral indices ended in the red.

- The BSE midcap index dropped by 0.4 percent, while the smallcap index concluded the day flat.

Global Markets:

- The Asia-Pacific markets showed a strong rebound on Thursday, contrasting with the overnight losses on Wall Street where both the S&P 500 and the Nasdaq Composite experienced declines for the fourth consecutive day.

- Australia’s S&P/ASX 200 rose by 0.48%, closing at 7,642.1 and breaking a five-day losing streak. This gain occurred despite the country’s unemployment rate inching up to 3.8% in March, which was lower than the 3.9% expected by Reuters.

- South Korea’s Kospi saw a notable recovery from Wednesday’s losses, leading the Asian markets with a 1.95% increase to close at 2,634.7. Additionally, the small-cap Kosdaq surged by 2.72%, finishing at 855.65.

- In Japan, the Nikkei 225 index reversed its earlier losses and ended the day with a 0.31% increase at 38,079, marking the end of a three-day losing streak. Similarly, the broad-based Topix index advanced by 0.54% to 2,677.45.

- Meanwhile, Hong Kong’s Hang Seng index climbed by 1%, and the mainland Chinese CSI 300 index traded up by 0.12%, closing at 3,569.8.

Stocks in Spotlight

- JSW Energy shares surged by 4 percent following an Arbitral Tribunal’s decision to award their subsidiary, Ind-Barath Energy (Utkal) Limited (IBEUL), a claim for recovery from Tamil Nadu Generation and Distribution Corporation Limited (TANGEDCO). The award amounted to Rs. 120 crore, along with 9 percent interest from the date of wrongful encashment of performance bank guarantee by TANGEDCO until the entire amount is paid.

- Bharti Airtel shares saw a 4 percent increase driven by expectations of tariff hikes surpassing forecasts. According to a recent report by IIFL Securities analysts, they anticipate two rounds of tariff increases within the next three years, which could positively impact Bharti Airtel, Vodafone Idea, and Reliance Jio.

- Nestle India shares experienced a decline of nearly 3 percent following a report by Public Eye that criticized the FMCG giant for adding sugar and honey to its leading infant milk and cereal products in developing nations like India but not in European markets.

- Infosys Ltd, the second-largest IT services company in India, surpassed market expectations by reporting a net profit of Rs 7,969 crore for the fiscal fourth quarter. The company’s revenue for the three months ending March 31 stood at Rs 37,923 crore, as disclosed in an exchange filing on April 18. Additionally, Infosys announced a final dividend of Rs 20 per equity share along with a one-time dividend of Rs 8 per share.

News from the IPO world🌐

- Nephro Care India files DRHP to raise funds via IPO

- JNK India has fixed a price band of Rs 395-415 per share

- Deepak Builders & Engineers files draft papers with Sebi to raise funds via IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 0.8 |

| NIFTY PSU BANK | -0.2 |

| NIFTY IT | -0.2 |

| NIFTY METAL | -0.3 |

| NIFTY REALTY | -0.5 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1761 |

| Decline | 2047 |

| Unchanged | 121 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 37,753 | (0.1) % | 0.1 % |

| 10 Year Gsec India | 7.2 | (0.1) % | 0.9 % |

| WTI Crude (USD/bbl) | 83 | (3.1) % | 17.5 % |

| Gold (INR/10g) | 72,934 | 0.3 % | 8.0 % |

| USD/INR | 83.59 | 0.1 % | 0.7 % |

Please visit www.fisdom.com for a standard disclaimer