Technical Overview – Nifty 50

The Nifty50 witnessed a gap-up opening on 9th April and recorded its life high at 22,768 levels. Post forming a life high levels index witnessed a profit booking and formed a lower high lower low formation on the intraday chart.

The Benchmark index on the daily chart has formed a bearish candle resembling a dark cloud cover candle stick pattern. The Nifty50 on the daily chart is trading within the rising channel pattern and the prices have reached near the upper band of the pattern. The index is trading above its 9 & 21 EMA and the slope is tilted on the higher side.

The momentum oscillator RSI (14) supported a horizontal trend line near 40 levels and moved above 60 with a bullish crossover. The outlook for the Nifty Remains bullish with an immediate resistance placed at 22,800 levels and support placed at 22,500 levels.

Technical Overview – Bank Nifty

The Banking index continued its outperformance against the benchmark index and closed higher with more than 150 points gains. The Bank nifty on the daily chart has given a horizontal trend line breakout above 48,500 levels and confirmed a bullish signal.

The higher high higher low formation on the daily chart is witnessing an ongoing bullish trend in the Banking sector. The index is trading above its 9 & 21 EMA and the slope is tilted on the higher side.

The momentum oscillator RSI (14) has taken support of an upward rising trend line near 50 levels and moved higher above 70 levels with a bullish crossover. The outlook for the Bank Nifty Remains bullish with an immediate resistance placed at 49,200 levels and support placed at 48,200 levels.

Indian markets:

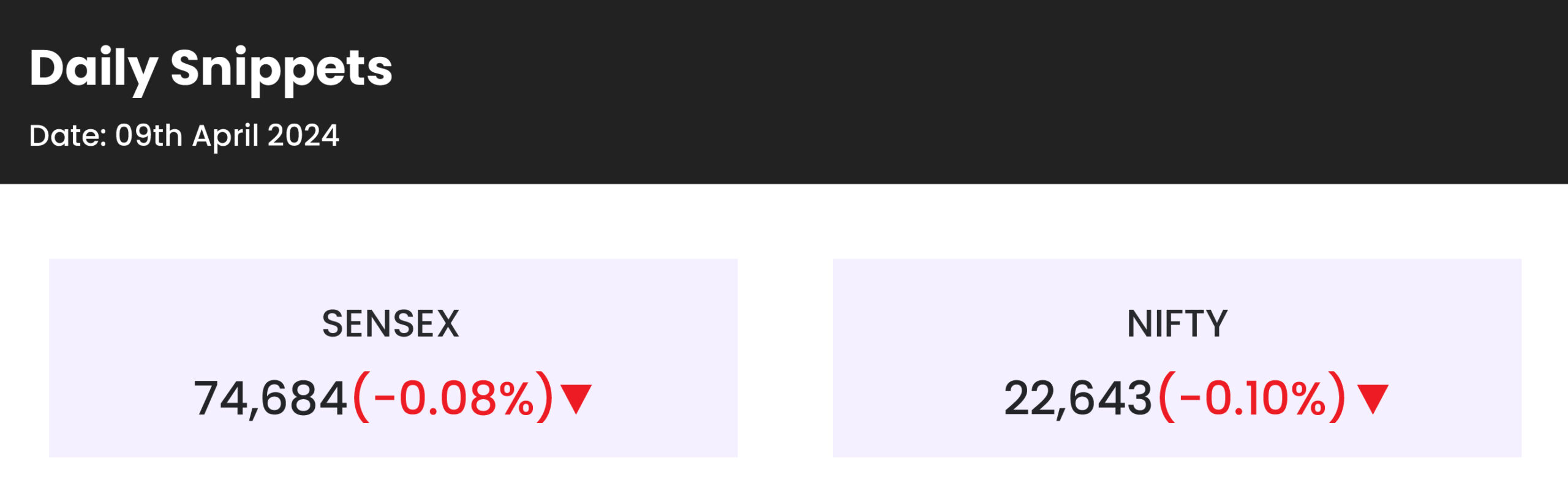

- Indian benchmark indices, the Sensex and the Nifty, reached new all-time highs on April 9.

- However, they couldn’t sustain the gains due to profit booking ahead of the release of important inflation data for both India and the US.

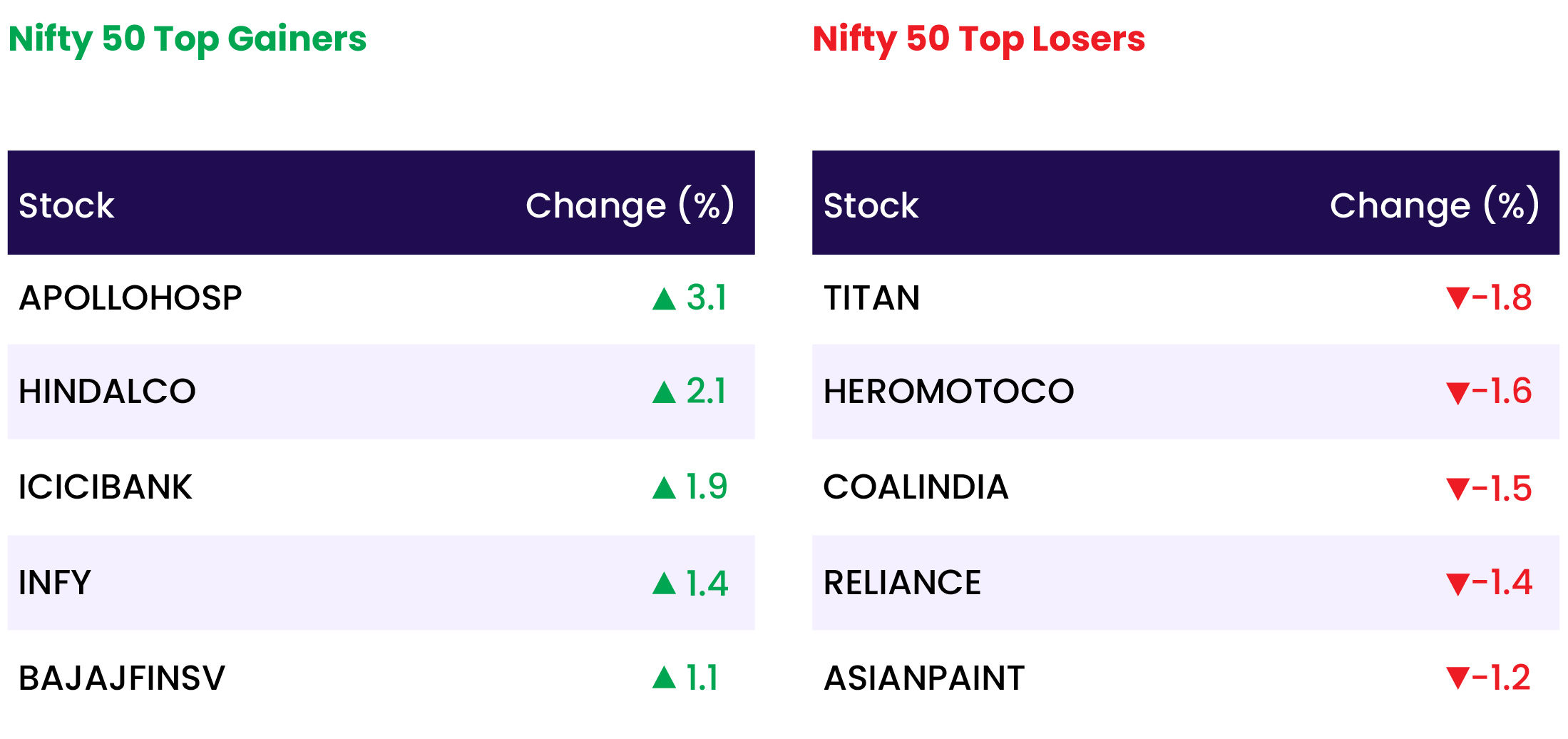

- In terms of sectors, auto, capital goods, FMCG, energy, infrastructure, oil and gas, and pharma saw losses ranging from 0.3 to 1 percent.

- Conversely, the banking, metals, and realty indices experienced gains of 0.3 to 1 percent.

Global Markets:

- European markets experienced declines on Tuesday as investors awaited upcoming key economic data, particularly U.S. inflation figures scheduled for release on Wednesday.

- There is ongoing speculation about a potential rate cut in March, with CME’s FedWatch tool indicating approximately a 50% chance of such an action. However, Minneapolis Fed President Neel Kashkari recently suggested the possibility of zero rate cuts this year if inflation persists.

- Overnight, U.S. stock futures showed minimal movement, while Asia-Pacific markets displayed a mixed performance as investors anticipated consumer confidence data from Japan

Stocks in Spotlight

- Infosys stock saw a rise of over 1.39 percent following an upgrade from BofA, which shifted its rating on the IT services company from “neutral” to “buy”. The global brokerage also increased the target price for Infosys to Rs 1,785 from Rs 1,735, citing attractive valuations. This adjustment suggests an 18 percent potential upside from the current levels.

- Ajmera Realty witnessed a surge of over 5 percent following its announcement that sales had surpassed Rs 1,000 crore in FY24. In the March quarter alone, the company experienced a doubling in sales value to Rs 287 crore, marking a remarkable 104 percent increase from the same period last year. Additionally, collections for the quarter amounted to Rs 197 crore, reflecting a substantial 91 percent rise compared to the previous year.

- Gland Pharma’s stock witnessed a decline of over 2 percent following a block deal worth Rs 1,590 crore. Reports from Moneycontrol indicated that two entities associated with the former promoter of the company, Dr. Ravi Penmetsa, namely Nicomac Machinery Private Ltd and RP Advisory Services Private Ltd, were planning to sell a 4.4 percent stake in the pharmaceutical company.

- FMCG stocks faced significant losses, emerging as some of the poorest performers, despite benchmark indices reaching new highs in their ongoing record surge. Hindustan Unilever, Colgate, Marico, UBL, Tata Consumer, Godrej Consumer Products, and Britannia all saw declines of up to 2 percent, in contrast to the 0.4 percent rise in the Nifty index. Analysts’ warnings about a lackluster fourth quarter for FMCG companies, attributed to sluggish rural growth, delayed winter, and increased competition, prompted caution among investors, contributing to the downtrend in FMCG stocks.

News from the IPO world🌐

- Blackstone-backed Aadhar Housing Finance gets Sebi nod to launch Rs 5,000 crore IPO

- Gujarat-based Vasuki Global files IPO papers with Sebi

- Vishal Mega Mart said to pick Kotak, ICICI for mega IPO

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY METAL | 1.1 |

| NIFTY REALTY | 0.5 |

| NIFTY PRIVATE BANK | 0.5 |

| NIFTY FINANCIAL SERVICES | 0.4 |

| NIFTY BANK | 0.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1692 |

| Decline | 2229 |

| Unchanged | 110 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,892 | 0.0 % | 3.2 % |

| 10 Year Gsec India | 7.2 | 0.5 % | 1.4 % |

| WTI Crude (USD/bbl) | 87 | 0.2 % | 23.7 % |

| Gold (INR/10g) | 70,636 | (0.1) % | 6.7 % |

| USD/INR | 83.27 | (0.0) % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer