Technical Overview – Nifty 50

The benchmark index continues to remain in the recent session zone of 23,230 – 23,420. On the daily timeframe, the index has formed a TWEEZER TOP formation at an all-time high. The bullish momentum has halted, and the ADX (Directional Index) has dropped below 20 levels in the 75-minute timeframe, suggesting a dormant trend. On a 75-minute time period, RSI (14) is coming up against trend line resistance.

On the 75-minute time frame, the index is finding support at the 10-EMA, while on the daily time period, it is trading above the major EMA.

Support levels for the upcoming sessions are 23,200 and 23,000, with resistance around 23,450 and 23,600.

Technical Overview – Bank Nifty

The BANK NIFTY index closed at 49,706, down 75 points or -0.15% on the day.

The Banking Index is lacking upside momentum after last week’s volatility. Index hovered between 49,530 and 49,970 for the whole session. The index is trading near the upper band of WEDGE PATTERN. The momentum is lost in a 75-minute time frame, where ADX (Directional Index) has moved below 13, below 20 refers to a dormant trend.

The index is trading above major EMA on a daily time frame and taking support on 20-EMA on a 75-minute time frame.

Support levels for the upcoming sessions are 49,500 and 48,900, with resistance around 50,250 and 50,500.

Indian markets:

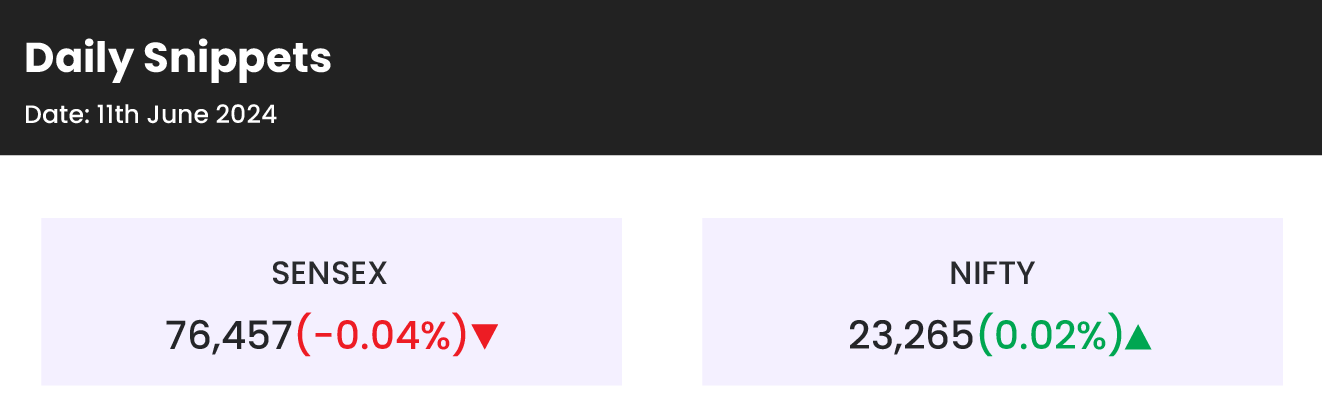

- On Tuesday, June 11, Indian stock market benchmarks continued to consolidate for the second consecutive session amid weak global cues. Despite opening higher and trading in positive territory for most of the session, the Sensex and Nifty 50 ended flat due to profit booking in the absence of fresh triggers.

- Investors are booking profits in large-cap stocks as market focus shifts to the new government’s policy decisions, the upcoming Union Budget, and global developments.

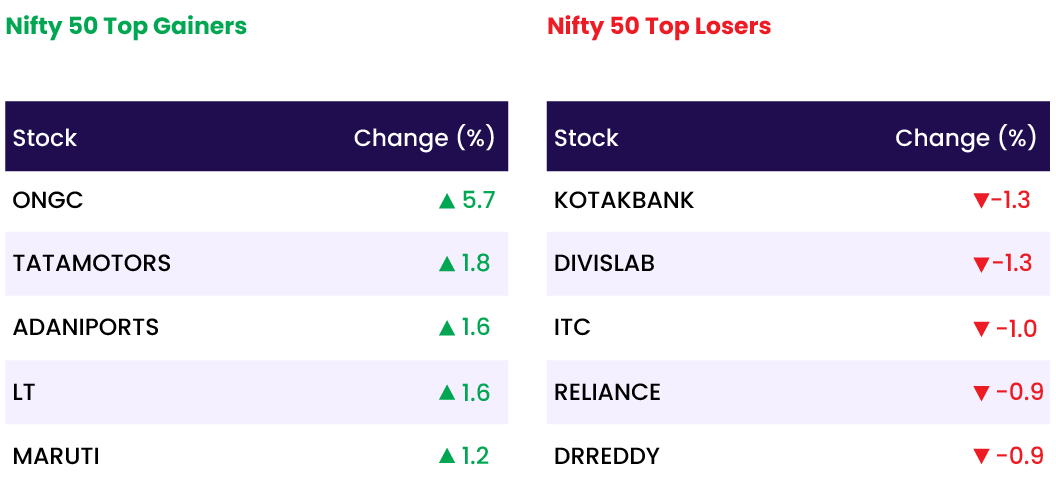

- Sectoral indices showed a mixed performance, with the Realty index gaining over 1 percent. The Nifty Auto index also contributed to the gains, rising nearly 1 percent. The oil and gas, industrials, and capital goods sectors displayed robust gains of up to 2 percent, according to stock exchange data.

- The broader market outperformed the benchmarks, with both the midcap and smallcap indices gaining nearly 1 percent.

Global Markets:

- Asia-Pacific markets displayed mixed performance on Tuesday, even as the S&P 500 and Nasdaq Composite reached new highs on Wall Street overnight.

- Markets in Australia, Hong Kong, mainland China, and Taiwan resumed trading after being closed for a public holiday the previous day.

- The Taiwan Weighted index reversed from a record high, falling 0.3%.

- Japan’s Nikkei 225 extended its gains, climbing 0.25%, while the broader Topix index slipped 0.2%.

- South Korea’s Kospi rebounded from Monday’s losses, gaining 0.15% and the small-cap Kosdaq rose 0.42%.

- In contrast, Hong Kong’s Hang Seng index fell 0.88%, and the mainland Chinese CSI 300 index dropped 0.87%, hitting its lowest level in almost two months.

- Australia’s S&P/ASX 200 declined 1.33%.

Stocks in Spotlight

- InterGlobe Aviation shares fell 4.2 percent following a block deal worth Rs 3,689 crore, involving a 2.2 percent stake in the company. Reports indicate that the seller in this transaction was InterGlobe Enterprises, the holding company of promoter Rahul Bhatia’s family.

- Rail Vikas Nigam Limited (RVNL) shares surged 5 percent after the company emerged as the lowest bidder for a Central Railway project valued at Rs 138 crore. Railway stocks also saw gains as cabinet minister Ashwini Vaishnaw retained the Railway Ministry, signaling policy continuity.

- IRB Infrastructure Developers shares dropped 5.3 percent following block deals worth Rs 2,656 crore, involving a 6.8 percent stake in the company. Reports indicate that Cintra, an affiliate of Dutch infrastructure major Ferrovial, was looking to offload around a 5 percent stake in the company for $228 million.

News from the IPO world🌐

- Ixigo IPO enjoys strong response even on Day 2.

- Leela seeks $2.5 bn valuation IPO likely in 9 months

- Kronox Lab shares got listed at 21% premium

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 1.8 |

| NIFTY OIL & GAS | 1.3 |

| NIFTY REALTY | 1.1 |

| NIFTY AUTO | 0.8 |

| NIFTY CONSUMER DURABLES | 0.3 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2461 |

| Decline | 1402 |

| Unchanged | 106 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,868 | 0.2 % | 3.1 % |

| 10 Year Gsec India | 7.0 | (0.2) % | (0.3) % |

| WTI Crude (USD/bbl) | 76 | (0.2) % | 5.6 % |

| Gold (INR/10g) | 71,237 | (0.1) % | 4.6 % |

| USD/INR | 83.54 | 0.1 % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer