Technical Overview – Nifty 50

The Benchmark index traded with a conservative bullish bias throughout the week and formed a spinning top candle stick pattern on the weekly chart with a weekly gain of 0.75 percent. This week the Index has formed three Doji candles which indicates narrow-range trading sessions with volatility.

The Nifty50 on the daily chart is trading within the rising channel pattern and the prices are approaching near the upper band of the pattern. The index is trading above its 9 & 21 EMA and the slope is tilted on the higher side.

The momentum oscillator RSI (14) has taken support of a horizontal trend line near 40 levels and moved higher above 60 levels with a bullish crossover. The outlook for the Nifty Remains bullish with an immediate resistance placed at 22,700 levels and support placed at 22,200 levels.

Technical Overview – Bank Nifty

The Bank Nifty has outperformed the Benchmark index on the weekly chart with a gain of more than 2.80 percent for the week. The index has formed a tall bullish candle on the weekly chart indicating a bullish outlook for the Banking Index.

The Bank Nifty on the daily chart is trading within the rising channel pattern and the prices are approaching near the upper band of the pattern. The index is trading above its 9 & 21 EMA and the slope is tilted on the higher side.

The momentum oscillator RSI (14) has taken support of an upward rising trend line near 50 levels and moved higher near 70 levels with a bullish crossover. The outlook for the Bank Nifty Remains bullish with an immediate resistance placed at 49,300 levels and support placed at 47,800 levels.

Indian markets:

- Sensex and Nifty ended flat in a volatile session on April 5 after Monetary Policy Committee of Reserve Bank of India (RBI) decided to keep the key rates unchanged, but the midcap index managed to extend gains for a tenth day in a row.

- Throughout the session, domestic market activity remained subdued as the RBI’s policy announcement failed to provide clear indications regarding potential rate cuts. Furthermore, concerns over geopolitical tensions, escalating crude oil prices, and weak global cues added to investor apprehension.

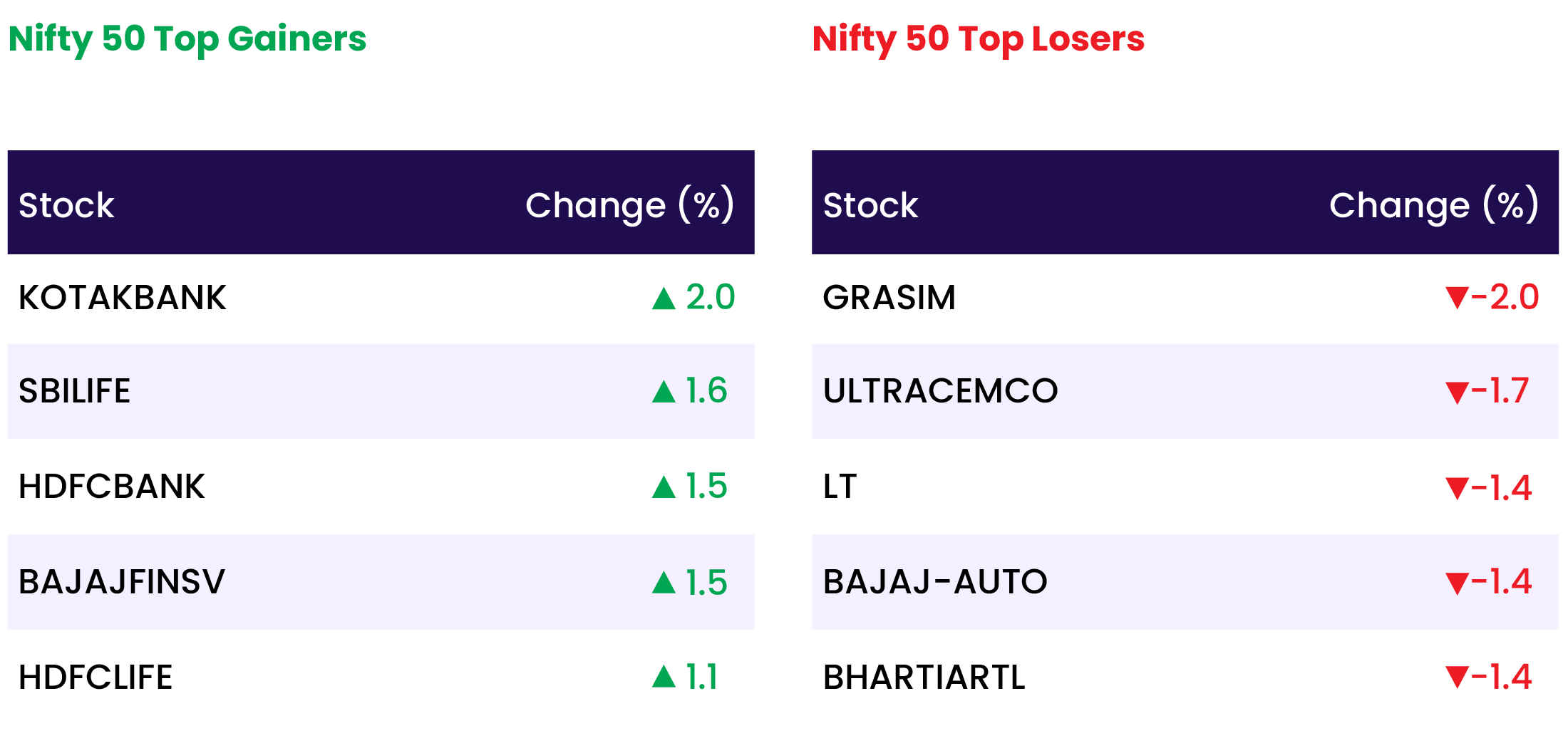

- While banking stocks held steady, the FMCG and realty indices witnessed gains of 0.5-1.5 percent. Conversely, Information Technology and Media sectors experienced declines of 0.4 percent each.

Global Markets:

- On Friday, Japan’s Nikkei 225 spearheaded the downturn in Asia-Pacific markets, spurred by comments from U.S. Federal Reserve officials hinting at a potential delay in rate cuts, which consequently dragged Wall Street lower during the previous session.

- The Nikkei 225 in Japan declined by 1.96%, marking its first dip below the 39,000 marks in approximately three weeks. The broader Topix index also saw a decrease of 1.08%.

- Meanwhile, Australia’s S&P/ASX 200 slipped by 0.56%, following a notable 2.2% decrease in exports recorded for February.

- South Korea’s Kospi index experienced a 1.01% decline, reversing its gains from the previous day when it led major Asian benchmarks. Additionally, the small-cap Kosdaq dropped by 1.2%, marking its lowest point since March 7.

- In contrast, Hong Kong’s Hang Seng index resumed trading following a public holiday and managed to edge up by 0.18%, while mainland China markets remained closed.

Stocks in Spotlight

- IREDA shares surged over 11 percent following the BSE’s adjustment of the circuit filter for the company from 5 percent to 20 percent, effective April 5. However, it’s worth noting that bids in conflicting directions have the potential to trigger circuit breakers. Over the past week, the state-owned financial institution has witnessed a remarkable 32 percent increase in its stock value, driven by record loan growth in FY24.

- Indraprastha Medical Corp witnessed a significant spike of 17 percent in its stock value after HDFC Bank, India’s largest private lender, divested 27.8 lakh shares in the company. This divestment by HDFC Bank amounted to 3.03 percent of the total share capital of Indraprastha Medical Corporation, valued at Rs 55.46 crore in an all-cash transaction.

- Shares of Mahindra Lifespace Developers and other realty firms experienced gains subsequent to the Reserve Bank of India’s decision to maintain policy rates at 6.5 percent for the seventh consecutive time. ANAROCK Group chairman Anuj Puri commented that the unchanged rate status would sustain the momentum in residential real estate sales, enabling prospective homebuyers to proceed with their purchases.

News from the IPO world🌐

- Supermarket chain Patel Retail files DRHP for IPO

- Bharti Hexacom IPO booked 3.24 times so far on final day

- Gujarat-based Vasuki Global files IPO papers with Sebi

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 1.4 |

| NIFTY BANK | 0.9 |

| NIFTY PRIVATE BANK | 0.9 |

| NIFTY FINANCIAL SERVICES | 0.9 |

| NIFTY PSU BANK | 0.7 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2424 |

| Decline | 1424 |

| Unchanged | 100 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,597 | (1.4) % | 2.3 % |

| 10 Year Gsec India | 7.1 | 0.3 % | 0.4 % |

| WTI Crude (USD/bbl) | 87 | 1.7 % | 23.0 % |

| Gold (INR/10g) | 69,765 | 0.2 % | 6.2 % |

| USD/INR | 83.45 | 0.1 % | 0.5 % |

Please visit www.fisdom.com for a standard disclaimer