Technical Overview – Nifty 50

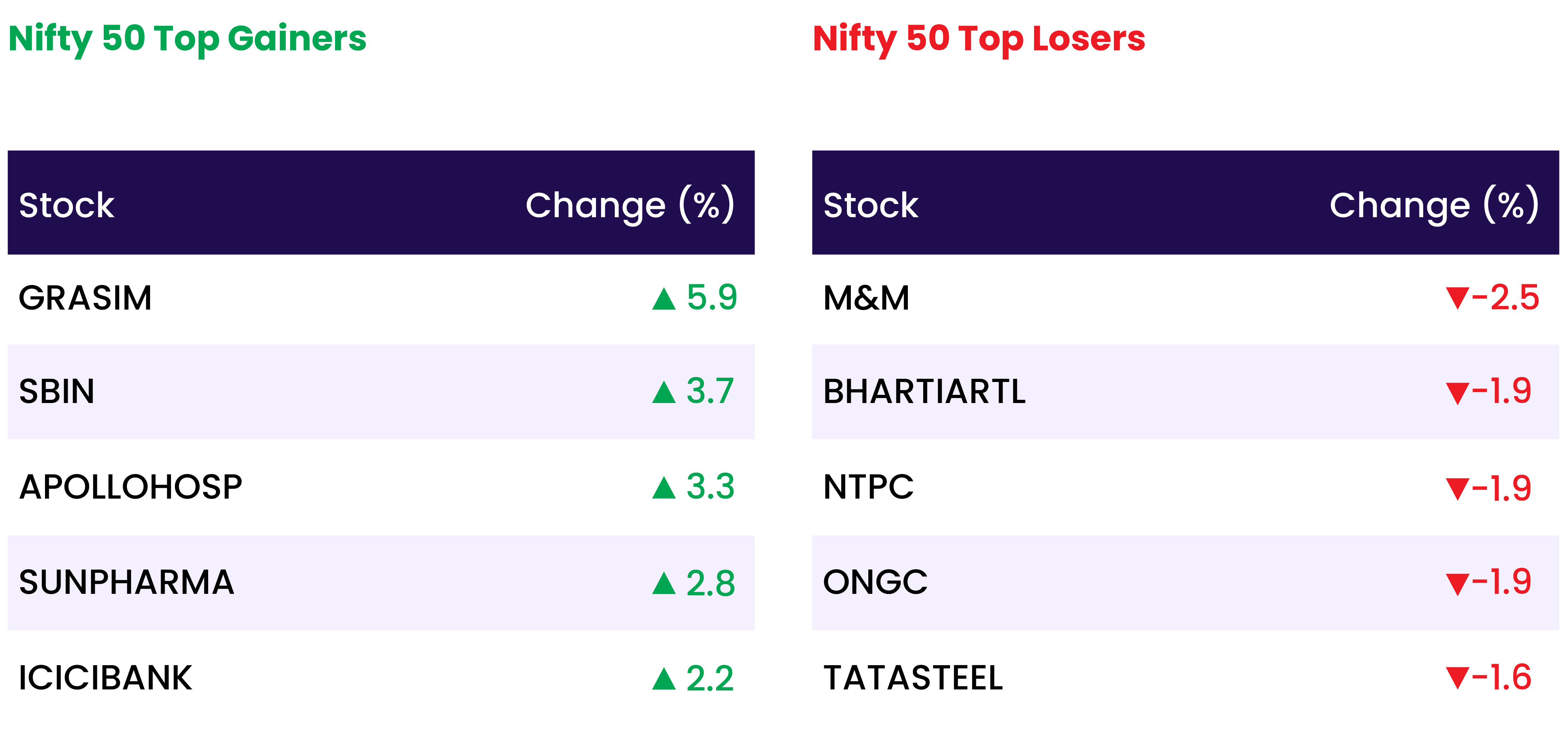

The Benchmark Index witnessed a gap opening above nearly 22,000 levels but couldn’t hold on to its gains and drifted lower, given a trend line breakdown on the lower time frame. The Nifty 50 formed a tall bearish candle on the daily chart and the index drifted more than 1% indicating a sell-on rallies market for the day.

The Nifty has engulfed its previous five days’ candle which is indicating a massive profit booking on the Index. The prices have closed below their 9 EMA and are presently taking support near their 21 EMA which is placed at 21,650 levels.

The momentum oscillator RSI (14) drifted lower near 50 levels with a bearish crossover on the cards. The Index has rejected to close above 22,000 levels for the third time suggesting a strong resistance zone. Technically speaking, Nifty’s technical picture shifts to neutral amidst range-bound technical conditions on the daily charts with the biggest hurdles at the Nifty 22,000 – 21,500 mark.

Technical Overview – Bank Nifty

The Banking Index witnessed a gap opening above nearly 46,000 levels but couldn’t hold on to its gains and drifted lower, given a trend line breakdown on the lower time frame. The Bank Nifty formed a tall bearish candle on the daily chart and the index drifted more than 1% indicating a sell-on rallies market for the day.

The Bank Nifty has engulfed its previous three days’ candle which is indicating a massive profit booking on the Index. The prices have closed below their 9, 21 & 50 EMA which indicates a sell on rallies market for the Banking index.

Technically speaking, Bank Nifty’s technical picture shifts from bearish to neutral amidst range-bound technical conditions on the daily charts with the biggest hurdles at the Bank Nifty 44,500 – 47,000 mark.

Indian markets:

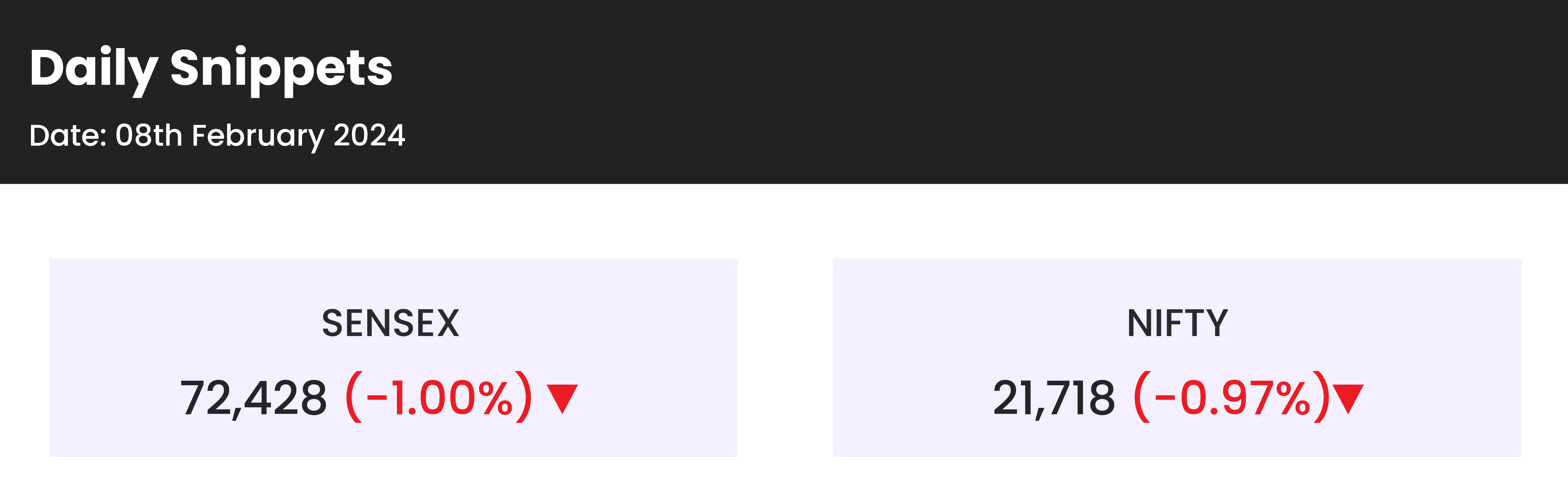

- The Sensex and Nifty experienced a sharp decline on February 8, attributed to the Reserve Bank of India’s decision to maintain key interest rates.

- Investor caution has been evident in recent weeks, resulting in fluctuations within a limited range.

- Sectors sensitive to interest rates, including banks, financial services, and auto, bore the brunt of selling pressure throughout the trading day.

- The banking industry, already grappling with liquidity challenges, faced additional strain as the central bank’s decision signaled no imminent rate cuts.

- Consequently, investors reacted by offloading their positions in financial stocks.

Global Markets:

- The pan-European Stoxx 600 showed a modest increase of 0.2% in early trading sessions, with sectors exhibiting mixed performance.

- Japan’s Nikkei index led the gains in the Asia-Pacific region on Thursday, reaching new 34-year highs. This surge followed reports indicating that the country’s central bank was not planning to aggressively tighten its monetary policy.

- Overnight trading on Wednesday saw U.S. stock futures remaining relatively unchanged after the S&P 500 closed the regular session near the significant milestone of 5,000 points.

- Investors are poised to scrutinize fresh data on U.S. jobless claims scheduled for release on Thursday, aiming to assess the labor market’s current health and potential implications for market dynamics.

Stocks in Spotlight

- ITC stock experienced a 4 percent decline following an announcement from its major shareholder, British American Tobacco (BAT), regarding its intention to reduce its stake in the conglomerate. BAT is actively engaged in the regulatory procedures necessary to achieve this stake reduction. Should BAT succeed in reducing its stake by four percentage points, aiming for a 25 percent shareholding in ITC, it would involve offloading shares valued at approximately Rs 20,760 crore, based on ITC’s current market capitalization. This development underscores ongoing shifts in ownership dynamics within the company, impacting investor sentiment and market valuation..

- Cummins India Ltd witnessed an 8 percent surge following its announcement of impressive earnings for the quarter ending December 2023. The company’s Q3 results displayed a notable enhancement in performance compared to the corresponding period last year, sparking investor optimism and propelling the stock’s significant upward movement.

- Trent Ltd continued its upward momentum, surging nearly 7 percent, buoyed by a favorable third-quarter earnings report. Brokerages remain optimistic about the Tata Group firm, citing its robust revenue productivity, aggressive expansion of stores, margin benefits from moderated raw material costs, and operational leverage as key factors driving positive sentiment among investors.

News from the IPO world 🌐

- Bumper Debut | BLS E-Services stock lists at 129% premium to IPO price

- Entero Healthcare sets price band for Rs. 1600 cr IPO at Rs. 1,195-1258

- Exicom Tele Systems may launch IPO by Feb end

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 2.0 |

| NIFTY MEDIA | 2.0 |

| NIFTY OIL & GAS | 0.9 |

| NIFTY IT | 0.2 |

| NIFTY HEALTHCARE INDEX | 0.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1575 |

| Decline | 2274 |

| Unchanged | 96 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,677 | 0.4 % | 2.6 % |

| 10 Year Gsec India | 7.1 | 0.1 % | (1.1) % |

| WTI Crude (USD/bbl) | 73 | 0.7 % | 4.2 % |

| Gold (INR/10g) | 62,305 | (0.0) % | 0.4 % |

| USD/INR | 83.05 | 0.0 % | 0.0 % |

Please visit www.fisdom.com for a standard disclaimer