Technical Overview – Nifty 50

The Benchmark index on the 09th of February again popped up with super volatility and prices swung like a pendulum throughout the day and kept traders guessing for the trend. The Index witnessed a marginal gap up opening but couldn’t hold on to its opening gains for too long and drifted lower.

The Nifty on the daily chart has formed a diamond pattern on the daily chart. On the weekly time frame, the index has formed a spinning top candle stick pattern which indicates sideways trading week. The momentum oscillator RSI (14) drifted lower near 50 levels with a bearish crossover on the cards.

The Index has rejected to close above 22,000 levels for the third time suggesting a strong resistance zone. Technically speaking, Nifty’s technical picture shifts to neutral amidst range-bound technical conditions on the daily charts with the biggest hurdles at the Nifty 22,100 – 21,500 mark.

Technical Overview – Bank Nifty

The Banking Index witnessed a gap opening above nearly 46,000 levels but couldn’t hold on to its gains and drifted lower, given a trend line breakdown on the lower time frame. The Bank Nifty formed a tall bearish candle on the daily chart and the index drifted more than 1% indicating a sell-on rallies market for the day.

The Bank Nifty has engulfed its previous three days’ candle which is indicating a massive profit booking on the Index. The prices have closed below their 9, 21 & 50 EMA which indicates a sell on rallies market for the Banking index.

Technically speaking, Bank Nifty’s technical picture shifts from bearish to neutral amidst range-bound technical conditions on the daily charts with the biggest hurdles at the Bank Nifty 44,500 – 47,000 mark.

Indian markets:

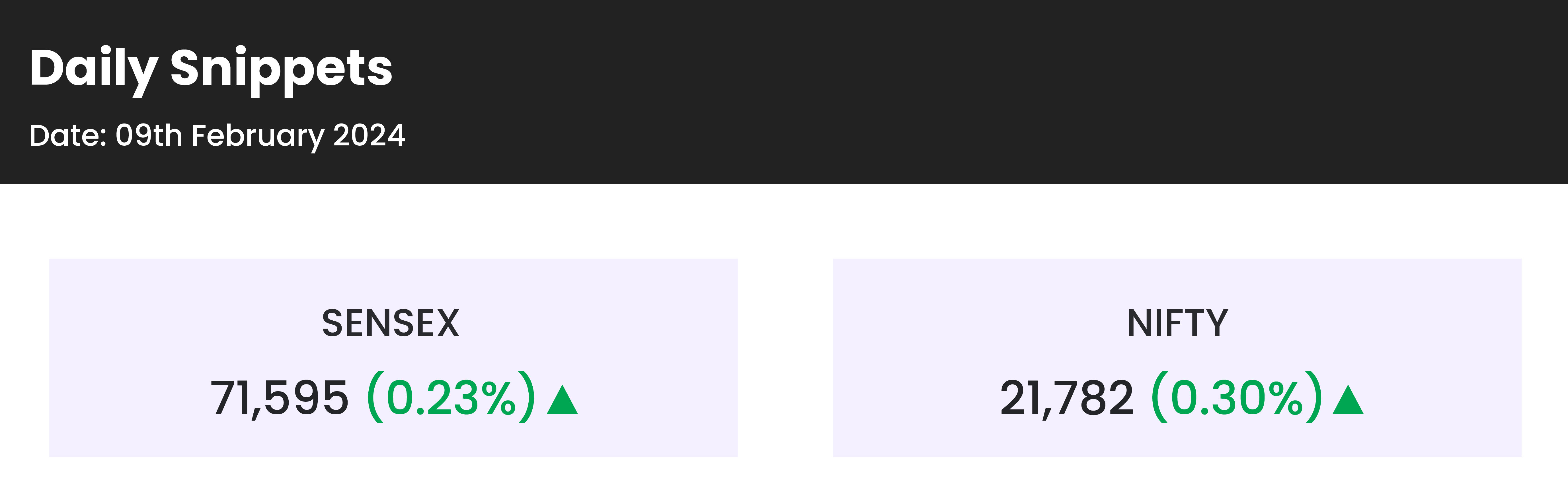

- The Sensex and Nifty closed February 9 with slight gains in a volatile trading session, with investors anticipating additional market catalysts.

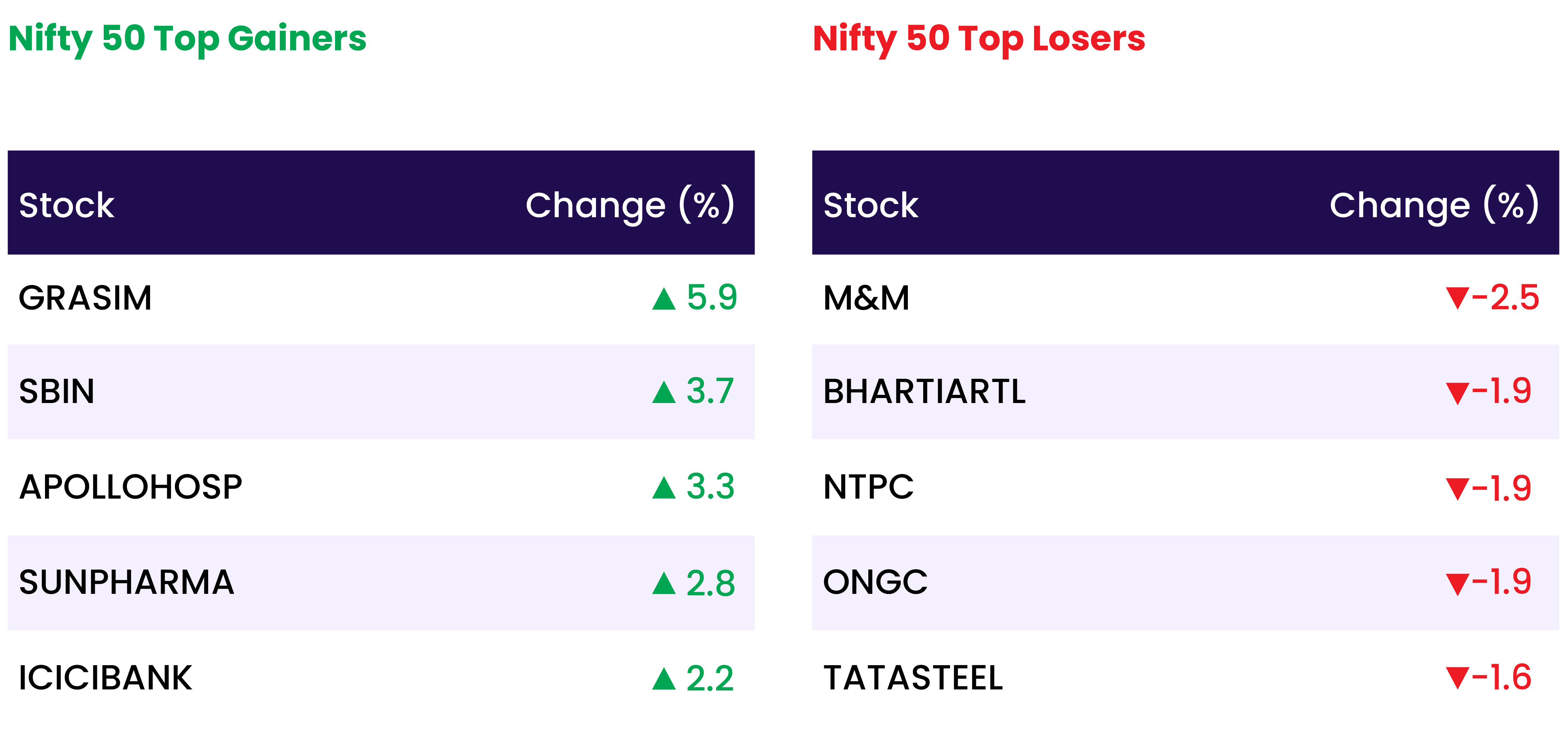

- Banks experienced buying during dips, while the metals and real estate sectors faced selling pressure.

- Sectoral performance was varied, with the Nifty Bank rebounding from heavy selling to rise by 1.38 percent.

- Additionally, the Nifty Healthcare index saw gains of approximately 1 percent, while the Nifty Pharma index registered a half-percent increase.

Global Markets:

- The pan-European Stoxx 600 edged up by 0.1% in early trading sessions, featuring mixed performance across sectors.

- Notably, health-care stocks surged by 1%, while utilities experienced a decline of 0.9%.

- In the Asia-Pacific region, Japan’s Nikkei index soared to fresh 34-year highs on Friday, surpassing the 37,000 mark for the first time in 34 years with a 0.4% rise.

- Meanwhile, many markets in the region were either fully or partially closed for the Lunar New Year holiday, resulting in subdued trading activity.

- On the U.S. front, futures indicated a lower opening on Friday morning following the S&P 500’s historic milestone, crossing the 5,000 mark for the first time during intraday trading.

Stocks in Spotlight

- LIC’s stock closed 1.92 percent lower despite initially surging by 4 percent during intraday trading. The state-run insurer reported a significant 49 percent year-on-year increase in net profit to Rs 9,441 crore, coupled with a 4.67 percent growth in net premium income to Rs 1.17 lakh crore for the quarter. However, market sentiment shifted, leading to a decline in the stock price by the end of the trading session.

- The stock of Paytm witnessed a 6.16 percent decline following reports of its impending acquisition of Bengaluru-based Bitsila. This comes amidst ongoing uncertainty regarding the future of its banking arm, exacerbated by recent RBI restrictions. Investors reacted negatively to this development, contributing to the drop in Paytm’s stock price.

- Quess Corp’s shares declined by 1.3 percent following revelations from forensic-cum-activist investment firm Muddy Waters. The firm alleged that Quess’s promoter, Fairfax Financial Holdings, utilized the company as an accounting lever, allegedly generating $889.9 million of profit and book value in 2018. This disclosure sparked investor concern, leading to the drop in Quess Corp’s stock price.

News from the IPO world 🌐

- Bumper Debut | BLS E-Services stock lists at 129% premium to IPO price

- Entero Healthcare sets price band for Rs. 1600 cr IPO at Rs. 1,195-1258

- Exicom Tele Systems may launch IPO by Feb end

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY BANK | 1.38 |

| NIFTY PRIVATE BANK | 1.01 |

| NIFTY PSU BANK | 0.97 |

| NIFTY HEALTHCARE INDEX | 0.96 |

| NIFTY FINANCIAL SERVICES | 0.69 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1270 |

| Decline | 2573 |

| Unchanged | 89 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,677 | 0.4 % | 2.6 % |

| 10 Year Gsec India | 7.1 | 0.1 % | (1.1) % |

| WTI Crude (USD/bbl) | 73 | 0.7 % | 4.2 % |

| Gold (INR/10g) | 62,305 | (0.0) % | 0.4 % |

| USD/INR | 83.05 | 0.0 % | 0.0 % |

Please visit www.fisdom.com for a standard disclaimer