Technical Overview – Nifty 50

NIFTY50 on the daily chart continued its bullish momentum but volatility was again on the mark. Initially, the index was trading flat near 21,850 levels but the sharp spike was witnessed in the second half of the trading session and maintained its bullish status quo.

Currently, the Nifty has taken support near the upward-slanting trend line and has closed higher even after opening below the trend line.

The momentum oscillator and the MACD indicator stand at bullish levels but the prices have crossed above its 9 & 21 EMA which was acting as a hurdle for the past few days.

The bias has turned to a buy on dips immediate support is placed at 21,700 levels and resistance is capped below 22,100 levels.

Technical Overview – Bank Nifty

BANK NIFTY on the daily chart continued its bullish momentum but volatility was again on the mark. The Banking Index formed a bullish candle with a tall wick on the lower end indicating a reversal from the lower levels.

The Bank Nifty has moved above its 9 & 21 EMA and closed above its 50 EMA which is placed at 46,060 levels. On the daily chart, the index is on the verge of a breakout of a triangle pattern. The momentum oscillator and the MACD indicator stand at bullish levels.

On the weekly chart, the Banking index is forming a hammer candle formation and if the index sustains this pattern then we may see a reversal from the lower levels. The bias has turned to a buy on dips immediate support is placed at 45,700 levels and resistance is capped below 47,000 levels.

Indian markets:

- Indian equity indices, led by Nifty, extended their winning streak for the third consecutive session on February 15, closing at 21,900 in yet another volatile trading session.

- Despite starting higher amid positive global cues, the market erased initial gains to trade rangebound in the first half before regaining momentum in the second half, closing near the day’s high levels.

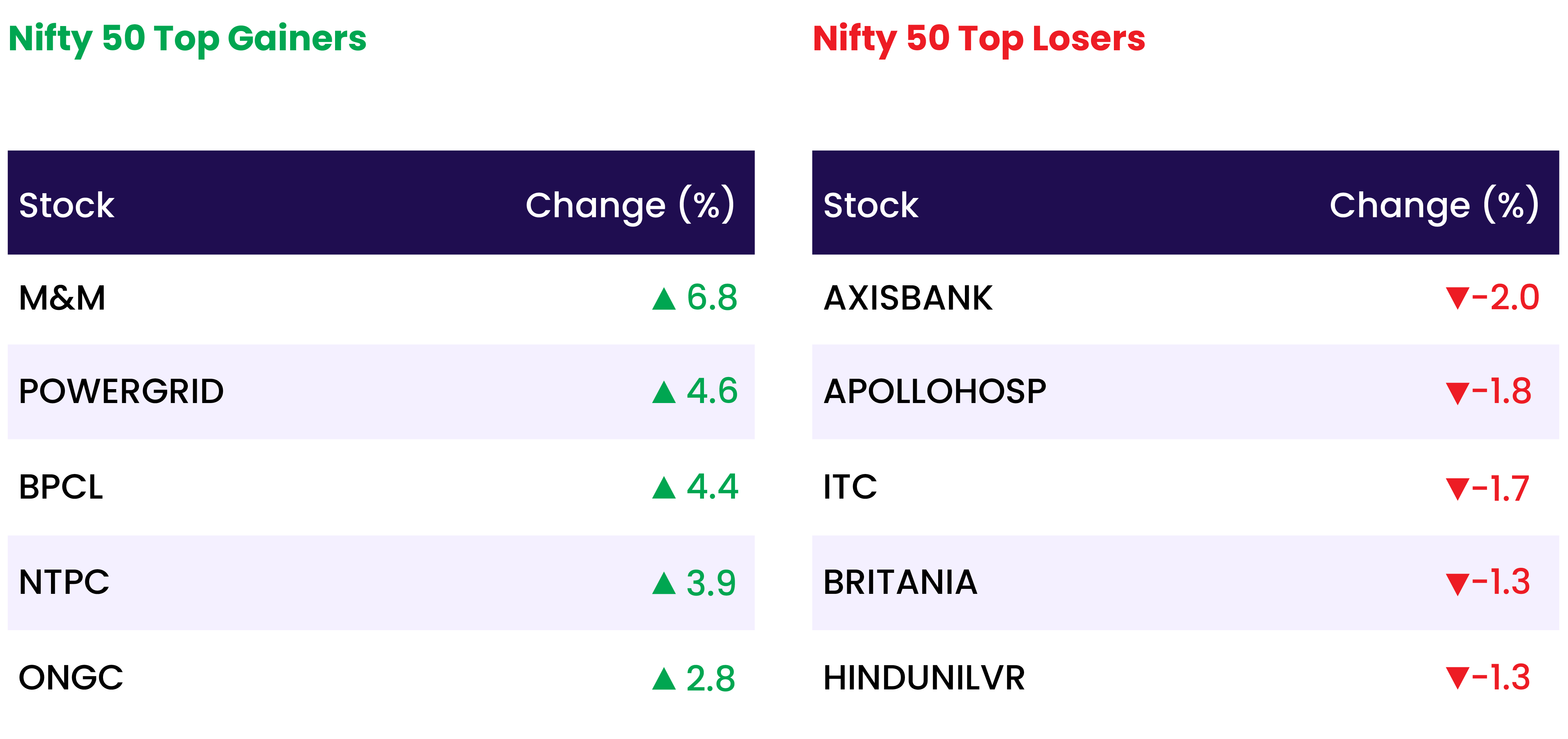

- Across sectors, the FMCG index experienced a decline of 0.9 percent, while auto, PSU Bank, metal, realty, power, and oil & gas sectors witnessed gains ranging from 1 to 2 percent.

Global Markets:

- European markets concluded lower on Tuesday, with investors analyzing incoming corporate earnings reports and monitoring a key U.S. inflation release.

- Losses intensified following the announcement of new U.S. inflation figures for January, which exceeded expectations. Stubbornly high shelter prices exerted pressure on consumers.

- The unexpected rise in inflation suggests that the U.S. Federal Reserve might adopt a more cautious approach regarding interest rate cuts, diverging from the market’s expectations of swift and substantial cuts.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.

- Aster DM Healthcare experienced a notable surge of 7.22 percent following its announcement of a company split to establish two distinct entities concentrating on India and the GCC region. This strategic move by the company contributed to the significant rise in its stock price.

- Axis Bank shares witnessed a decline of over 2 percent during afternoon trade on February 15, following reports that BJP leader Subramanian Swamy had filed a petition in the Delhi High Court alleging the bank’s involvement in a Rs 5,100-crore scam. According to a post on the Bar and Bench website, Swamy accused Axis Bank of making undue gains through transactions involving shares of Max Life Insurance.

News from the IPO world 🌐

- Travel portal Ixigo files draft papers for IPO

- Hyundai seeks expansion higher valuation with India IPO

- Ullu Digital files papers for Rs. 135-150 crore IPO biggest ever for an SME

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 3.27 |

| NIFTY OIL & GAS | 2.46 |

| NIFTY AUTO | 1.35 |

| NIFTY REALTY | 0.98 |

| NIFTY BANK | 0.68 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2329 |

| Decline | 1536 |

| Unchanged | 73 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,424 | 0.4 % | 1.9 % |

| 10 Year Gsec India | 7.1 | 0.2 % | (0.7) % |

| WTI Crude (USD/bbl) | 77 | (1.6) % | 8.1 % |

| Gold (INR/10g) | 61,170 | (0.2) % | (2.5) % |

| USD/INR | 83.0 | (0.1) % | (0.0) % |

Please visit www.fisdom.com for a standard disclaimer