Technical Overview – Nifty 50

Nifty50 after a long weekend witnessed a gap-up opening in a truncated week and trading with a bullish bias throughout the day. The Index was trading in a bullish tone but was not able to cross above 23,600 levels.

The gap remained intact for the day and the prices closed with a gain of more than 80 points for the day. The Index on the daily chart has witnessed an upward rising channel pattern breakout and prices are moving in a higher high higher low formation. The previous week we witnessed sideways trading sessions where prices traded within the 200-point range for the entire week.

The Nifty50 is trading above its 21 and 50 EMA and the oscillator is reading in a bullish zone above. The view remains bullish for the index with immediate support at 23,400 and resistance above 23,650 levels.

Technical Overview – Bank Nifty

BANK NIFTY after a long weekend witnessed a gap-up opening in a truncated week and trading with a bullish bias throughout the day. The Banking index is trading in a higher high higher low formation indicating a bullish trend.

The Banking Index has witnessed a range breakout above its previous week’s high and formed a bullish candle on the daily time frame. The Index is still trading within the rising channel pattern on the daily chart.

The Bank Nifty is trading above its 21 and 50 EMA and the oscillator is reading in a bullish zone above. The view remains bullish for the index with immediate support at 50,000 and resistance above 51,000 levels.

Indian markets:

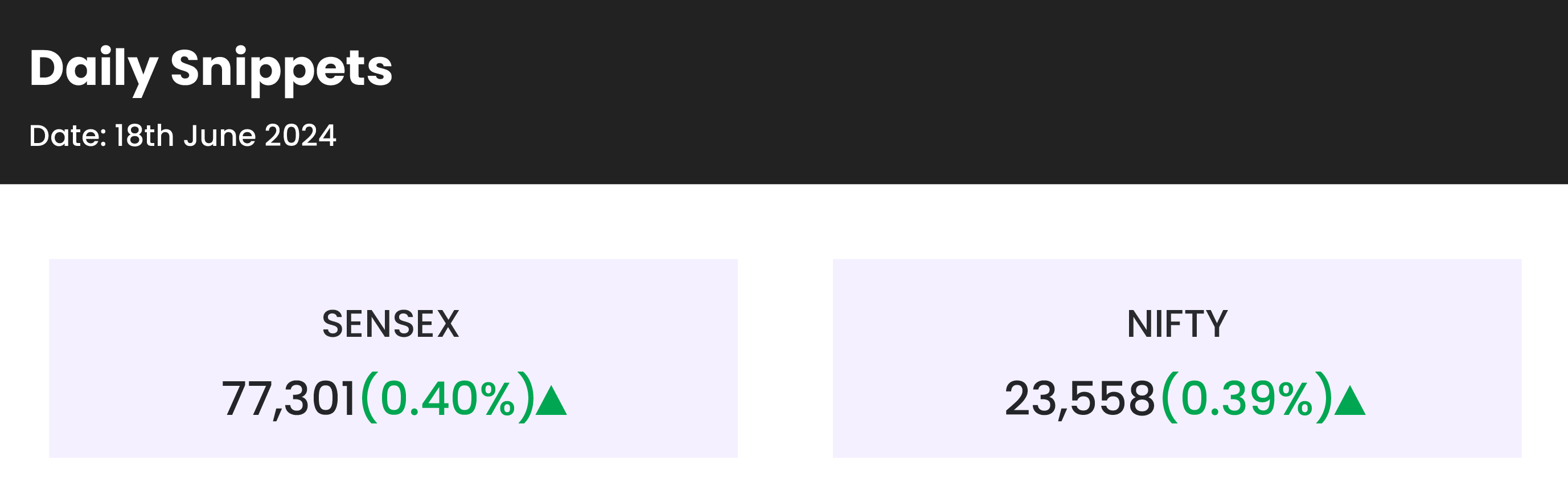

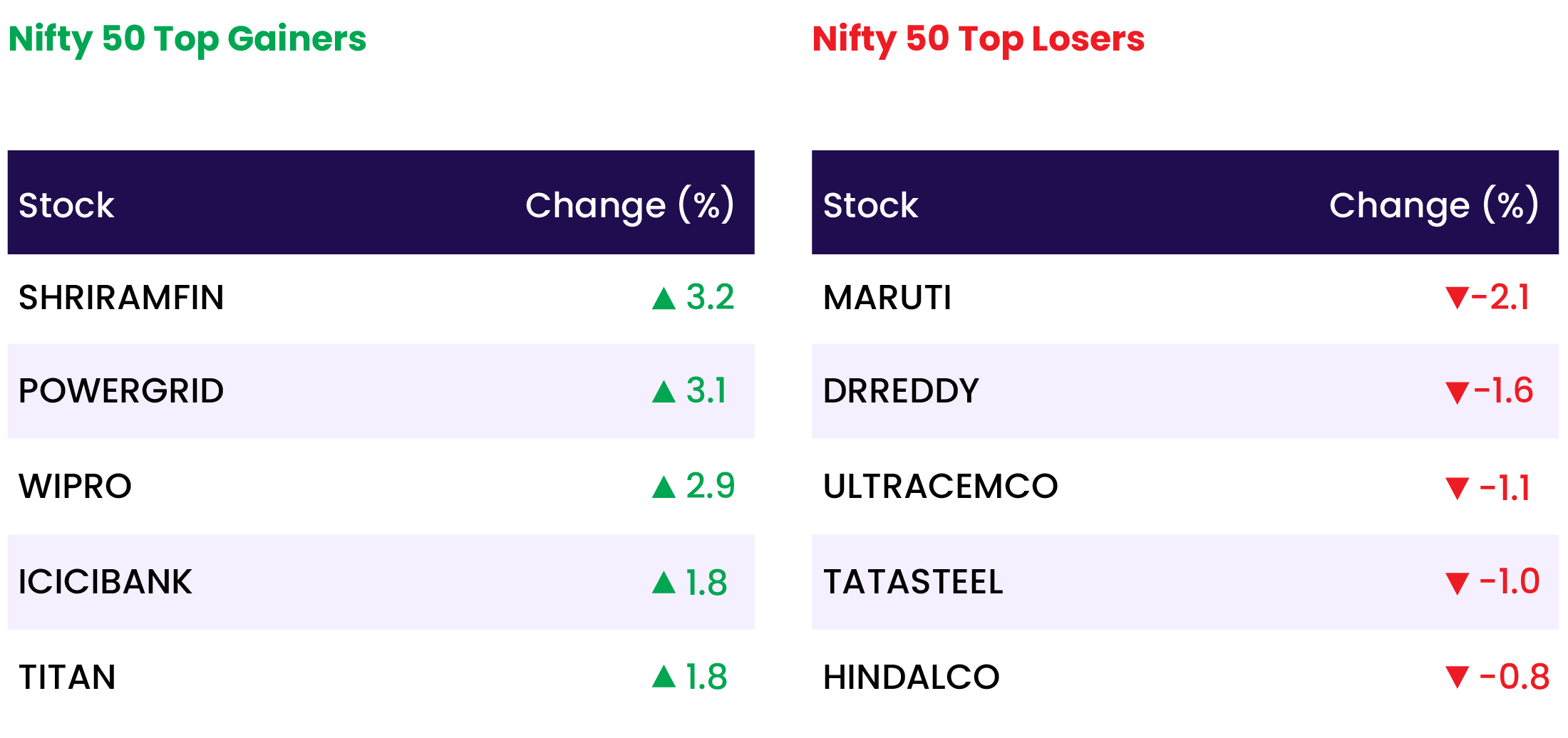

- The Indian stock market’s record-breaking streak persisted as major equity indices—the Sensex and the Nifty 50—reached new all-time highs on Tuesday, June 18.

- Positive global cues bolstered domestic sentiment, while gains in heavyweights like HDFC Bank, ICICI Bank, and Power Grid lifted the benchmarks.

- Among sectoral indices, Nifty Realty led the gains with a 1.9 percent surge, followed by Nifty Consumer Durables and Nifty Bank, which rose 1.6 percent and 1 percent, respectively.

- Conversely, Nifty Healthcare was the biggest laggard, dropping 0.6 percent, followed by Nifty Pharma and Nifty Metal, both down 0.4 percent.

Global Markets:

- Asia-Pacific markets rebounded on Tuesday following an overnight rally on Wall Street, as investors evaluated the Reserve Bank of Australia’s interest rate decision.

- Australia’s S&P/ASX 200 increased by 1.01%, after the decision.

- Japan’s Nikkei 225 rose 1%, recovering from a nearly 2% drop on Monday, while the Topix climbed 0.58%.

- South Korea’s Kospi advanced 0.72%, driven by gains in chipmakers Samsung Electronics and SK Hynix, which surged approximately 2.18% and 5.16%, respectively.

- The small-cap Kosdaq ended the day unchanged. Hong Kong’s Hang Seng index dipped by 0.11%, whereas mainland China’s CSI 300 increased by 0.27%.

Stocks in Spotlight

- Paras Defence and Space Technologies surged by 20 percent following two significant transactions totaling Rs 318.10 crore on June 18. In the first major deal, a 1.8 percent stake in the company was exchanged at an average price of Rs 1,252, amounting to Rs 88.7 crore. The second substantial transaction, valued at Rs 229.40 crore, involved a 4.4 percent equity stake in the defense company.

- BLS E-Services surged by around 7 percent after the company announced a pact to acquire a 55 percent controlling interest in Aadifidelis Solutions and its affiliates for an enterprise value of approximately Rs 190 crore, according to an exchange filing. BLS E-Services will make an upfront payment of Rs 71 crore for the acquisition, with the remaining amount deferred and linked to the achievement of milestones in FY25. The all-cash deal is expected to be completed in Q2 of FY25.

- HFCL shares soared over 5 percent after the company was exempted from the anti-dumping duties imposed by the European Commission on other Indian Optical Fiber Cable (OFC) manufacturers. According to a statement from the European Commission, HFCL was the only Indian company found not to be engaged in dumping OFC in European markets.

News from the IPO world🌐

- Stanley Lifestyles IPO opens on June 21

- Paras Healthcare to file DRHP by June-end for Rs 1000-1200 cr IPO: Sources

- DEE Development IPO Opens June 19

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY REALTY | 1.9 |

| NIFTY CONSUMER DURABLES | 1.6 |

| NIFTY PRIVATE BANK | 1.1 |

| NIFTY BANK | 0.9 |

| NIFTY FINANCIAL SERVICES | 0.8 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2167 |

| Decline | 1836 |

| Unchanged | 147 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,778 | 0.5 % | 2.8 % |

| 10 Year Gsec India | 7.0 | (0.0) % | (0.3) % |

| WTI Crude (USD/bbl) | 78 | (0.2) % | 11.5 % |

| Gold (INR/10g) | 71,149 | (0.2) % | 4.6 % |

| USD/INR | 83.55 | 0.0 % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer