Technical Overview – Nifty 50

The Benchmark index on 22nd April witnessed a gap up opening and the gap remained throughout the entire trading sessions. The Index on the daily chart has formed a bullish piercing candle stick pattern suggesting support at the 21,800 mark.

The Index has formed a double bottom formation near 21,700 levels and reversed strongly from the lower levels. The Nifty successes in closing above its 9 & 21 EMA and the RSI (14) has taken support near the lower band of the rectangle pattern and moved near 50 levels.

The Nifty50 has formed a hammer candle stick pattern on the weekly chart and has taken support near its 21 EMA. The immediate support for the Index is placed at 22,100 levels and resistance is capped at 22,500 levels. If the Index witnessed a breakdown below 22,100 levels, then the gate is open till 21,800 mark. Similarly, a close above 22,500 will trigger more upside till 22,700 levels.

Technical Overview – Bank Nifty

The Bank Nifty index on 22nd April witnessed a gap up opening and the gap remained throughout the entire trading session. The Banking Index on the daily chart has formed a bullish piercing candle stick pattern suggesting support at the 47,000 mark.

The Bank Nifty has formed a hammer candle stick pattern on the weekly chart and has taken support near its 21 EMA. The Momentum oscillator RSI (14) has taken support near the upward-rising trend line at 50 levels but still is in a bearish crossover mode.

The immediate support for the Banking Index is placed at 47,500 levels and resistance is capped at 48,500 levels. If the Index witnessed a breakdown below 47,500 levels, then the gate is open till 47,000 mark. Similarly, a close above 48,500 will trigger more upside till 48,900 levels.

Indian markets:

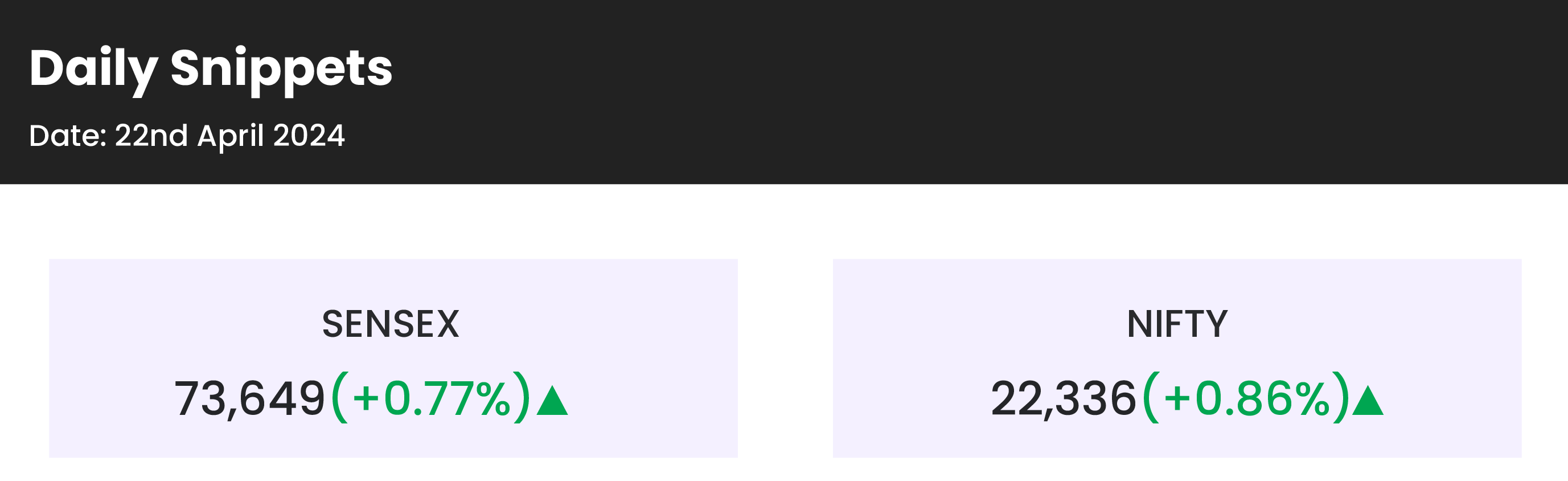

- On Monday, April 22, both the Sensex and the Nifty 50, continued their upward trend for the second consecutive day, buoyed by positive global indicators and a reduction in tensions between Iran and Israel, reflecting the positive sentiment in global markets.

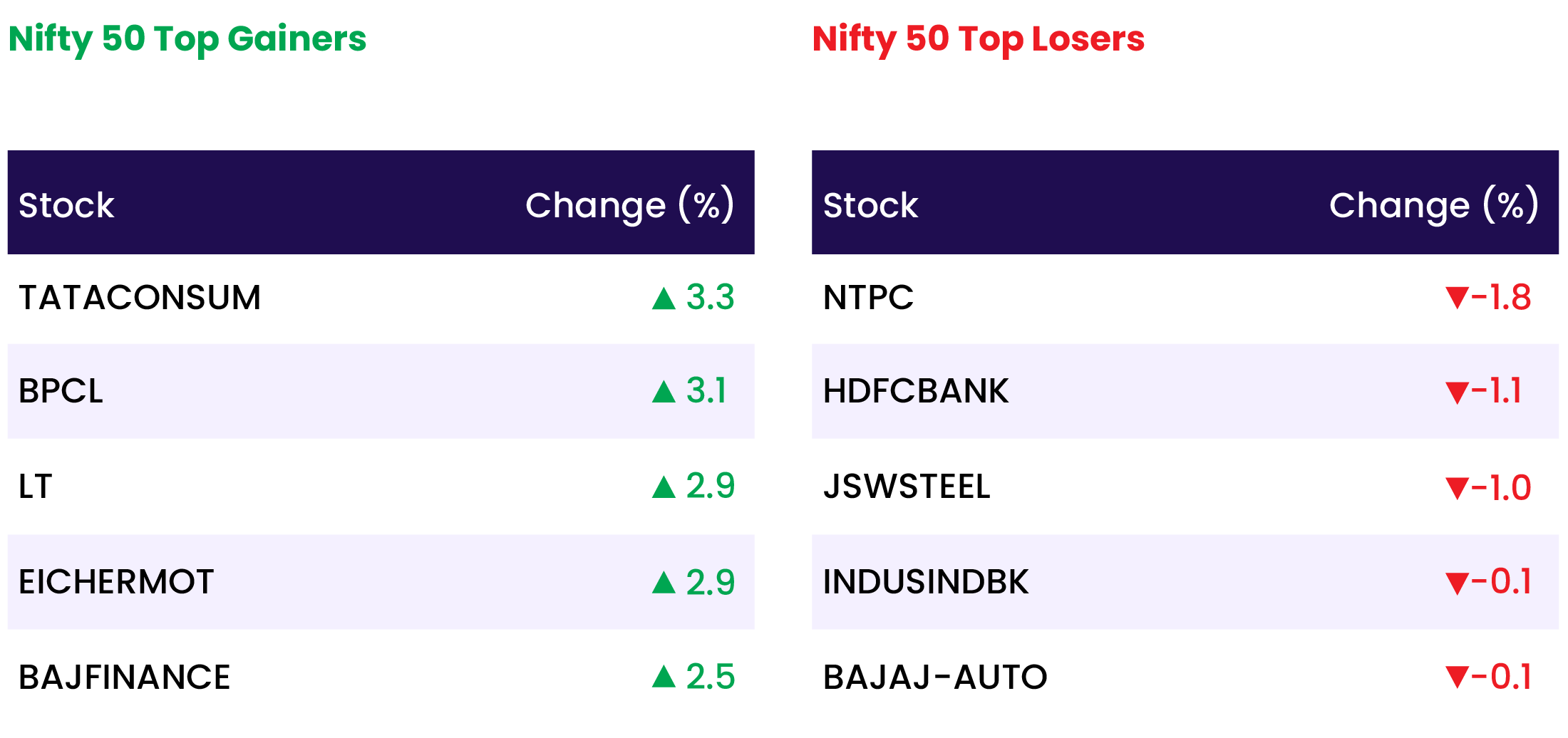

- All sectoral indices concluded on a positive note, with gains of up to 3 percent observed in auto, PSU bank, capital goods, oil & gas, FMCG, healthcare, and realty sectors.

- Additionally, BSE midcap and smallcap indices each closed one percent higher, contributing to the overall optimistic market sentiment.

Global Markets:

- Asia-Pacific markets rebounded from Friday’s downturn as investors turned their attention to upcoming data releases from China, Japan, and South Korea.

- Friday saw a regional market decline triggered by Israel’s strike on Iran, leading to stock losses and increased demand for safe-haven assets.

- Hong Kong’s Hang Seng index surged by nearly 2%, contrasting with Mainland China’s CSI 300, which slipped by 0.3% to close at 3,530.9 after the LPR announcement, making it the only major market to decline on Monday.

- Japan’s Nikkei 225 closed 1% higher at 37,438.61, while the broader Topix index saw a more substantial gain of 1.38%, closing at 2,662.46.

- South Korea’s Kospi also experienced a rise of 1.45%, closing at 2,629.44, while the small-cap Kosdaq index advanced by 0.46%, ending at 845.82.

- Australia’s S&P/ASX 200 began the week on a positive note, closing up by 1.08% at 7,649.20.

Stocks in Spotlight

- Persistent Systems witnessed a sharp decline of over 9 percent in its stock value following the company’s announcement of a flat margin guidance for FY25 alongside its Q4 results. Despite reporting a 25.36 percent increase in net profit year-on-year, reaching Rs 315.3 crore for the fourth quarter.

- IREDA’s stock surged by 6 percent subsequent to the company’s report of a 33 percent year-on-year rise in net profit, totaling Rs 337 crore for the March quarter of FY24. Additionally, the net interest income saw a substantial growth of 35 percent to Rs 481.4 crore.

- Welspun Corp saw a 4 percent increase in its stock value after revealing the acquisition of Rs 872 crore worth of orders since its previous disclosure on March 22. These orders, comprising multiple line pipe contracts in both the US and India, contributed to the positive market sentiment.

- NTPC’s shares experienced a decline of over 1 percent following an announcement by its wholly owned subsidiary regarding the signing of a Memorandum of Understanding (MoU) with Indus Towers. The MoU, signed on April 18, aims to collaborate on grid-connected renewable energy-based power projects, including solar, wind, energy storage, and related solutions, in line with the government’s carbon-neutral economy objectives.

News from the IPO world🌐

- Vodafone Idea’s Rs 18,000 crore FPO fully subscribed on last day

- JNK India has fixed a price band of Rs 395-415 per share

- Solar cell maker Premier Energies files IPO papers to raise more than Rs 1,500 crore

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PSU BANK | 3.1 |

| NIFTY CONSUMER DURABLES | 2.4 |

| NIFTY PHARMA | 1.3 |

| NIFTY HEALTHCARE INDEX | 1.1 |

| NIFTY AUTO | 0.9 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2599 |

| Decline | 1310 |

| Unchanged | 148 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 37,986 | 0.6 % | 0.7 % |

| 10 Year Gsec India | 7.2 | (0.4) % | 1.2 % |

| WTI Crude (USD/bbl) | 83 | (3.1) % | 17.5 % |

| Gold (INR/10g) | 72,103 | (1.6) % | 6.2 % |

| USD/INR | 83.55 | (0.1) % | 0.6 % |

Please visit www.fisdom.com for a standard disclaimer