Technical Overview – Nifty 50

It was again a volatile day for the Benchmark index where prices continued to hover near 22,100 levels and finally broke above 22,200 levels in the final 15 minutes of trade and formed a bullish candle. The index on the 120-minute chart has given a breakout above its trend line resistance but traded within the range but broke towards the end.

The index has formed a bullish engulfing pattern on weekly charts. Nifty’s move above all-time high levels could lure more buyers to the trading floor, who together then can manage Nifty to climb towards Nifty’s 22500 mark. The momentum oscillator RSI (14) on the daily chart has moved above 60 levels with a bullish crossover.

The India VIX has inched at 16 levels indicating a highly volatile trading session ahead of elections. Looking ahead, Nifty needs to sustain above 22,200 for an up move to 22,500, with 21,950 acting as a strong support level in case of a downturn.

Technical Overview – Bank Nifty

The Banking Index charged higher on 20th February as the leader HDFC Bank rose more than 2 percent and was well combined with other private sector banks. The Bank Nifty formed a tall bullish candle on the daily chart indicating a convincing bullish momentum.

The Bank Nifty on the daily chart has witnessed a bullish golden crossover where 9 EMA and crossed above 21 EMA indicating a bullish momentum in the index. From the past couple of trading sessions Bank Nifty is outperforming the Nifty 50.

The Banking index is presently trading above its 9, 21, and 50 EMA on the daily chart and the slope of the averages is tilted higher. As the Index has crossed above its psychological resistance of 47,000 levels the trend looks more convincing at present levels. The next resistance for the Bank Nifty is placed at 48,000 levels and support is placed near 46,200 levels.

Indian markets:

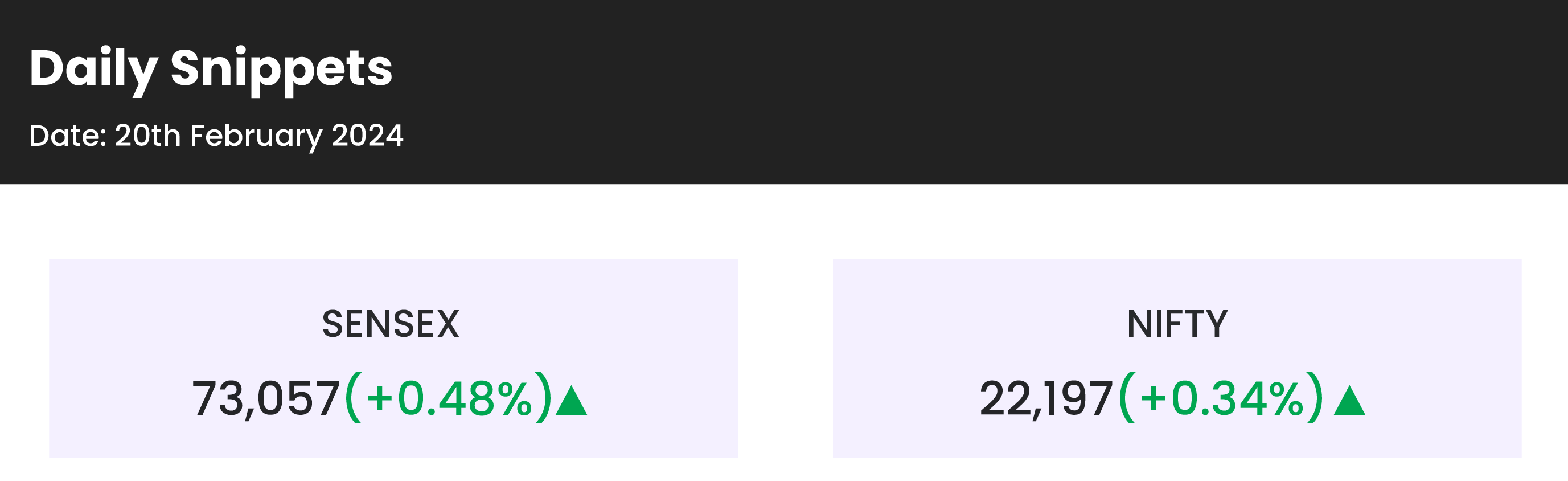

- Domestic benchmark indices continued their upward trend for the sixth consecutive day on February 20, with one index hitting new record levels.

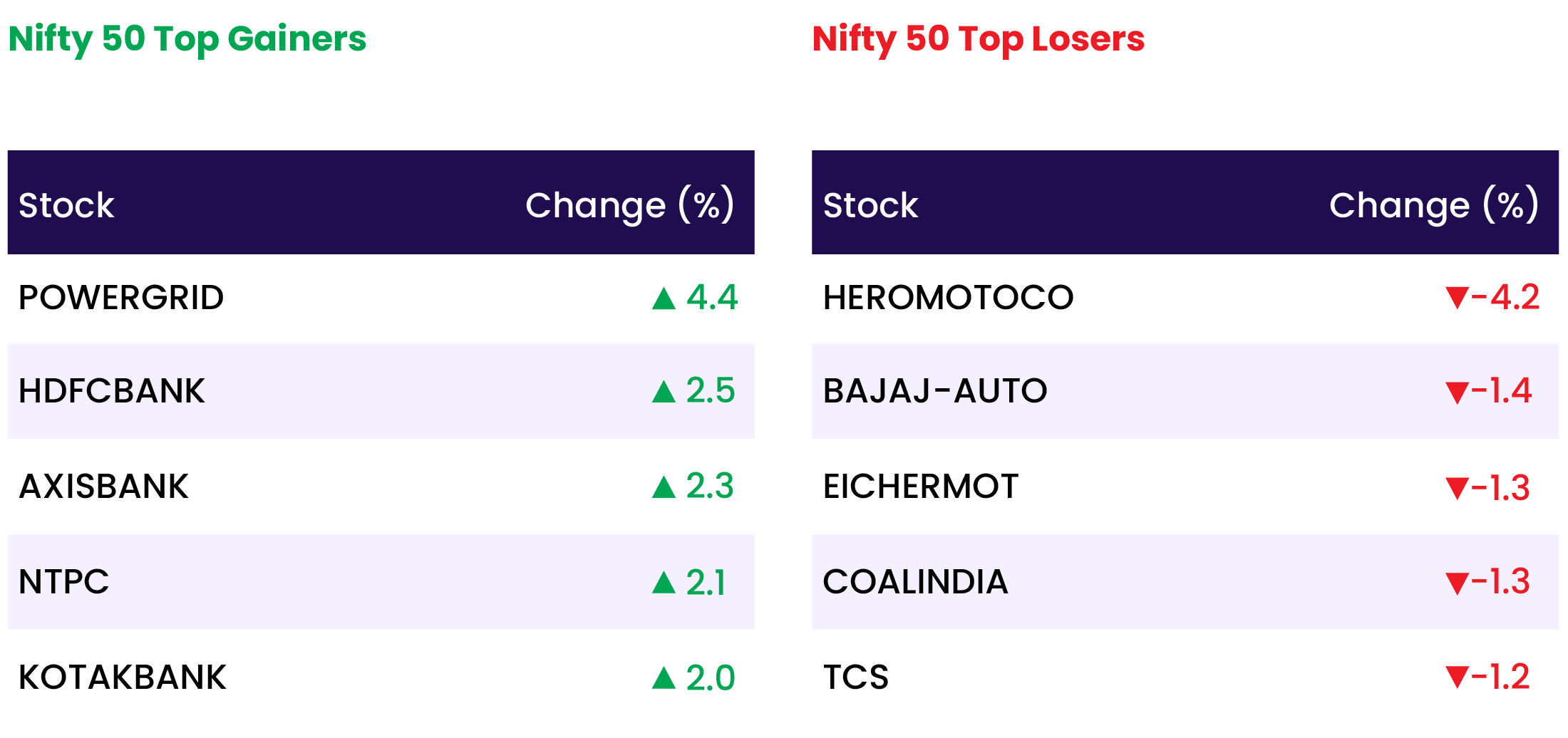

- Heavy buying in banks and financial services sectors bolstered both Sensex and Nifty.

- Nifty Media led the gains, surging by 2.27 percent.

- Following closely were Nifty Realty, Nifty Bank, and Nifty Financial Services, each registering gains of over one percent.

- However, Nifty IT and Nifty Auto experienced declines of around one percent each.

Global Markets:

- Early Tuesday, S&P 500 futures edged lower following the market’s first losing week in over a month.

- Futures linked to the S&P 500 decreased by 0.36%, while Nasdaq 100 futures dipped by 0.6%.

- Dow Jones Industrial Average futures also retreated, losing 65 points or 0.17%.

- The producer price index data released on Friday revealed that wholesale prices surged more than expected between December and January, heightening concerns about persistent inflation.

- Earlier in the week, the consumer price index exceeded economists’ forecasts, reaching 3.1% on an annualized basis, well above the Federal Reserve’s 2% target.

Stocks in Spotlight

- Oil India witnessed a significant surge of 12.4 percent driven by a bullish production outlook. According to brokerage house Motilal Oswal, Oil India’s production growth guidance remains strong, bolstered by increased drilling activity and development wells in existing areas. This positive assessment contributed to the notable uptick in Oil India’s stock price.Top of Form

- Power Grid stock soared by 4.36 percent the day following the company board’s endorsement of a Rs 656-crore investment for national electricity transmission projects. Additionally, Bernstein initiated coverage on the stock, rating it as ‘outperform’ and setting a target price of Rs 315. This surge in stock value underscores investor optimism, fueled by the company’s strategic investment decisions and growth prospects within the electricity transmission sector.

- Following a ‘buy’ rating from Global brokerage firm Citi, HDFC Bank stock climbed 2.53 percent, with a target price of Rs 2,050. Citi analysts expressed confidence in the bank’s sturdy and enduring franchise, foreseeing it as a catalyst for continued profitable growth in the coming periods.

- Following the announcement of significant alterations to its senior management cadre, Kotak Mahindra Bank experienced a notable surge of 2.04 percent in its stock value. The private sector lender disclosed that KVS Manian, presently occupying the position of whole-time director and key managerial personnel, will assume the role of joint managing director, effective March 1, 2024. This strategic move underscores the bank’s commitment to reinforcing its leadership team and navigating evolving market dynamics with agility and expertise.

News from the IPO world🌐

- IPO bound Ola Electric slashes prices of e-scooters by up to Rs. 25000

- Hyundai seeks expansion higher valuation with India IPO

- Ullu Digital files papers for Rs. 135-150 crore IPO biggest ever for an SME

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 2.27 |

| NIFTY FINANCIAL SERVICES | 1.23 |

| NIFTY BANK | 1.20 |

| NIFTY REALTY | 1.16 |

| NIFTY PRIVATE BANK | 1.02 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1949 |

| Decline | 1887 |

| Unchanged | 95 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,628 | (0.4) % | 2.0 % |

| 10 Year Gsec India | 7.1 | (0.5) % | (0.0) % |

| WTI Crude (USD/bbl) | 78 | (0.1) % | 8.5 % |

| Gold (INR/10g) | 61,662 | 0.3 % | (1.7) % |

| USD/INR | 83.0 | 0.0 % | (0.0) % |

Please visit www.fisdom.com for a standard disclaimer