Technical Overview – Nifty 50

The benchmark index is still showing bullish momentum, having reached a fresh all-time high of 23,236. For the remainder of the day, the benchmark index consolidated at the ascending channel’s upper band. On a 125-minute timeframe, the index is forming a higher-high, higher-low configuration.

The RSI (14) momentum indicator, which closed close to the 70 mark, indicated the breach of horizontal resistance. A slight profit booking in the index is indicated by the RSI’s modest negative divergence in a 125-minute timeframe. As always, the trend is to purchase on dips.

The upward trend should continue because the MACD is rising and above its polarity. The index’s position above each major DEMA lends more credence to the overall bullishness.

Based on benchmark index OI data, a base formation is suggested at the 24,000 level, where put writing is almost 81 lakhs contract. Resistance is possible at 24,200, where call writing is about 58 lakhs per contract. PCR for the benchmark index stands at 0.98.

The support and resistance levels for the next sessions are 23,800 and 23,650 and 24,00 and 24,400, respectively.

Technical Overview – Bank Nifty

The banking index underperformed the benchmark index by about 1% during the day, exhibiting bearish momentum. The index is moving close to the area of retest. The banking index’s upward velocity is not keeping up with the benchmark index.

The index found excellent support close to the retest zone and ideal support close to the 10-DEMA. On a 125-minute timeframe, the momentum indicator RSI (14) displays a hidden positive divergence. The upward trend should continue because the MACD is rising and above its polarity on a daily time frame. The index’s position above each major DEMA lends more credence to the overall bullishness.

For the next sessions, the resistance and support levels are 52,400–52,700 for resistance and 51,950–51,550 for support.

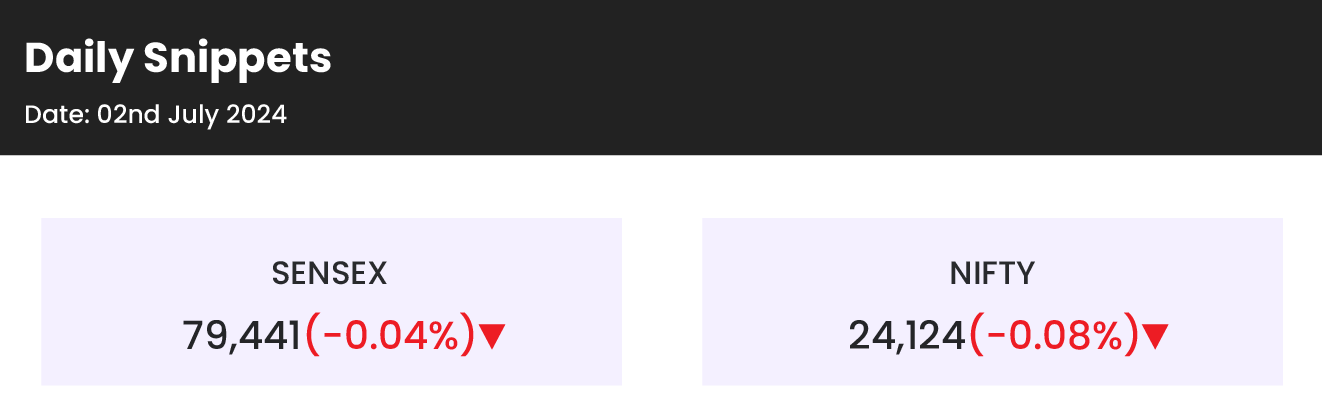

Indian markets:

- The market began the day at fresh highs but experienced fluctuations between gains and losses in the first half.

- Extended selling in the second half pushed the Nifty down near 24,050 before it recovered to end marginally lower.

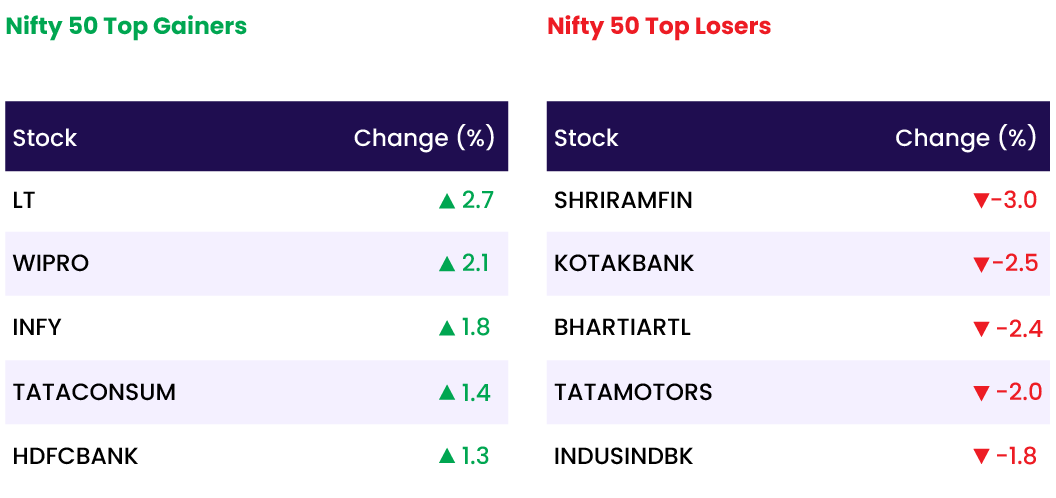

- Sector-wise performance:

- Capital goods, Information Technology, realty, and oil & gas sectors rose by 0.3-1 percent.

- Bank, auto, FMCG, and power sectors declined by 0.3-0.9 percent

Global Markets:

- After a positive session on Monday, the regional Stoxx 600 resumed last week’s decline.

- The index was trading 0.77% lower at 12:30 p.m. in London, extending losses following the consumer price index release.

- Most sectors were in the red, with insurance stocks down 2.2%.

- In contrast, oil and gas sectors pushed 1.1% higher.

- Headline inflation in the euro area dipped to 2.5% in June, as announced by the European Union’s statistics agency, matching the expectations of economists polled by Reuters

- However, core and services inflation figures remained stubbornly high, holding at 2.9% and 4.1%, respectively..

Stocks in Spotlight

- Angel One fell nearly 9 percent following the Securities and Exchange Board of India’s (SEBI) new circular revising the market intermediary charge mechanism. SEBI’s circular mandates that Market Infrastructure Institutions (MIIs) such as stock exchanges and clearing corporations should not offer discounts based on turnovers. This revision is likely to impact revenues for discount brokers like Angel One, which earn a significant portion of their income from these charges due to their large base of retail customers and lower volume/ticket sizes. In FY24, Angel One earned about Rs 400 crore from these charges.

- Larsen & Toubro (L&T) rose 3 percent after securing orders worth over $4 billion from Saudi Aramco for expanding its gas projects. The Rs 35,000 crore order is for Aramco’s gas compression systems, part of the $110 billion Jafurah gas project in the eastern province. This L&T order is included in Saudi Aramco’s $25 billion worth of contracts for engineering, procurement, and construction (EPC) related works, issued on June 30 for two gas expansion programs.

- Godrej Properties rallied over 4 percent after selling over 2,000 homes worth Rs 3,150 crore at the launch of its Godrej Woodscapes project in Bengaluru, Karnataka. This marks the company’s most successful launch ever in terms of sales value and volume. Additionally, it is the second project in three months to achieve sales of Rs 3,000 crore. With this launch, Godrej Properties has surpassed its full-year FY24 sales target for South India within the first quarter.

News from the IPO world🌐

- Sagility India files draft papers seeking SEBI’s nod to float IPO

- Softbank backed Firstcry, Unicommerce get SEBI approval for IPO

- Insurer Niva Bupa plans $360 million IPO.

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY IT | 1.2 |

| NIFTY MEDIA | 1.1 |

| NIFTY REALTY | 0.8 |

| NIFTY OIL & GAS | 0.3 |

| NIFTY PHARMA | 0.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1965 |

| Decline | 1953 |

| Unchanged | 90 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,169 | 0.1 % | 3.8 % |

| 10 Year Gsec India | 7.0 | 0.1 % | 1.3 % |

| WTI Crude (USD/bbl) | 83 | 2.3 % | 18.5 % |

| Gold (INR/10g) | 71,307 | 0.1 % | 6.4 % |

| USD/INR | 83.43 | 0.1 % | 0.7 % |

Please visit www.fisdom.com for a standard disclaimer