Technical Overview – Nifty 50

The benchmark index saw a lagging session. The index reached a new all-time high but was unable to sustain it. On a daily basis, an indecisive candle has formed.

Index has formed yet another spinning top candle on a daily time frame. The breakdown of the Double Top formation occurred in 15 15-minute time frame. The index is reversing from a rising trend line in the 75-minute time frame. Momentum indicator RSI (14) is hanging between 60 and 65, with resistance near a falling trend line.

Support levels for the following sessions are 23,200 and 22,900, with resistance around 23,450 and 23,600.

Technical Overview – Bank Nifty

Following last week’s volatility, the Banking Index lacks upward momentum. The index exhibited some positive momentum in the early hours of the day, but was unable to sustain it and fell below the 50,000 barrier. On the daily timeframe, the index is trading above the main EMA, while on the 75-minute timeframe, it is finding support at the 20-EMA.

The index is lingering above the top band of the wedge formation; on a 75-minute timeframe, the index might see a double bottom fall below 49,500.

Support levels for the forthcoming sessions are 49,500 and 48,900, with resistance around 50,250 and 50,500.

Indian markets:

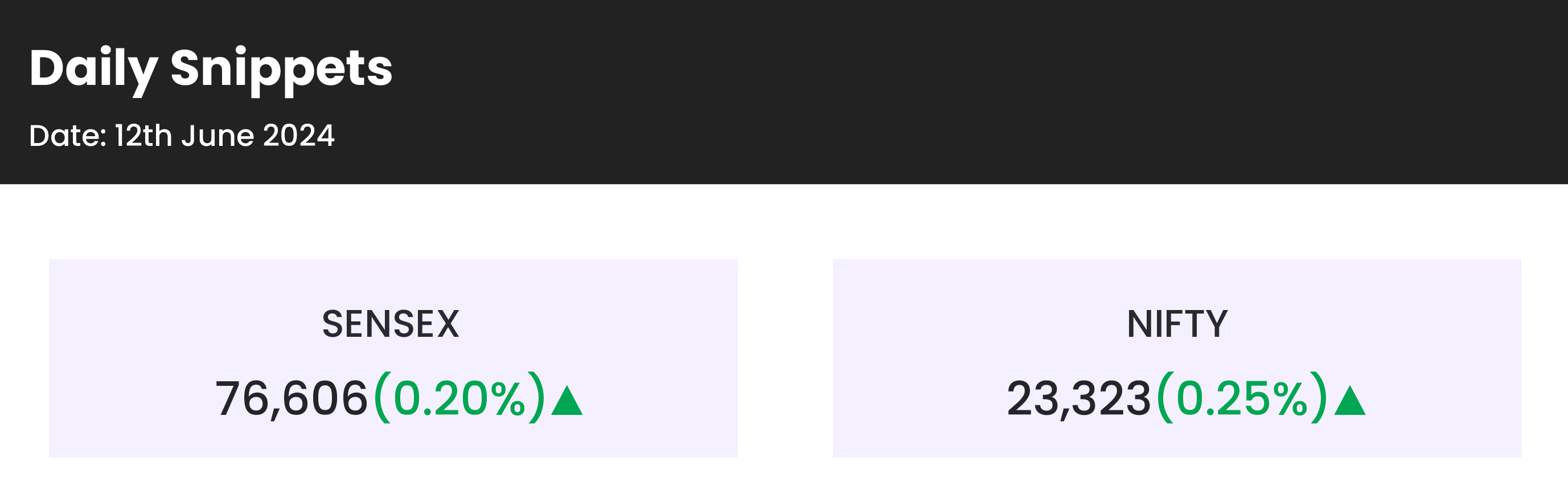

- Nifty 50 Index: Hit another record high during trade but closed with modest gains.

- Midcap Index: Reached record highs for the third consecutive day, crossing the 54,000 mark for the first time.

- Nifty Bank Index: Tested the 50,000 level but did not sustain it, ending the day in the green.

- Mid and Small Cap Indices: Outperformed benchmarks, each gaining over a percent.

- India VIX: Fell nearly 2.2% to 14.46, approaching pre-election levels.

- Automotive Shares: Rose on reports that the Society of Indian Automobile Manufacturers (SIAM) requested the heavy industries ministry to lower the GST.

Global Markets:

- The dollar steadied on Wednesday after hitting a four-week high against peer currencies the previous day.

- Market players are awaiting key U.S. inflation data and the Federal Reserve’s policy decision and updated economic projections later in the day.

- The U.S. dollar rebounded following Friday’s stronger-than-expected jobs report, which raised the prospect of persistent inflation and strong growth, making rate cuts less likely in the coming months.

- Investors will assess the inflation situation when the U.S. Consumer Price Index numbers are released at 1230 GMT, just hours before the Fed concludes its two-day policy meeting.

- Economists polled by Reuters expect headline inflation to have risen 0.1% in May, a slower pace than April’s 0.3% rise. Core inflation is expected to have risen 0.3% in May from April.

Stocks in Spotlight

- Shipping Corporation surged by up to 7.5 percent as investor sentiment improved on news of the company moving closer to divestment. A senior government official confirmed that the strategic sale of Shipping Corp is set to proceed without further delays, following the approval of a stamp duty waiver from Maharashtra. This waiver, worth approximately Rs 300 crore, was a potential major roadblock for SCI’s divestment process.

- HCL Tech rose by around 3 percent following the announcement of a $278 million deal renewal with Germany’s apoBank for a duration of 7.5 years. The IT giant will assist apoBank with an outcome-oriented managed services model aimed at delivering fast and secure banking services to its customers.

- Rites surged 3.4 percent on June 12 after signing an agreement with Eastern Railway’s Andal Diesel Shed, which is the largest shed in Eastern Railway with a fleet of 138 locomotive.

News from the IPO world🌐

- Ixigo IPO enjoys strong response even on Day 2.

- Leela seeks $2.5 bn valuation IPO likely in 9 months

- Kronox Lab shares got listed at 21% premium

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 1.9 |

| NIFTY PSU BANK | 1.2 |

| NIFTY HEALTHCARE INDEX | 0.8 |

| NIFTY OIL & GAS | 0.8 |

| NIFTY METAL | 0.5 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 2554 |

| Decline | 1336 |

| Unchanged | 101 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 38,747 | (0.3) % | 2.8 % |

| 10 Year Gsec India | 7.0 | (0.3) % | (0.6) % |

| WTI Crude (USD/bbl) | 78 | 0.2 % | 5.8 % |

| Gold (INR/10g) | 71,355 | 0.1 % | 4.7 % |

| USD/INR | 83.60 | 0.1 % | 0.7 % |

Please visit www.fisdom.com for a standard disclaimer