Technical Overview – Nifty 50

Nifty50 went into consolidation between the 23,400 and 23,665 level. The open and high levels showed a decline from the high levels and were almost equal. On a daily timeframe, a large bearish candle has developed in the consolidation zone. The positive momentum continuance can be explained by the MACD being above its polarity.

At all-time levels, the index formed a DOJI candle on a weekly timeframe. The double bottom neckline was broken and the momentum indicator, RSI (14) went over 68 levels. The MACD is creating a crossover and a higher-low structure that point to the continuation of the positive trend in the next weeks.

The resistance levels for the upcoming sessions are 23,700 and 23,850, while the support levels are 23,400 and 23,250.

Technical Overview – Bank Nifty

A large bullish candle has developed in the weekly timeframe of the banking index. The rising wedge resistance zone was crossed by the index’s closing. The index closed above the previous week’s hammer candle pattern. On a daily basis, Index has created a hanging man hammer candle or hanging man candle structure.

With a weekly trend line breakthrough, the momentum indicator RSI (14) has surpassed the 69 level. The index held and recovered from the low of the prior day. The big DEMA is being traded by the index; a mean reversion dip might occur, but any dip presents a chance for a long position. Overall bullish sentiment is confirmed by the daily time-frame MACD being above its polarity.

The range of resistance and support for the upcoming sessions is 52,000–52,500 for resistance and 51,000–50,600 for support.

Indian markets:

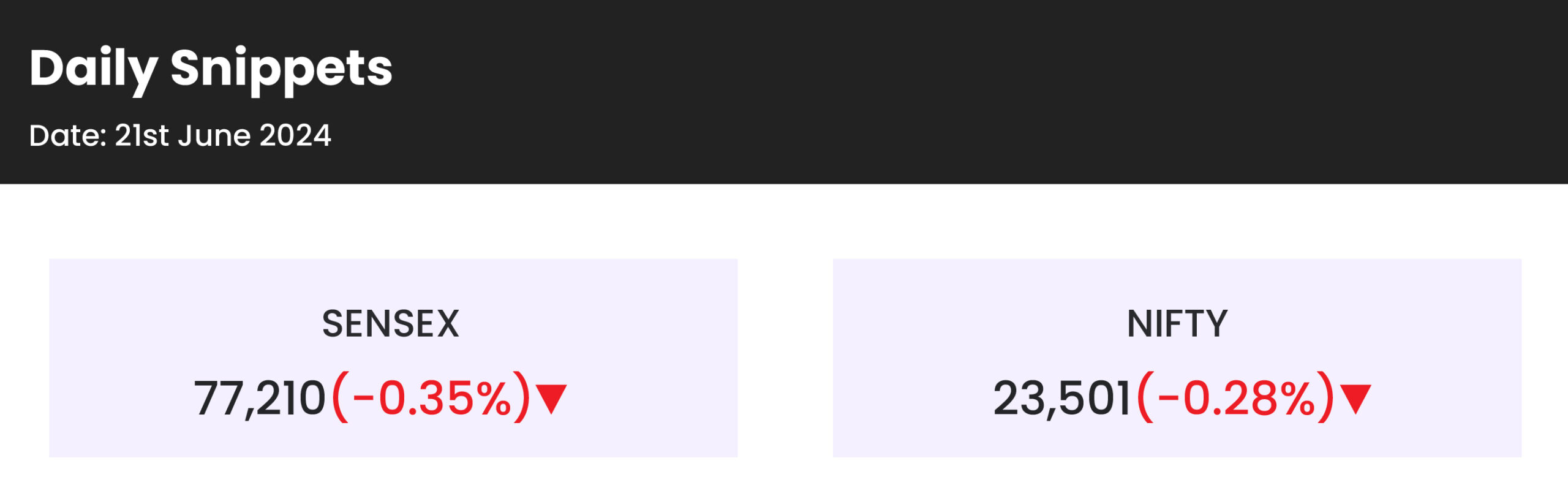

- Indian markets ended lower on June 21 amid profit booking after six consecutive days of gains, tracking weak global equities.

- The domestic market saw minor profit booking due to concerns over the slow progress of the monsoon, impacting the FMCG sector.

- A heatwave in Northern India boosted consumer durables stocks.

- Global markets were subdued, with weak guidance from Accenture leading to profit booking in US tech stocks.

- Domestic IT stocks saw buying interest as market participants had already factored in weaker earnings..

Global Markets:

- European stocks were lower on Friday morning as investors monitored several central bank decisions and data releases.

- The pan-European Stoxx 600 index extended losses to 0.85% by 11 a.m. in London, with bank stocks tumbling 1.8%.

- Equity markets have shaken off much of last week’s negativity after populist, far-right parties made strong gains in elections to the European Union Parliament.

- France’s CAC 40 index is heading for a weekly gain despite the country’s shock election announcement.

- The euro remains on the back foot as investors brace for a potential far-right victory in the euro zone’s second-largest economy

Stocks in Spotlight

- Sugar companies gained attention with a sudden intraday spike but quickly retreated from their highs. The optimism in the sector was driven by expectations of positive post-election decisions, such as an increase in minimum selling prices (MSP), removal of restrictions on ethanol production, and hikes in ethanol prices (B-heavy and sugarcane juice ethanol).

- JM Financial’s share price tumbled by up to 5.7 percent following a directive from the Securities and Exchange Board of India (SEBI). SEBI instructed the company to refrain from accepting new mandates as a lead manager in public issues of debt securities until March 31, 2025, or until further notice.

- RailTel Corporation of India surged over 12 percent to Rs 488 per share on June 21, approaching its 52-week high of Rs 491. This rally followed the announcement of a work order from South Central Railway worth Rs 20.22 crore for telecommunications work, specifically the provision of IP-MPLS across 523 RKM in the Secunderabad division. The project is scheduled for completion by June 18, 2025. RailTel has been consistently receiving new orders throughout the month.

News from the IPO world🌐

- Zepto bags $665 mn ahead of IPO next year.

- Vraj Iron and Steel IPO price band fixed at Rs 195-207/share. Issue to open on June 26

- Ola Electric, Emcure Pharma get Sebi nod for IPOs, setting stage for big listings

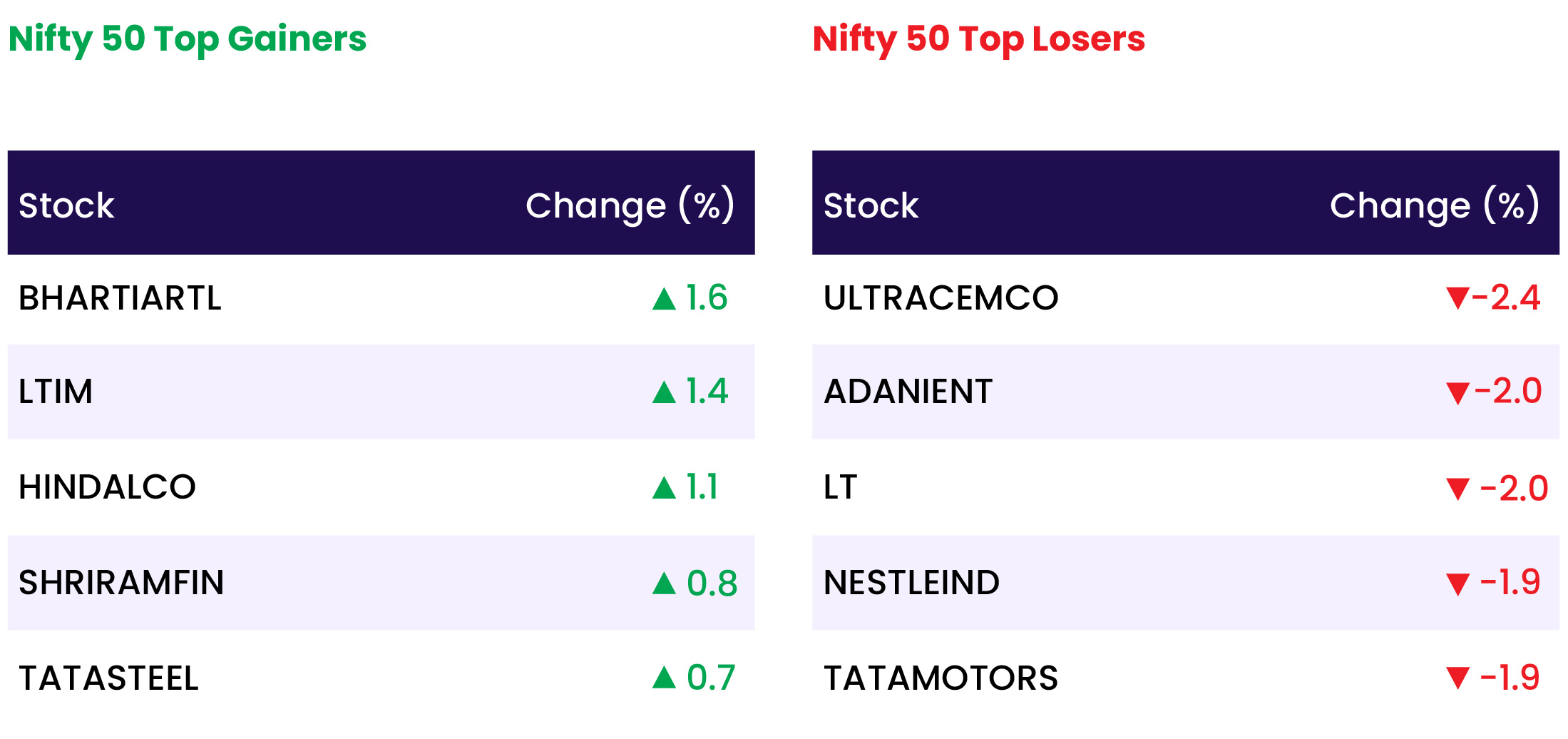

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY MEDIA | 1.0 |

| NIFTY IT | 0.8 |

| NIFTY CONSUMER DURABLES | 0.8 |

| NIFTY METAL | 0.4 |

| NIFTY PHARMA | -0.1 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1784 |

| Decline | 2086 |

| Unchanged | 117 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,135 | 0.8 % | 3.8 % |

| 10 Year Gsec India | 7.0 | 0.0 % | 0.5 % |

| WTI Crude (USD/bbl) | 82 | 2.0 % | 17.9 % |

| Gold (INR/10g) | 72,268 | 1.1 % | 6.3 % |

| USD/INR | 83.62 | 0.2 % | 0.7 % |

Please visit www.fisdom.com for a standard disclaimer