Technical Overview – Nifty 50

The NIFTY benchmark index ended the day down 183 points, or -0.80%, closed at 22,705. Profit booking is occurring on the benchmark index from its all-time high levels. The index is currently trading below the 22,800 mark. The index ranged for the whole session between levels 22,700 and 22,830. There was likely a mean reversion since the index closed close to the 10-DEMA.

As of right now, channel upper band reversal is functioning; the ATH shows a 400-point or 1.75 percent fall.

The index is encountering resistance at the 15-minute time frame’s 20-EMA. A double bottom structure is developing in the vicinity of the 22,800-retest zone in 15 15-minute time frame, with a bullish RSI divergence.

In the next session, the resistance levels 22,850 and 23,000 might be taken into consideration, while the support levels 22,550 and 22,400 should be closely monitored.

Technical Overview – Bank Nifty

The banking index had a strong booking of profits from 49,700 points, which was corrected by about 1,300 points or 2.60%. The index finished just above the 20-DEMA and closed just at 48,500 levels; mean reversion appears to be operating as expected. The recent consolidation breakout is now probably going to be retested, and the 20-DEMA may serve as a useful level of support.

The 10-EMA of the 15-minute time period is where the index is facing resistance. Even if the 15-minute timeframe trend is negative, there might be a swift upward move over 48,700.

The resistance levels of 49,000 and 49,500 might be considered in the upcoming sessions, while great attention should be given to the support levels of 48,200 and 47,800.

Indian markets:

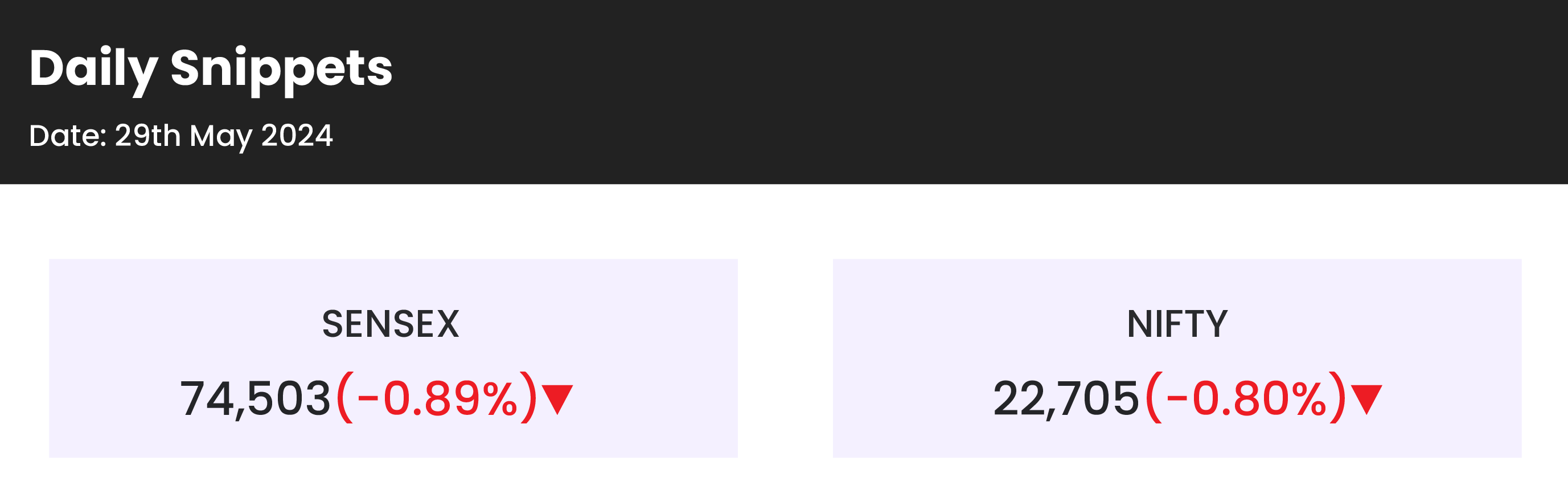

- Indian stock market benchmarks, the Sensex and the Nifty 50, extended their losing streak to a fourth consecutive session, closing with significant losses of about 1% each on Wednesday, May 29, amid weak global cues.

- The market remains under pressure ahead of the Lok Sabha election outcome on June 4. Experts anticipate continued high volatility due to election-related jitters, compounded by a lack of fresh cues, weak global signals, and concerns over geopolitical tensions, which are keeping market sentiment fragile.

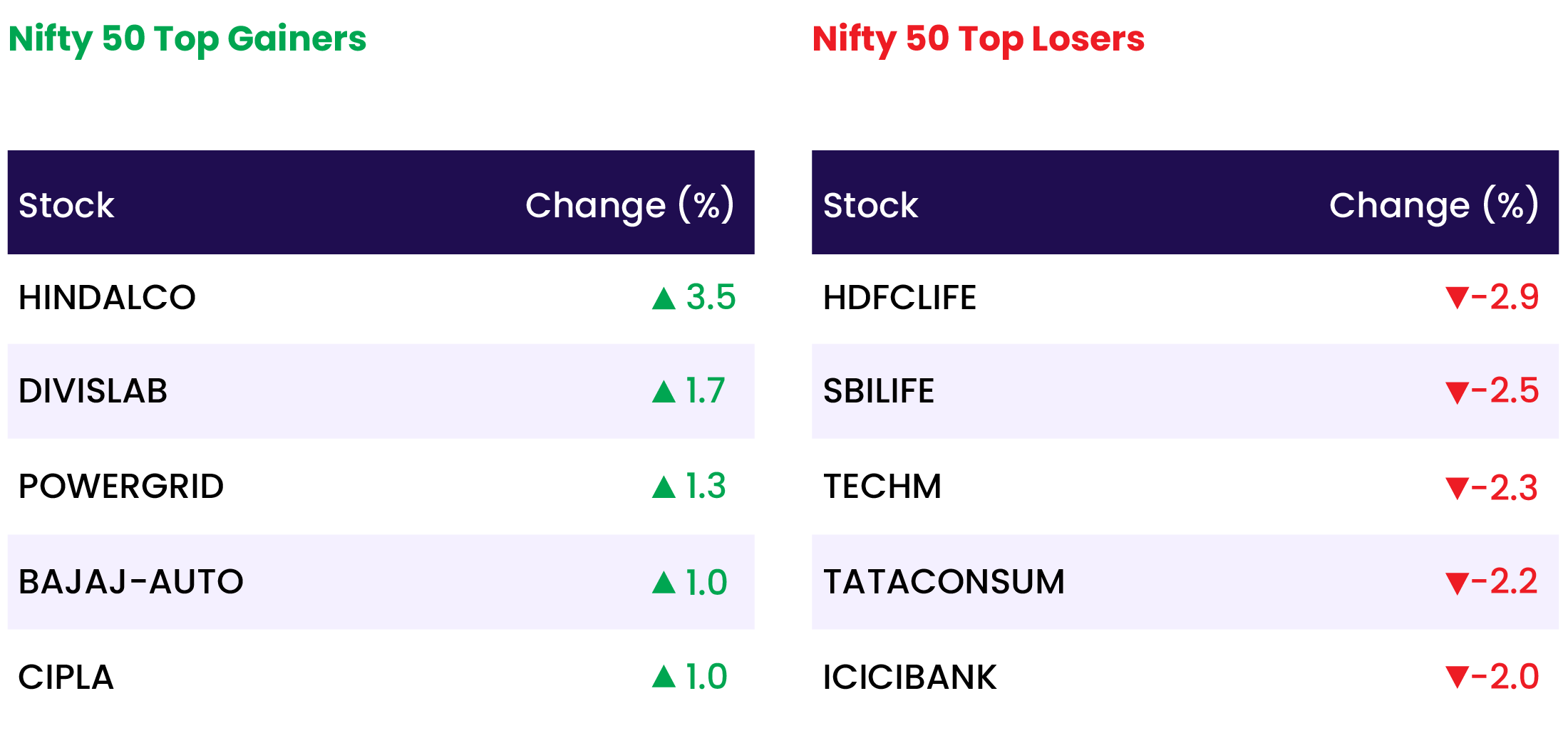

- Sectoral performance was mixed, with capital goods, telecom, healthcare, metal, and power sectors ending in the green, while auto, banking, FMCG, IT, oil & gas, and realty sectors declined by 0.3-1%.

- The BSE midcap index fell by 0.4%, while the smallcap index rose by 0.2%.

Global Markets:

- Asia-Pacific markets mostly traded lower on Wednesday as investors evaluated Australia’s inflation figures for April and consumer confidence data from Japan.

- Australia’s weighted consumer price index increased by 3.6% year-on-year in April, surpassing the 3.4% gain forecasted in a Reuters poll and higher than the 3.5% reported for March. Following the CPI announcement, the Australian S&P/ASX 200 dropped 1.3%.

- Japan’s Nikkei 225 fell 0.77%, while the broad-based Topix declined 0.97%. Both indexes reversed course from their initial gains to end the day lower.

- In South Korea, the Kospi decreased by 1.67%, weighed down by a 3.09% loss in Samsung Electronics after one of its unions announced a strike. The small-cap Kosdaq also fell by 1.48%.

- Hong Kong’s Hang Seng index led losses in Asia, dropping 1.67%. Conversely, mainland China’s CSI 300 rose by 0.12%, making it the only major Asian benchmark to finish in positive territory.

Stocks in Spotlight

- Suzlon Energy shares surged by 5% following the announcement of a 551.25-megawatt wind power project for the Aditya Birla Group in Gujarat and Rajasthan. Additionally, Nuvama initiated coverage on the stock with a ‘buy’ rating, citing positive growth prospects.

- MTAR Technologies shares dropped by 10% after the defense company reported a significant decline in net profit for the March quarter. The company announced a 53.4% decrease in Q4 consolidated net profit, which fell to Rs 4.9 crore compared to Rs 10.4 crore in the same period last year.

- Shares of One97 Communications, the parent company of the fintech giant Paytm, were halted in the 5 percent upper circuit on May 29 amid speculation that the Adani Group might purchase a stake in Paytm. However, the company later clarified that the news was speculative, stating that they are not currently involved in any discussions regarding this matter.

News from the IPO world🌐

- Mumbai-based Garuda Construction and Engineering refiles DRHP for IPO

- Ztech India IPO opens on May 29

- OYO withdraws DRHP, to refile IPO post refinancing

Daily Leader board:

Sectoral Performance

| Top Sectors | Day change (%) |

| NIFTY PHARMA | 0.6 |

| NIFTY HEALTHCARE INDEX | 0.4 |

| NIFTY METAL | 0.3 |

| NIFTY MEDIA | 0.2 |

| NIFTY CONSUMER DURABLES | -0.02 |

Advance Decline Ratio

| Advance/Declines | Day change (%) |

| Advances | 1623 |

| Decline | 2207 |

| Unchanged | 99 |

Numbers to track

| Indices Name | Latest | % 1D | % YTD |

| Dow Jones (US) | 39,070 | 0.0 % | 3.6 % |

| 10 Year Gsec India | 7.0 | 0.3 % | (1.3) % |

| WTI Crude (USD/bbl) | 80 | 2.7 % | 13.4 % |

| Gold (INR/10g) | 71,975 | (0.2) % | 6.8 % |

| USD/INR | 83.10 | 0.1 % | 0.1 % |

Please visit www.fisdom.com for a standard disclaimer